Question

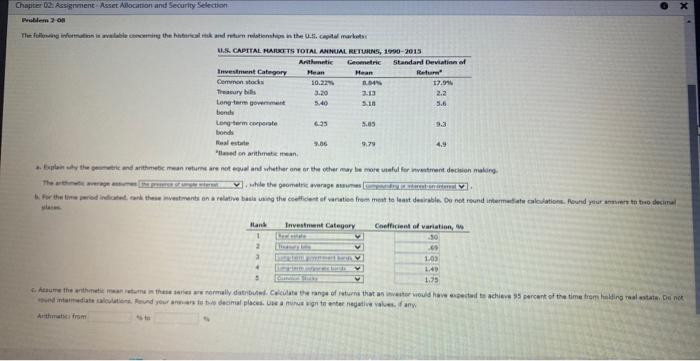

The following information is available concerning the historical risk and return relationships in the U.S. capital markets: U.S. CAPITAL MARKETS TOTAL ANNUAL RETURNS, 19902015 Investment

The following information is available concerning the historical risk and return relationships in the U.S. capital markets:

| U.S. CAPITAL MARKETS TOTAL ANNUAL RETURNS, 19902015 | ||||||

| Investment Category | Arithmetic Mean | Geometric Mean | Standard Deviation of Returna | |||

| Common stocks | 10.22 | % | 8.84 | % | 17.9 | % |

| Treasury bills | 3.20 | 3.13 | 2.2 | |||

| Long-term government bonds | 5.40 | 5.18 | 5.6 | |||

| Long-term corporate bonds | 6.25 | 5.85 | 9.3 | |||

| Real estate | 9.86 | 9.79 | 4.9 | |||

| aBased on arithmetic mean. | ||||||

Explain why the geometric and arithmetic mean returns are not equal and whether one or the other may be more useful for investment decision making.

The arithmetic average assumes -Select-compounding or interest-on-interestthe presence of simple interestItem 1 , while the geometric average assumes -Select-compounding or interest-on-interestthe presence of simple interestItem 2 .

For the time period indicated, rank these investments on a relative basis using the coefficient of variation from most to least desirable. Do not round intermediate calculations. Round your answers to two decimal places.

| Rank | Investment Category | oefficient of variation, % |

| 1 | -Select-Common StocksLong-term corporate bondsLong-term government bondsReal estateTreasury billsItem 3 | |

| 2 | -Select-Common StocksLong-term corporate bondsLong-term government bondsReal estateTreasury billsItem 5 | |

| 3 | -Select-Common StocksLong-term corporate bondsLong-term government bondsReal estateTreasury billsItem 7 | |

| 4 | -Select-Common StocksLong-term corporate bondsLong-term government bondsReal estateTreasury billsItem 9 | |

| 5 | -Select-Common StocksLong-term corporate bondsLong-term government bondsReal estateTreasury billsItem 11 |

Assume the arithmetic mean returns in these series are normally distributed. Calculate the range of returns that an investor would have expected to achieve 95 percent of the time from holding real estate. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any.

Arithmetic: from % to %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started