Answered step by step

Verified Expert Solution

Question

1 Approved Answer

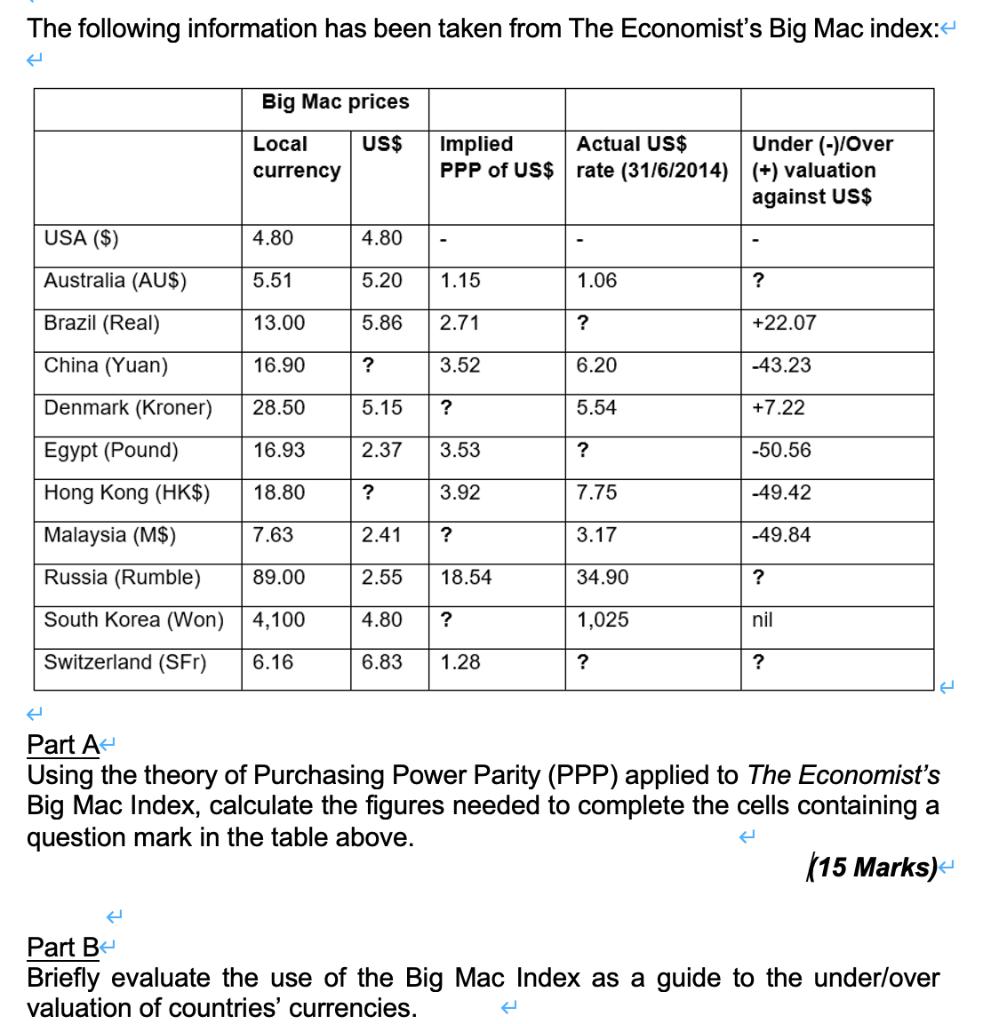

The following information has been taken from The Economist's Big Mac index: < USA ($) Australia (AU$) Brazil (Real) China (Yuan) Denmark (Kroner) Egypt

The following information has been taken from The Economist's Big Mac index: < USA ($) Australia (AU$) Brazil (Real) China (Yuan) Denmark (Kroner) Egypt (Pound) Hong Kong (HK$) Big Mac prices Local US$ currency 4.80 5.51 13.00 16.90 28.50 16.93 18.80 Malaysia (M$) Russia (Rumble) 89.00 South Korea (Won) 4,100 Switzerland (SFr) 6.16 7.63 4.80 5.20 5.86 ? 5.15 2.37 ? Implied PPP of US$ 1.15 2.71 3.52 ? 3.53 3.92 2.41 2.55 4.80 ? 6.83 1.28 ? 18.54 Actual US$ rate (31/6/2014) 1.06 ? 6.20 5.54 ? 7.75 3.17 34.90 1,025 ? Under (-)/Over (+) valuation against US$ ? +22.07 -43.23 +7.22 -50.56 -49.42 -49.84 ? nil ? Part A Using the theory of Purchasing Power Parity (PPP) applied to The Economist's Big Mac Index, calculate the figures needed to complete the cells containing a question mark in the table above. (15 Marks) Part Be Briefly evaluate the use of the Big Mac Index as a guide to the under/over valuation of countries' currencies. (

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Part A 1 Australia AU Implied exchange rate 115 local currency per US Actual exchange rate 106 Undervalued by 869 2 Brazil Real Implied exchange rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started