The following information is available for Victoria Inc.for calendar 2020:

1.Instalment sales recorded on the books was $ 100,000. Collections of instalment receivables was $ 50,000.Installment sales are taxed when cash is received.

2.Golf club dues were $ 3,800.

3.Machinery was acquired in January 2020 for $ 300,000. Victoria uses straight-line depreciation over a ten-year life (no residual value). For tax purposes, Victoria uses CCA at 14% for 2020 after considering the half-year rule.

4.Dividends received from a Canadian corporation were $ 4,000.

5.The estimated warranty liability related to 2020 sales was $ 19,600. Warranty repair costs paid during 2020 were $ 13,600. The remainder will be paid in 2021.

6.Pre-tax accounting income is $ 250,000. The enacted income tax rate is 25%.

I'm looking for

(a)Calculate taxable income for 2020.

(b)Calculate current income taxes payable for 2020.

(c)Calculate the balance of any deferred income taxes asset and deferred income tax liability at December 31, 2020.do for each item and identify any balances as either a deferred tax asset or a deferred tax liability.

(d)The journal entry(s) to record current income taxes for 2020 and record an entry for the deferred tax determined in part c.

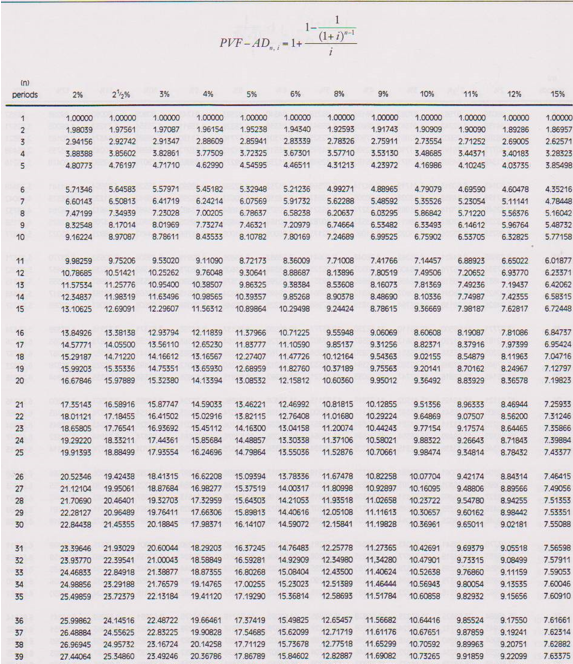

\f\fPVF-AD - 1+- 4% 5%% 8% 10% 11% 12% 15%% periods 100000 1.00000 1.0000D 1 00000 1.00000 1,00000 1.00000 1.00000 1.00000 1.0000 1.00000 1.00000 1.96154 1.92593 1.91743 1.90090 1.8695 1.98059 1.95238 1.94340 1.90909 1.97561 1 97087 2.69005 2.62571 294156 2.92742 291347 2.88609 2.85941 2.83539 2.78326 2.75911 2.73554 2.71252 5 68589 3.85602 3.87361 3.77509 3.72325 3.67301 5.57710 3.53130 3.48685 3.44371 3.40183 3.2832 471710 4.62990 4 54595 4.46511 4.31213 4.23972 4.16986 4.10245 4.03735 3.85498 4 80775 4.76190 5.71546 5.64503 5.57971 5.45182 5 32948 5.21236 4.99271 4.80965 4 79079 4.69590 4.60478 4.35216 6.41719 6.24214 6 07569 5.91732 5.62268 5.49592 5.35526 5.23054 5.11141 4.7844 6.60145 6 50813 700205 6 78637 6.58238 6.20637 6.03295 5.86842 5.71220 5 56576 5.1604 7.47199 7 34939 7.23028 8.17014 8.01959 7.75274 7.46521 7.20979 5.74664 6 59482 6.35-493 6.14612 5.96764 5.46732 8.32548 8.78611 8 45553 8.10782 7.80169 7 24689 6 99525 6.75902 6.55705 6 32825 5.77158 9.16724 8.97087 7.14457 6 08925 6.65022 6.01877 11 9.98259 9.75206 9.55020 9.11090 8.72175 8.56009 7.71008 7.41765 10.78685 10.51421 10.25262 9 76048 9.30641 3.88687 8.15896 7.80519 7.49505 7 20652 6.95770 6.2557 10 98507 9.86325 9.58584 8.59606 8.16075 7.81569 7 49256 7.19457 6.42067 11.57534 11.25776 10.95400 14.96319 11.65496 10 98565 10.39357 9.85268 8.90578 8.48590 8.10596 7 74087 7.43595 6 9851 12.34837 6 72448 15 13.10625 12.69091 12.29607 11.56512 10.89654 10 20496 9.24424 8.78615 9.56660 7.58187 7.62817 13.84926 15.58138 12.95794 12.11859 11 57966 10 71225 9.59948 9.06089 3.60608 8.15087 7.81086 6 84757 16 3.82571 8.57916 7.97599 6.95424 17 14 57771 14.05500 15 56110 12.65250 11.85777 11.10590 9.85157 9.51256 9.54363 9.02155 8.54879 9.11905 7.04716 18 15 20187 14,71320 14.19612 15.16567 12 27407 11.47726 10.12164 9 30141 8.70162 8.24967 7.12797 19 15 99203 15.55596 14.75551 15.65950 12.68959 11.82760 10.57189 9.75565 7.19823 20 16 67846 15.97869 15 32590 14.13494 15 08552 12.15812 10.60360 9.95012 9.56492 8.85929 8.56578 12.46992 10.81815 10.12855 9.51356 8.90395 8.46944 7.25933 21 17 35145 16.58916 15 87747 14.59033 13 46221 17.18455 16.41502 15.02916 13 82115 12.76-408 11.01680 10.29224 9.64869 9.07507 8 56200 7.31246 18 01121 8.54465 7.35868 23 18 65905 17.76541 16.93692 15.45112 14.16300 13.04150 11.20074 10.44243 9.77154 9.17574 15.85684 14 49857 13.30338 11.37106 10 59021 9.89322 9.26645 8.71845 7.39884 24 19.29220 18 35211 17.44351 25 19.91395 18 88499 17.93554 16.24696 14 79864 13.55036 11.52876 10.70661 9.98474 9.34814 8 78452 7.43377 8 84514 7.46415 26 20.525-45 19 42458 18.41315 16.62208 15.09594 15.78336 11.67478 10 82258 10.07704 9.42174 19.95061 18.87684 16.98273 15.57519 14,00317 11.80996 10.16095 9.49806 7.49056 21.12104 28 21.70690 20 46401 19.32703 17 32959 15.64905 14.21053 11 93518 11.02658 10.25723 9 54780 894795 7.51353 22.28127 20 98489 19.76411 17.66300 15.89815 14.40616 12 05108 11.11613 10.30657 9.60162 8 98442 7.53351 22.84498 21.45355 20.18845 17.98371 16.14107 14.59072 12.15841 11.19828 10.36951 9 65011 9.02181 7.5508 31 25.59646 21.93029 20.60044 18 29203 16.37245 14.76485 12 25778 11.27965 10.42691 9.69379 9.05518 7.56598 16.59281 BOBZE FL 12 54980 11.54280 10.47901 9 73315 9.08499 18 58849 7.57911 52 25.95770 22.39541 21.00043 18 87355 16.80268 15.08404 12 45500 11.40524 10.52638 9 76860 9.11159 7.59055 24.46845 22.84918 21.38877 11.46444 10.56943 9.80054 9.13535 7 60046 24.96856 23.29198 21.76579 19.14765 17.00255 15.25023 12 51589 9.15656 7 60910 55 25.49659 25.72579 22.13184 19.41120 17.19290 15 36814 12 58695 11.51784 10.60858 9.82932 17.37419 15.49825 12.65457 11.56682 10.64416 9.85524 9.17550 7.61661 25.99862 24.14515 22.48722 19 65461 26.48864 24.59625 22.83225 19 90828 17.54685 15.62099 12.71719 11.61175 10.67651 9.87859 9.19241 7.62314 17.74129 15.75678 12.77518 11.65299 10.70592 9.89963 9.20751 7.62082 26.96945 24.95732 23.16724 20.14258 25.34860 25.49246 20 36786 17.86789 15 84602 12.82887 11.69082 10.73265 9.91859 9.22099 7 63575 27.44064