Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is available for the first two years of operations for Jackson, Inc.: a . The company sells its merchandise on an installment

The following information is available for the first two years of operations for Jackson, Inc.:

a The company sells its merchandise on an installment contract basis. In

Jackson, Inc. reported gross profit of $ tax purposes, and $ for

financial statement purposes. This will result in a taxable amount of $ in

b Jackson, Inc. insures the lives of its chief executives. The premiums paid amount

each year from is $ and this amount was shown as an expense on

the income statement.

c Product warranty expense accrued for financial reporting was $ in Actual

warranties paid and deducted on the tax returns was $ in The remainder

will be paid $ in and $ in

d Jackson, Inc. earns interest on Massachusetts taxexempt state bonds in the amounts

of $ each year in and

e In the company incurred a lawsuit which is probable and estimated at $ It

has been properly recorded as a litigation liability at and will be paid in

f Depreciation of property, plant and equipment for financial reporting purposes amounts

to $ each year for The company deducts the full cost under the

IRS Code Section $ amount allowed for tax purposes in

The enacted tax rates existing for December are and for and thereafter.

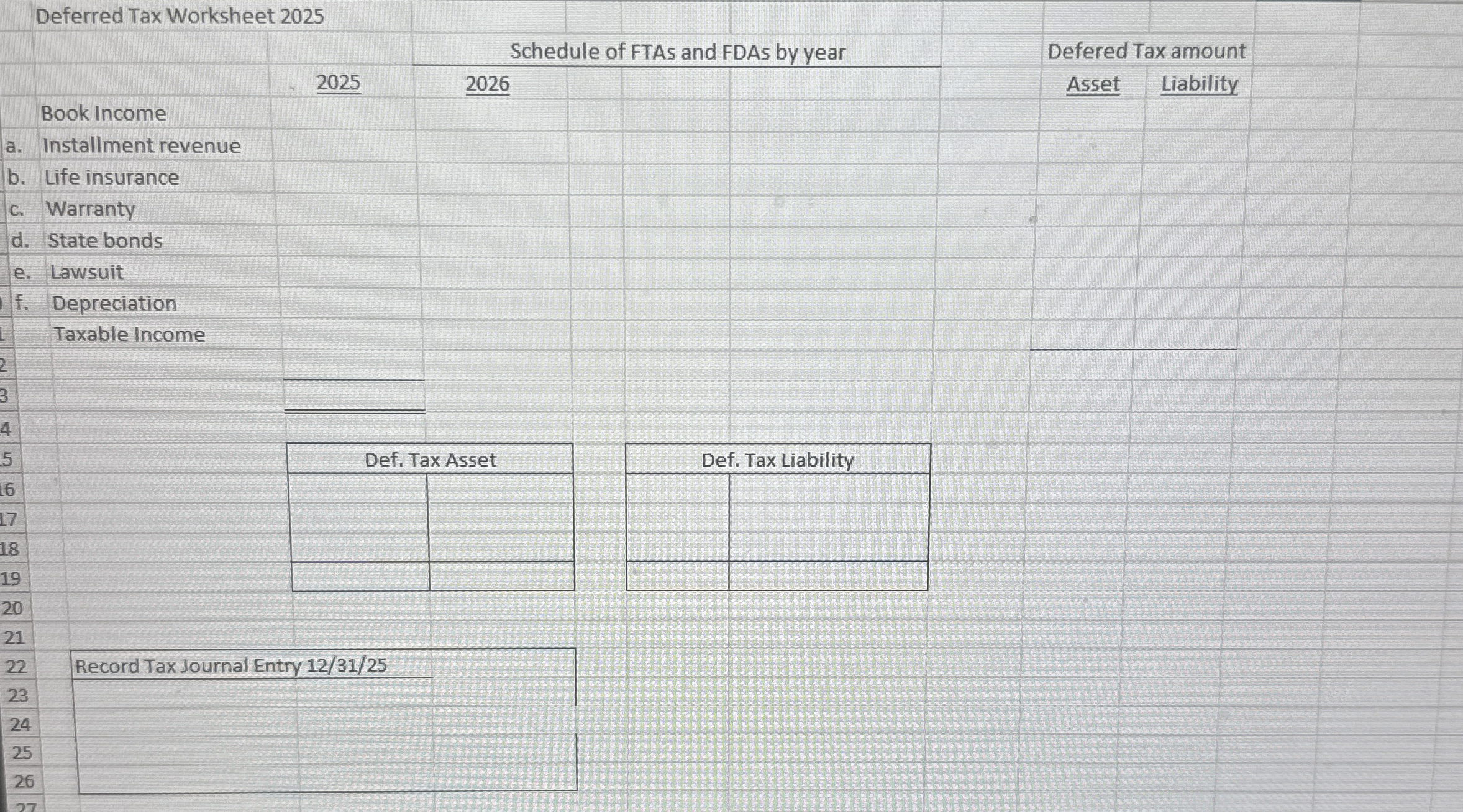

Deferred Tax Worksheet

Book Income

a Installment revenue

b Life insurance

c Warranty

d State bonds

e Lawsuit

f Depreciation

Taxable Income

Deferred Tax Worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started