Answered step by step

Verified Expert Solution

Question

1 Approved Answer

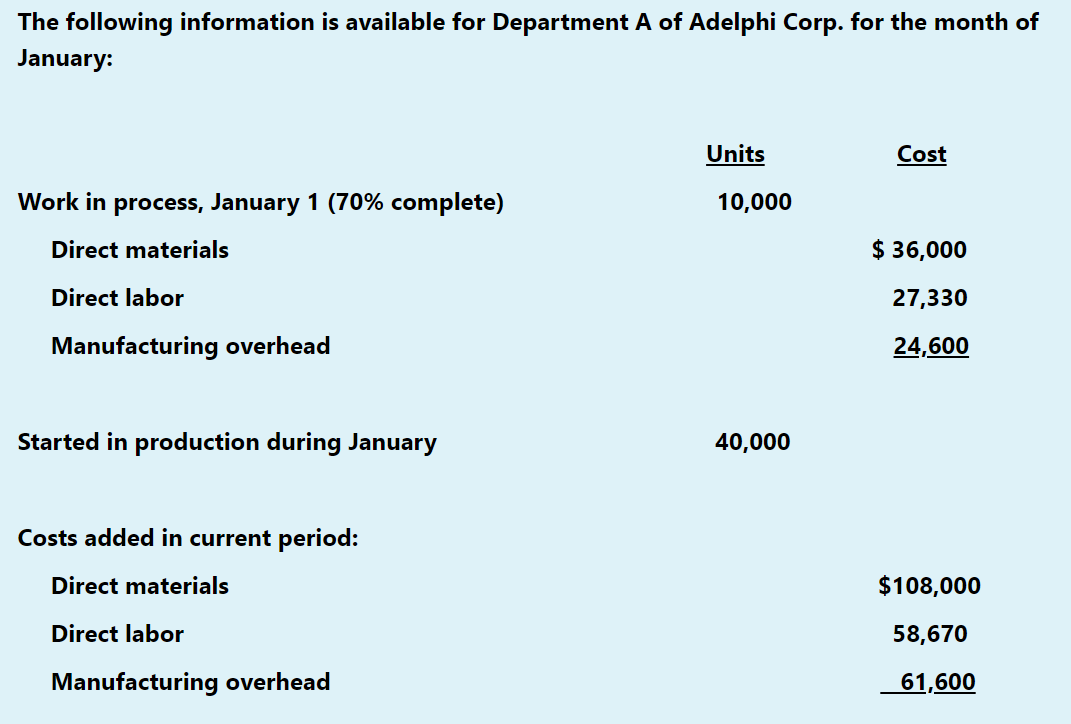

The following information is available for Department A of Adelphi Corp. for the month of January: Units Cost Work in process, January 1 (70%

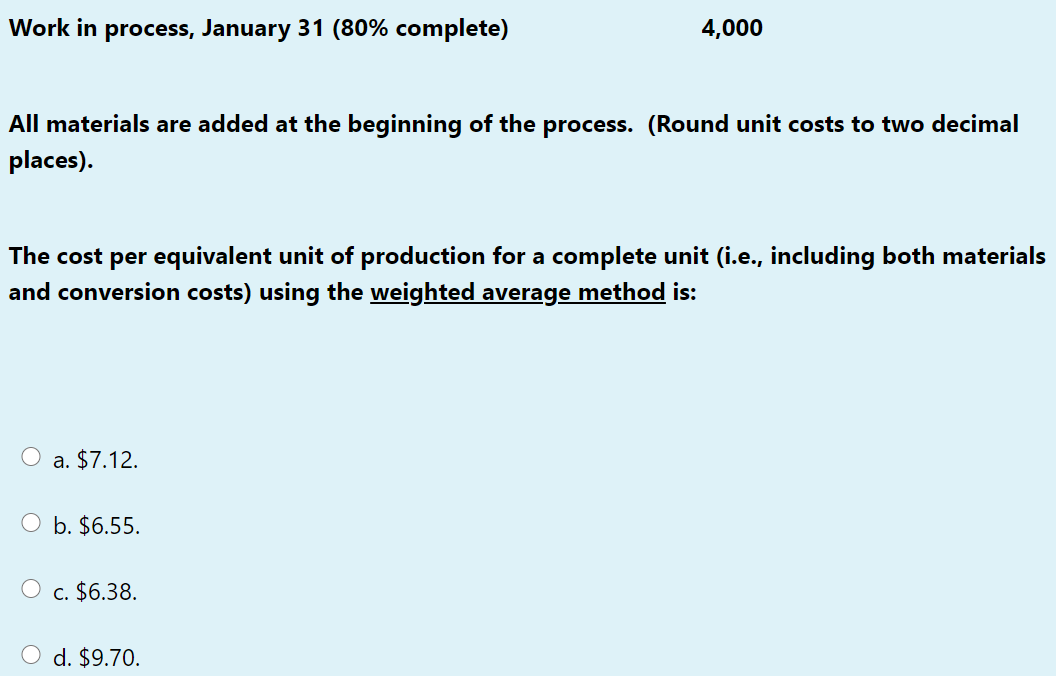

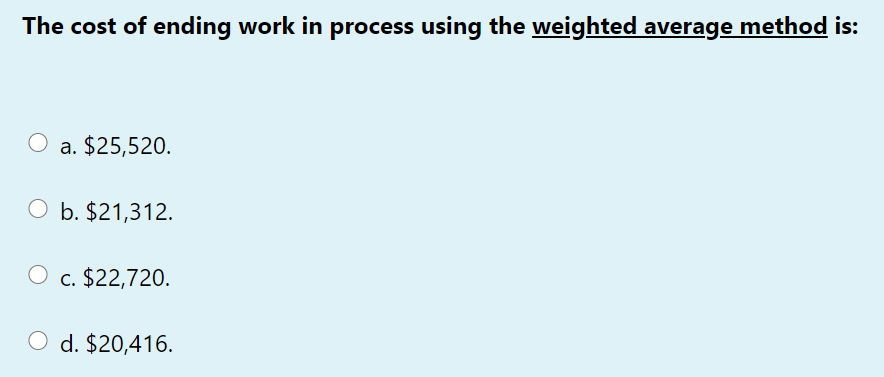

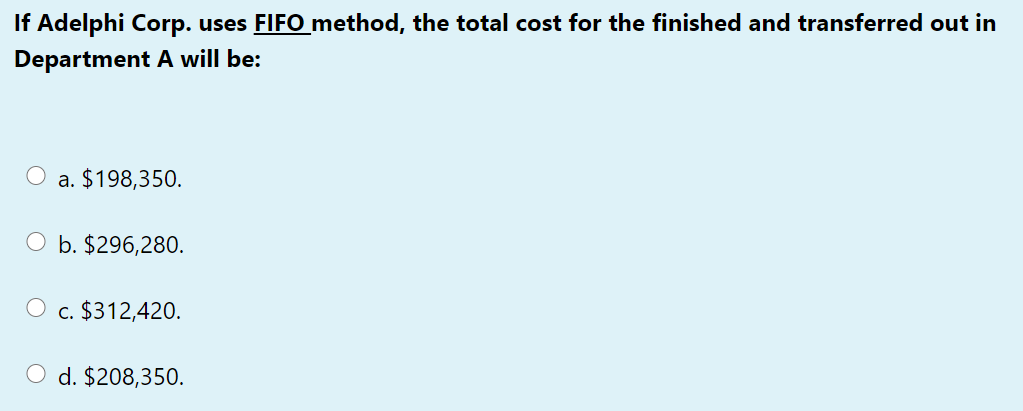

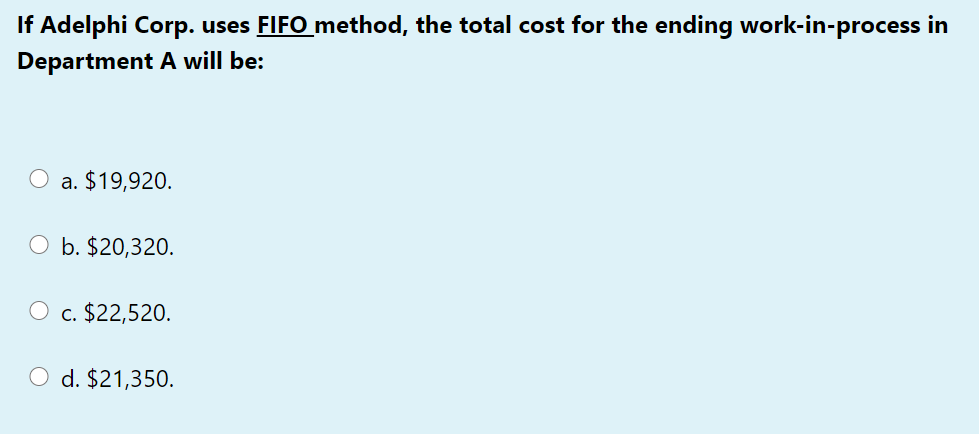

The following information is available for Department A of Adelphi Corp. for the month of January: Units Cost Work in process, January 1 (70% complete) Direct materials $ 36,000 Direct labor 27,330 Manufacturing overhead 24,600 Started in production during January Costs added in current period: Direct materials $108,000 58,670 Direct labor Manufacturing overhead 61,600 10,000 40,000 Work in process, January 31 (80% complete) 4,000 All materials are added at the beginning of the process. (Round unit costs to two decimal places). The cost per equivalent unit of production for a complete unit (i.e., including both materials and conversion costs) using the weighted average method is: a. $7.12. O b. $6.55. c. $6.38. O d. $9.70. The cost of ending work in process using the weighted average method is: a. $25,520. b. $21,312. c. $22,720. O d. $20,416. If Adelphi Corp. uses FIFO method, the total cost for the finished and transferred out in Department A will be: a. $198,350. O b. $296,280. O c. $312,420. O d. $208,350. If Adelphi Corp. uses FIFO method, the total cost for the ending work-in-process in Department A will be: a. $19,920. O b. $20,320. c. $22,520. d. $21,350. The following information is available for Department A of Adelphi Corp. for the month of January: Units Cost Work in process, January 1 (70% complete) Direct materials $ 36,000 Direct labor 27,330 Manufacturing overhead 24,600 Started in production during January Costs added in current period: Direct materials $108,000 58,670 Direct labor Manufacturing overhead 61,600 10,000 40,000 Work in process, January 31 (80% complete) 4,000 All materials are added at the beginning of the process. (Round unit costs to two decimal places). The cost per equivalent unit of production for a complete unit (i.e., including both materials and conversion costs) using the weighted average method is: a. $7.12. O b. $6.55. c. $6.38. O d. $9.70. The cost of ending work in process using the weighted average method is: a. $25,520. b. $21,312. c. $22,720. O d. $20,416. If Adelphi Corp. uses FIFO method, the total cost for the finished and transferred out in Department A will be: a. $198,350. O b. $296,280. O c. $312,420. O d. $208,350. If Adelphi Corp. uses FIFO method, the total cost for the ending work-in-process in Department A will be: a. $19,920. O b. $20,320. c. $22,520. d. $21,350. The following information is available for Department A of Adelphi Corp. for the month of January: Units Cost Work in process, January 1 (70% complete) Direct materials $ 36,000 Direct labor 27,330 Manufacturing overhead 24,600 Started in production during January Costs added in current period: Direct materials $108,000 58,670 Direct labor Manufacturing overhead 61,600 10,000 40,000 Work in process, January 31 (80% complete) 4,000 All materials are added at the beginning of the process. (Round unit costs to two decimal places). The cost per equivalent unit of production for a complete unit (i.e., including both materials and conversion costs) using the weighted average method is: a. $7.12. O b. $6.55. c. $6.38. O d. $9.70. The cost of ending work in process using the weighted average method is: a. $25,520. b. $21,312. c. $22,720. O d. $20,416. If Adelphi Corp. uses FIFO method, the total cost for the finished and transferred out in Department A will be: a. $198,350. O b. $296,280. O c. $312,420. O d. $208,350. If Adelphi Corp. uses FIFO method, the total cost for the ending work-in-process in Department A will be: a. $19,920. O b. $20,320. c. $22,520. d. $21,350. The following information is available for Department A of Adelphi Corp. for the month of January: Units Cost Work in process, January 1 (70% complete) Direct materials $ 36,000 Direct labor 27,330 Manufacturing overhead 24,600 Started in production during January Costs added in current period: Direct materials $108,000 58,670 Direct labor Manufacturing overhead 61,600 10,000 40,000 Work in process, January 31 (80% complete) 4,000 All materials are added at the beginning of the process. (Round unit costs to two decimal places). The cost per equivalent unit of production for a complete unit (i.e., including both materials and conversion costs) using the weighted average method is: a. $7.12. O b. $6.55. c. $6.38. O d. $9.70. The cost of ending work in process using the weighted average method is: a. $25,520. b. $21,312. c. $22,720. O d. $20,416. If Adelphi Corp. uses FIFO method, the total cost for the finished and transferred out in Department A will be: a. $198,350. O b. $296,280. O c. $312,420. O d. $208,350. If Adelphi Corp. uses FIFO method, the total cost for the ending work-in-process in Department A will be: a. $19,920. O b. $20,320. c. $22,520. d. $21,350.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Equivalent Units Physical units Material Conversion Units completed and transferred out 46000 1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started