Answered step by step

Verified Expert Solution

Question

1 Approved Answer

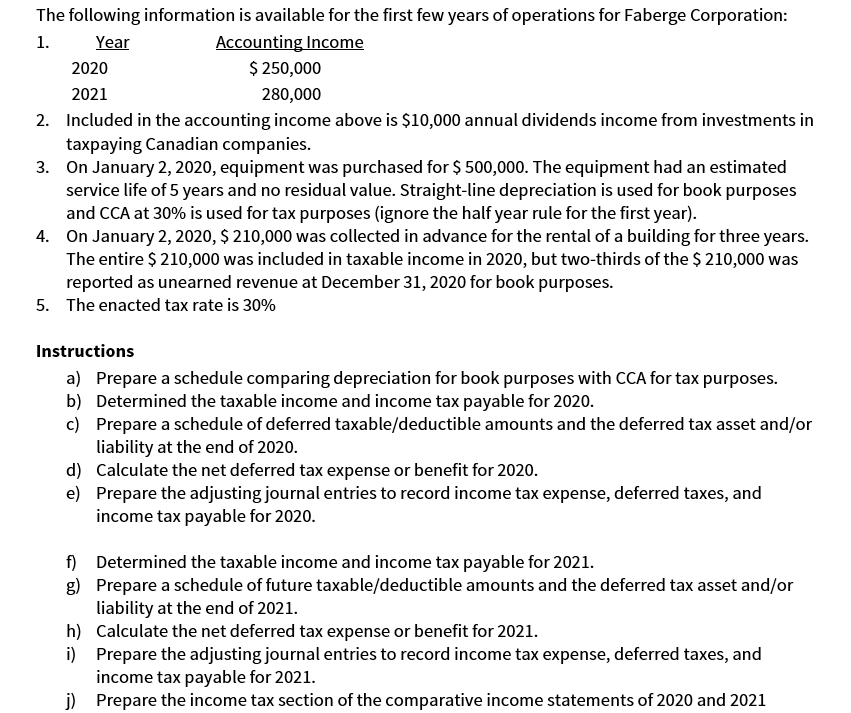

The following information is available for the first few years of operations for Faberge Corporation: 1. Year Accounting Income $ 250,000 280,000 2020 2021

The following information is available for the first few years of operations for Faberge Corporation: 1. Year Accounting Income $ 250,000 280,000 2020 2021 2. Included in the accounting income above is $10,000 annual dividends income from investments in taxpaying Canadian companies. 3. On January 2, 2020, equipment was purchased for $ 500,000. The equipment had an estimated service life of 5 years and no residual value. Straight-line depreciation is used for book purposes and CCA at 30% is used for tax purposes (ignore the half year rule for the first year). 4. On January 2, 2020, $ 210,000 was collected in advance for the rental of a building for three years. The entire $ 210,000 was included in taxable income in 2020, but two-thirds of the $ 210,000 was reported as unearned revenue at December 31, 2020 for book purposes. 5. The enacted tax rate is 30% Instructions a) Prepare a schedule comparing depreciation for book purposes with CCA for tax purposes. b) Determined the taxable income and income tax payable for 2020. c) Prepare a schedule of deferred taxable/deductible amounts and the deferred tax asset and/or liability at the end of 2020. Calculate the net deferred tax expense or benefit for 2020. d) e) f) g) Prepare the adjusting journal entries to record income tax expense, deferred taxes, and income tax payable for 2020. Determined the taxable income and income tax payable for 2021. Prepare a schedule of future taxable/deductible amounts and the deferred tax asset and/or liability at the end of 2021. h) Calculate the net deferred tax expense or benefit for 2021. i) Prepare the adjusting journal entries to record income tax expense, deferred taxes, and income tax payable for 2021. j) Prepare the income tax section of the comparative income statements of 2020 and 2021

Step by Step Solution

★★★★★

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a As per the books depreciation Cost of equipment Useful life 500000 5 years 100000 As per the CCA t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started