Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is avallable on January 3 1 , 2 0 2 4 . a . At the end of January, the company estimates

The following information is avallable on January a At the end of January, the company estimates that the remaining units of Inventory purchased on January are expected to sell In February for only $ each. Hint: Determine the number of units remaining from January after subtracting the units returned on January and the units assumed sold FIFO on January b The company records an adjusting entry for $ for estimated future uncollectible accounts. c The company accrues interest on notes payable for January. Interest is expected to be pald each December d The company accrues income taxes at the end of January of $ Requirement General Journal General Ledger Trial Balance Income StatementJanuary Purchase units for $ on account $ each

January Purchase units for $ on account $ each

January Purchase units for $ on account $ each

January Return of the units purchased on January because of defects.

January Sell units on account for $ The cost of the units sold is determined using a FIFO perpetual inventory system.

January Receive $ from customers on accounts receivable.

January Pay $ to inventory suppliers on accounts payable.

January write off accounts receivable as uncollectible, $

January Pay cash for salaries during January, $

The following information Is avallable on January

a At the end of January, the company estimates that the remalning units of Inventory purchased on January are expected to sell

In February for only $ each. HInt: Determine the number of units remaining from January after subtracting the units

returned on January and the units assumed sold FIFO on January

b The company records an adjusting entry for $ for estimated future uncollectlble accounts.

c The company accrues interest on notes payable for January. Interest is expected to be pald each December

d The company accrues income taxes at the end of January of $

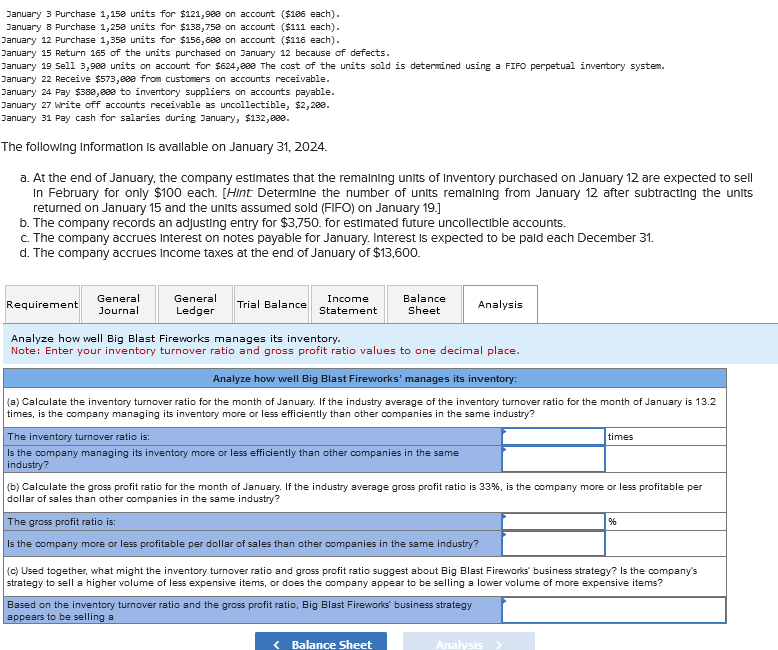

Analyze how well Big Blast Fireworks manages its inventory.

Note: Enter your inventory turnover ratio and gross profit ratio values to one decimal place.

Analyze how well Big Blast Fireworks' manages its inventory:

a Calculate the inventory turnover ratio for the month of January. If the industry average of the inventory turnover ratio for the month of January is

times, is the company managing its inventory more or less efficiently than other companies in the same industry?

The inventory turnover ratio is:

Is the company managing its inventory more or less efficiently than other companies in the same

industry?

b Calculate the gross profit ratio for the month of January. If the industry average gross profit ratio is is the company more or less profitable per

dollar of sales than other companies in the same industry?

The gross profit ratio is:

Is the company more or less profitable per dollar of sales than other companies in the same industry?

c Used together, what might the inventory turnover ratio and gross profit ratio suggest about Big Blast Fireworks' business strategy? Is the company's

strategy to sell a higher volume of less expensive items, or does the company appear to be selling a lower volume of more expensive items?

Based on the inventory turnover ratio and the gross profit ratio, Big Blast Fireworks' business strategy

appears to be selling a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started