Question

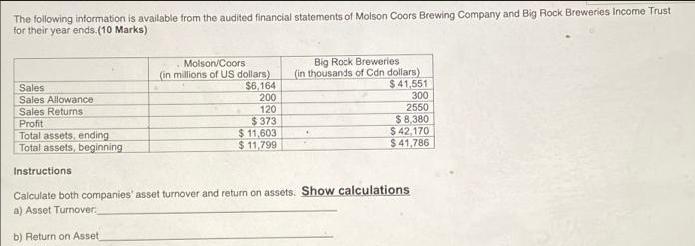

The following information is available from the audited financial statements of Molson Coors Brewing Company and Big Rock Breweries Income Trust for their year

The following information is available from the audited financial statements of Molson Coors Brewing Company and Big Rock Breweries Income Trust for their year ends.(10 Marks) Molson/Coors (in millions of US dollars). $6,164 Sales Sales Allowance Sales Returns Profit Total assets, ending Total assets, beginning Instructions Calculate both companies' asset turnover and return on assets. Show calculations a) Asset Turnover b) Return on Asset 200 120 $373 Big Rock Breweries (in thousands of Cdn dollars) $41,551 $11,603 $11,799 300 2550 $8,380 $ 42,170 $41,786

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Asset Turnover Asset Turnover is calculated by dividing the companys sales by its average total a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

8th Edition

1285190904, 978-1305176348, 1305176340, 978-1285190907

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App