Question

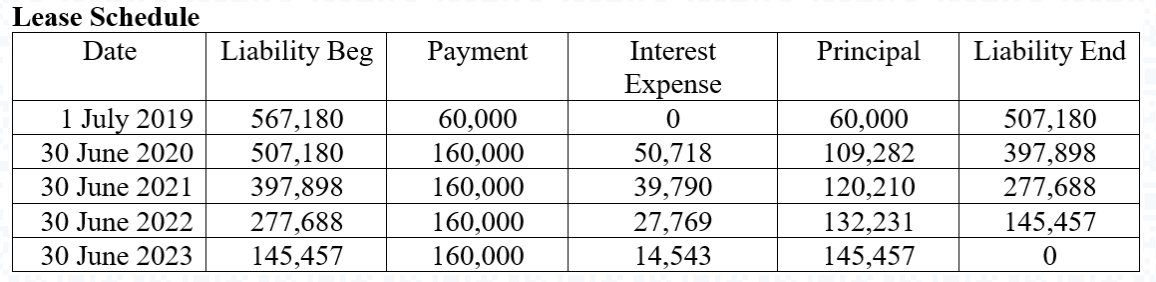

The following information is extracted from a lease schedule in the records of Kennards Ltd The information is for equipment acquired under a finance lease

The following information is extracted from a lease schedule in the records of Kennards Ltd

The information is for equipment acquired under a finance lease agreement.

Required

Based on the information from this lease schedule of Kennards Ltd what is

(a) The amount of the Fair value of the Lease Liability

(b) The amount of the Right of Use Equipment

(c) The lease interest rate

(d) The length of the term of the lease

(e) The date of the first lease payment

(f) Assuming the leased equipment will be returned at the end of the lease term, use this lease schedule to prepare the journal entries for the year ended 30 June 2021.

(g) Applying this lease schedule how would this information appear in the Balance Sheet as at 30 June 2021.

(h) Briefly explain how depreciation is considered for any right of use lease asset and how the number of years is determined when depreciating any right of use lease asset

Lease Schedule Date Liability Beg Payment Principal Liability End 1 July 2019 30 June 2020 30 June 2021 30 June 2022 30 June 2023 567,180 507,180 397,898 277,688 145,457 60,000 160,000 160,000 160,000 160,000 Interest Expense 0 50,718 39,790 27,769 14,543 60,000 109,282 120,210 132,231 145,457 507,180 397,898 277,688 145,457 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started