Answered step by step

Verified Expert Solution

Question

1 Approved Answer

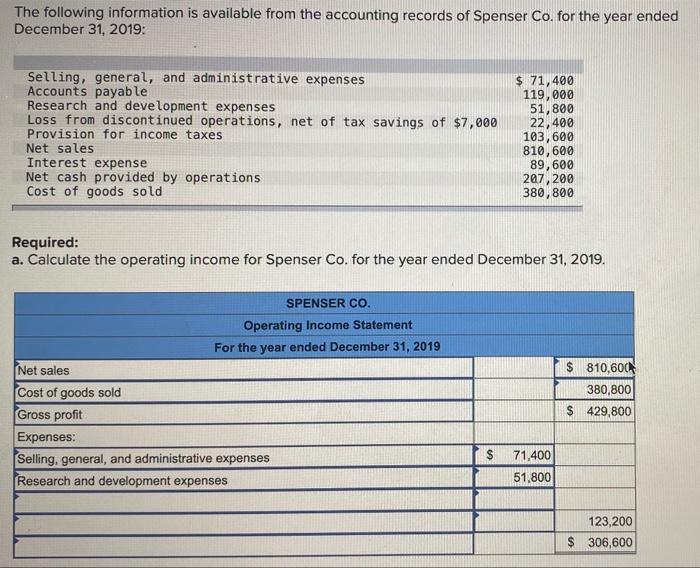

The following information is available from the accounting records of Spenser Co. for the year ended December 31, 2019: Selling, general, and administrative expenses

The following information is available from the accounting records of Spenser Co. for the year ended December 31, 2019: Selling, general, and administrative expenses Accounts payable $ 71,400 119,000 Research and development expenses 51,800 Loss from discontinued operations, net of tax savings of $7,000 Provision for income taxes 22,400 103,600 Net sales 810,600 Interest expense Net cash provided by operations 89,600 207, 200 380,800 Cost of goods sold Required: a. Calculate the operating income for Spenser Co. for the year ended December 31, 2019. SPENSER CO. Operating Income Statement For the year ended December 31, 2019 $ 810,600 Net sales 380,800 Cost of goods sold Gross profit $ 429,800 Expenses: Selling, general, and administrative expenses Research and development expenses 123,200 $ 306,600 $ 71,400 51,800 b. Calculate the company's net income for 2019.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answera SPENSER CO OPERATING INCOME STATEMENT FOR THE YEAR ENDED DECEMBER ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started