Question

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1, 2, 3, 4, 5, and

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1, 2, 3, 4, 5, and 6.

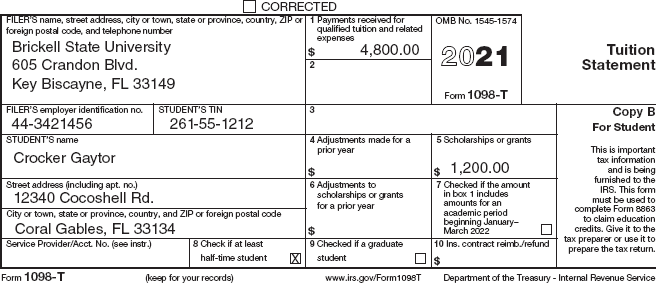

The Gaytors paid tuition and fees for both Crocker and Cayman to attend college. Recall that Crocker is a freshman at Brickell State and Cayman is a part-time student in community college. Crocker received a $1,200 scholarship from Brickell State. Crockers Form 1098-T is shown below. The Gaytors paid tuition and fees of $1,400 for Cayman in 2021. Crocker is a dependent and Cayman is not. married filed jointly with AGI or 73555.

What would you put as your qualified tuition? Can you deduct the 1400 for Cayman?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started