Answered step by step

Verified Expert Solution

Question

1 Approved Answer

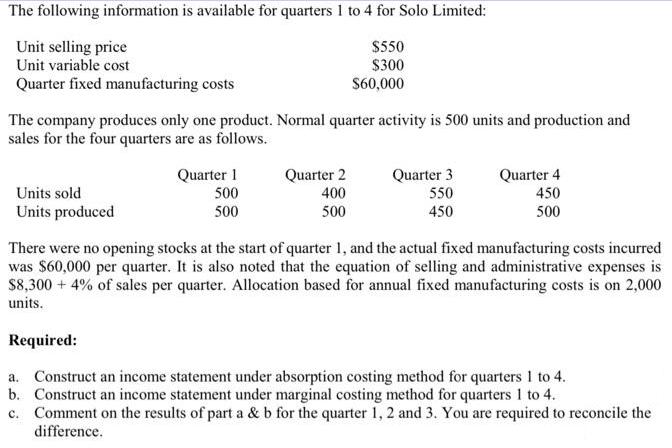

The following information is available for quarters 1 to 4 for Solo Limited: Unit selling price $550 Unit variable cost $300 Quarter fixed manufacturing

The following information is available for quarters 1 to 4 for Solo Limited: Unit selling price $550 Unit variable cost $300 Quarter fixed manufacturing costs $60,000 The company produces only one product. Normal quarter activity is 500 units and production and sales for the four quarters are as follows. Units sold Units produced Quarter 1 500 500 Required: Quarter 2 400 500 Quarter 3 550 450 Quarter 4 450 500 There were no opening stocks at the start of quarter 1, and the actual fixed manufacturing costs incurred was $60,000 per quarter. It is also noted that the equation of selling and administrative expenses is $8,300 + 4% of sales per quarter. Allocation based for annual fixed manufacturing costs is on 2,000 units. a. Construct an income statement under absorption costing method for quarters 1 to 4. Construct an income statement under marginal costing method for quarters 1 to 4. b. c. Comment on the results of part a & b for the quarter 1, 2 and 3. You are required to reconcile the difference.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Income Statement under Absorption Costing Method To construct the income statement under absorption costing method we need to consider both variable and fixed manufacturing costs as part of the cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started