Answered step by step

Verified Expert Solution

Question

1 Approved Answer

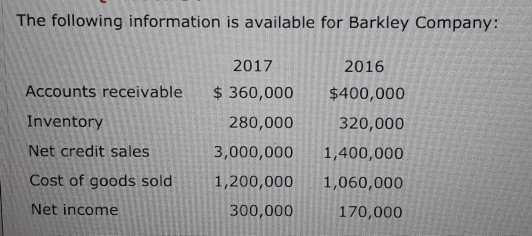

The following information is available for Barkley Company: Accounts receivable Inventory Net credit sales Cost of goods sold Net income 2017 $360,000 280,000 3,000,000 1,200,000

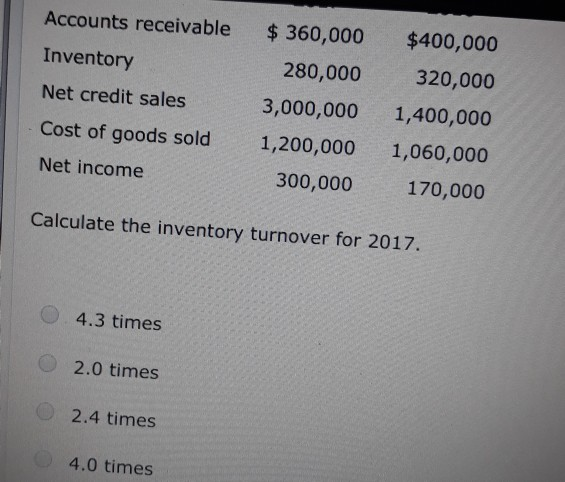

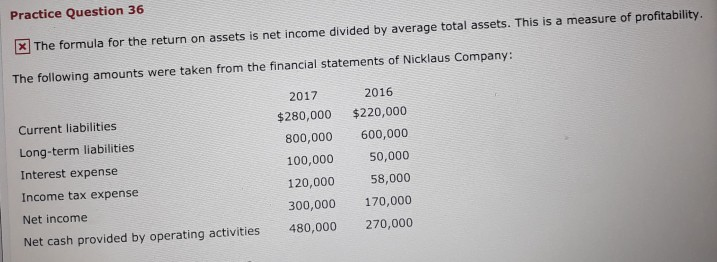

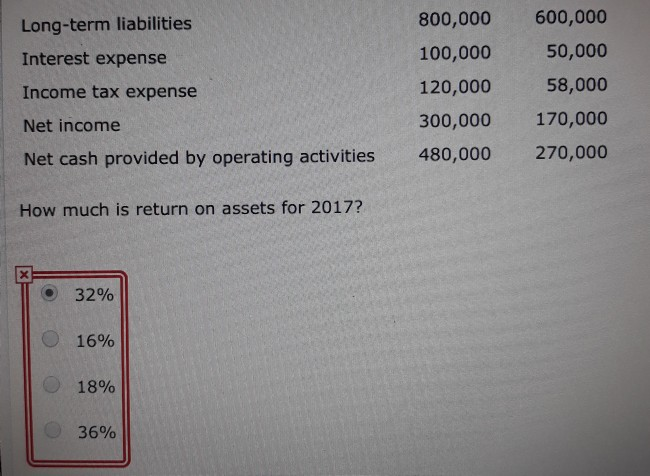

The following information is available for Barkley Company: Accounts receivable Inventory Net credit sales Cost of goods sold Net income 2017 $360,000 280,000 3,000,000 1,200,000 300,000 2016 $400,000 320,000 1,400,000 1,060,000 170,000 Accounts receivable Inventory Net credit sales Cost of goods sold Net income $ 360,000 280,000 3,000,000 1,200,000 300,000 $400,000 320,000 1,400,000 1,060,000 170,000 Calculate the inventory turnover for 2017. 4.3 times 2.0 times 0 2.4 times 4.0 times FIUCLIC QUILIUI JU X The formula for the return on assets is net income divided by average total assets. This is a measure of profitability. The following amounts were taken from the financial statements of Nicklaus Company: Current liabilities Long-term liabilities Interest expense Income tax expense Net income Net cash provided by operating activities 2017 $280,000 800,000 100,000 120,000 300,000 480,000 2016 $220,000 600,000 50,000 58,000 170,000 270,000 Long-term liabilities Interest expense Income tax expense Net income Net cash provided by operating activities 800,000 100,000 120,000 300,000 480,000 600,000 50,000 58,000 170,000 270,000 How much is return on assets for 2017? 32% 16% 18% 36%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started