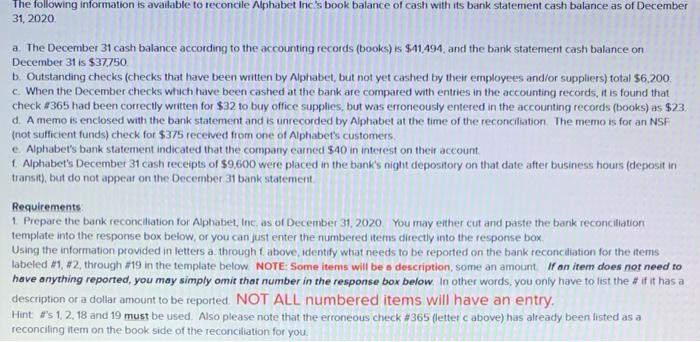

The following information is available to reconcile Alphabet Inc's book balance of cash with its bank statement cash balance as of December 31, 2020 a. The December 31 cash balance according to the accounting records (books) is $11.494, and the bank statement cash balance on December 31 is $37,750 b. Outstanding checks (checks that have been written by Alphabet, but not yet cashed by their employees and/or suppliers) total $6.200 When the December checks which have been cashed at the bank are compared with entries in the accounting records, it is found that check #365 had been correctly written for $32 to buy office supplies, but was erroneously entered in the accounting records (books) as $23. d. A memo is enclosed with the bank statement and is unrecorded by Alphabet at the time of the reconciliation The memo is for an NSF (not sufficient funds) check for $375 received from one of Alphabet's customers e Alphabet's bank statement indicated that the company carned $40 in interest on their account 1 Alphabet's December 31 cash receipts of $9,600 were placed in the bank's night depository on that date after business hours (deposit in transit), but do not appear on the December 31 bank statement Requirements 1 Prepare the bank reconciliation for Alphabet, Inc. as of December 31, 2020 You may either cut and paste the bank reconciliation template into the response box below, or you can just enter the numbered items directly into the response box Using the information provided in letters a through above, identify what needs to be reported on the bank reconciliation for the items labeled #1, #2, through #19 in the template below NOTE Some items will be a description, some an amount on item does nor need to have anything reported, you may simply omit that number in the response box below. In other words, you only have to list the # if it has a description or a dollar amount to be reported. NOT ALL numbered items will have an entry. Hint #'s 1, 2, 18 and 19 must be used. Also please note that the erroneous check #365 (letter above) has already been listed as a reconciling item on the book side of the reconciliation for you. The following information is available to reconcile Alphabet Inc's book balance of cash with its bank statement cash balance as of December 31, 2020 a. The December 31 cash balance according to the accounting records (books) is $11.494, and the bank statement cash balance on December 31 is $37,750 b. Outstanding checks (checks that have been written by Alphabet, but not yet cashed by their employees and/or suppliers) total $6.200 When the December checks which have been cashed at the bank are compared with entries in the accounting records, it is found that check #365 had been correctly written for $32 to buy office supplies, but was erroneously entered in the accounting records (books) as $23. d. A memo is enclosed with the bank statement and is unrecorded by Alphabet at the time of the reconciliation The memo is for an NSF (not sufficient funds) check for $375 received from one of Alphabet's customers e Alphabet's bank statement indicated that the company carned $40 in interest on their account 1 Alphabet's December 31 cash receipts of $9,600 were placed in the bank's night depository on that date after business hours (deposit in transit), but do not appear on the December 31 bank statement Requirements 1 Prepare the bank reconciliation for Alphabet, Inc. as of December 31, 2020 You may either cut and paste the bank reconciliation template into the response box below, or you can just enter the numbered items directly into the response box Using the information provided in letters a through above, identify what needs to be reported on the bank reconciliation for the items labeled #1, #2, through #19 in the template below NOTE Some items will be a description, some an amount on item does nor need to have anything reported, you may simply omit that number in the response box below. In other words, you only have to list the # if it has a description or a dollar amount to be reported. NOT ALL numbered items will have an entry. Hint #'s 1, 2, 18 and 19 must be used. Also please note that the erroneous check #365 (letter above) has already been listed as a reconciling item on the book side of the reconciliation for you