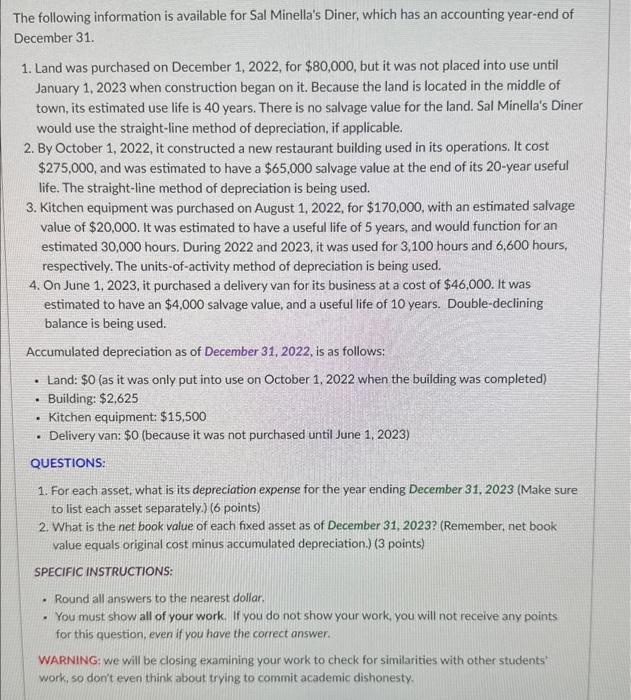

The following information is available for Sal Minella's Diner, which has an accounting year-end of December 31 . 1. Land was purchased on December 1,2022 , for $80,000, but it was not placed into use until January 1,2023 when construction began on it. Because the land is located in the middle of town, its estimated use life is 40 years. There is no salvage value for the land. Sal Minella's Diner would use the straight-line method of depreciation, if applicable. 2. By October 1,2022 , it constructed a new restaurant building used in its operations. It cost $275,000, and was estimated to have a $65,000 salvage value at the end of its 20 -year useful life. The straight-line method of depreciation is being used. 3. Kitchen equipment was purchased on August 1, 2022, for $170,000, with an estimated salvage value of $20,000. It was estimated to have a useful life of 5 years, and would function for an estimated 30,000 hours. During 2022 and 2023 , it was used for 3,100 hours and 6,600 hours, respectively. The units-of-activity method of depreciation is being used. 4. On June 1,2023 , it purchased a delivery van for its business at a cost of $46,000. It was estimated to have an $4,000 salvage value, and a useful life of 10 years. Double-declining balance is being used. Accumulated depreciation as of December 31,2022 , is as follows: - Land: $0 (as it was only put into use on October 1, 2022 when the building was completed) - Building: $2,625 - Kitchen equipment: $15,500 - Delivery van: $0 (because it was not purchased until June 1,2023) QUESTIONS: 1. For each asset, what is its depreciation expense for the year ending December 31,2023 (Make sure to list each asset separately.) (6 points) 2. What is the net book value of each fixed asset as of December 31, 2023? (Remember, net book value equals original cost minus accumulated depreciation.) (3 points) SPECIFIC INSTRUCTIONS: - Round all answers to the nearest dollar. - You must show all of your work. If you do not show your work, you will not receive any points for this question, even if you have the correct answer. WARNING: we will be closing examining your work to check for similarities with other students work, so dor't even think about trying to commit academic dishonesty