Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AXAM Inc. is a US company specialising in electronic cryptographic systems for banks. AXAM has recently purchased a new software package from a UK

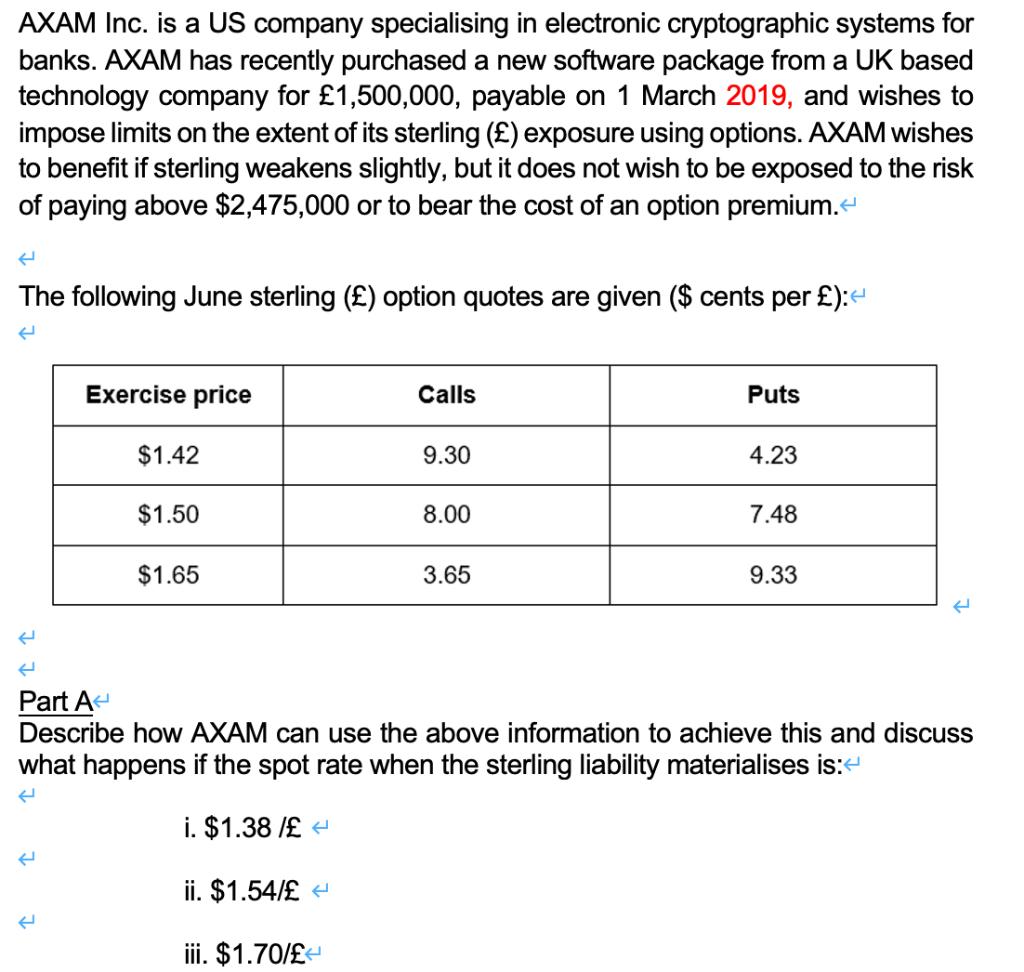

AXAM Inc. is a US company specialising in electronic cryptographic systems for banks. AXAM has recently purchased a new software package from a UK based technology company for 1,500,000, payable on 1 March 2019, and wishes to impose limits on the extent of its sterling () exposure using options. AXAM wishes to benefit if sterling weakens slightly, but it does not wish to be exposed to the risk of paying above $2,475,000 or to bear the cost of an option premium. < The following June sterling () option quotes are given ($ cents per ): < Exercise price Calls Puts $1.42 9.30 4.23 $1.50 8.00 7.48 $1.65 3.65 9.33 Part A Describe how AXAM can use the above information to achieve this and discuss what happens if the spot rate when the sterling liability materialises is: < i. $1.38/ ii. $1.54/ iii. $1.70/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

AXAM can use options to hedge its sterling exposure and limit the extent of its potential loss or gain In this case AXAM is concerned about the cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started