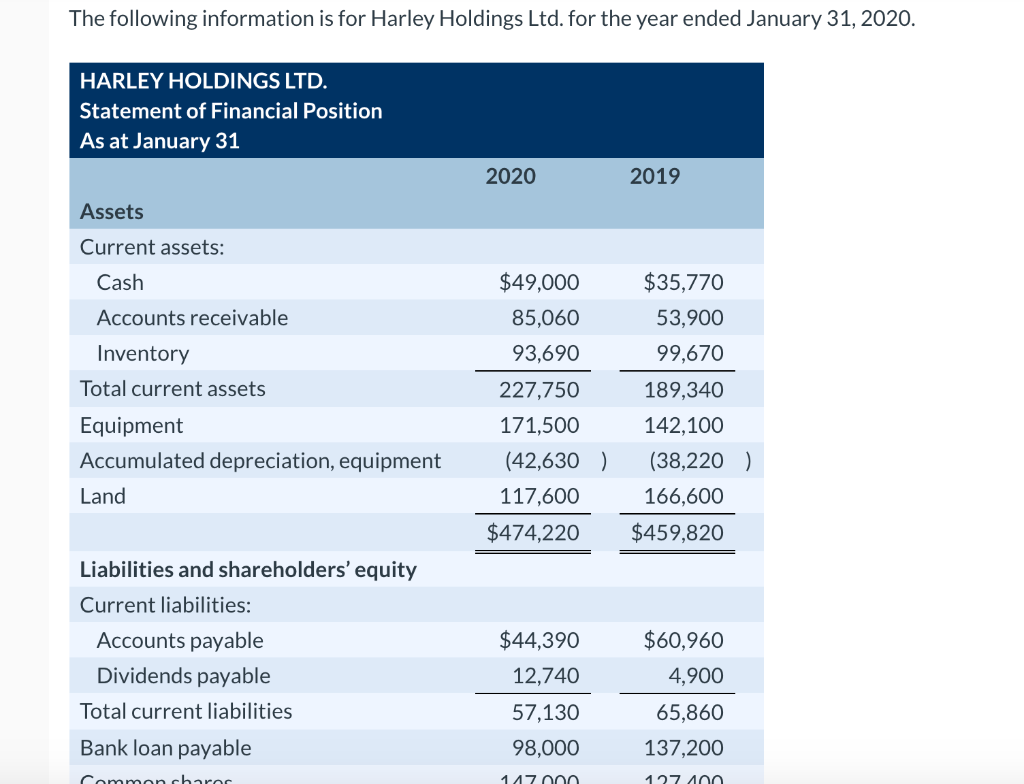

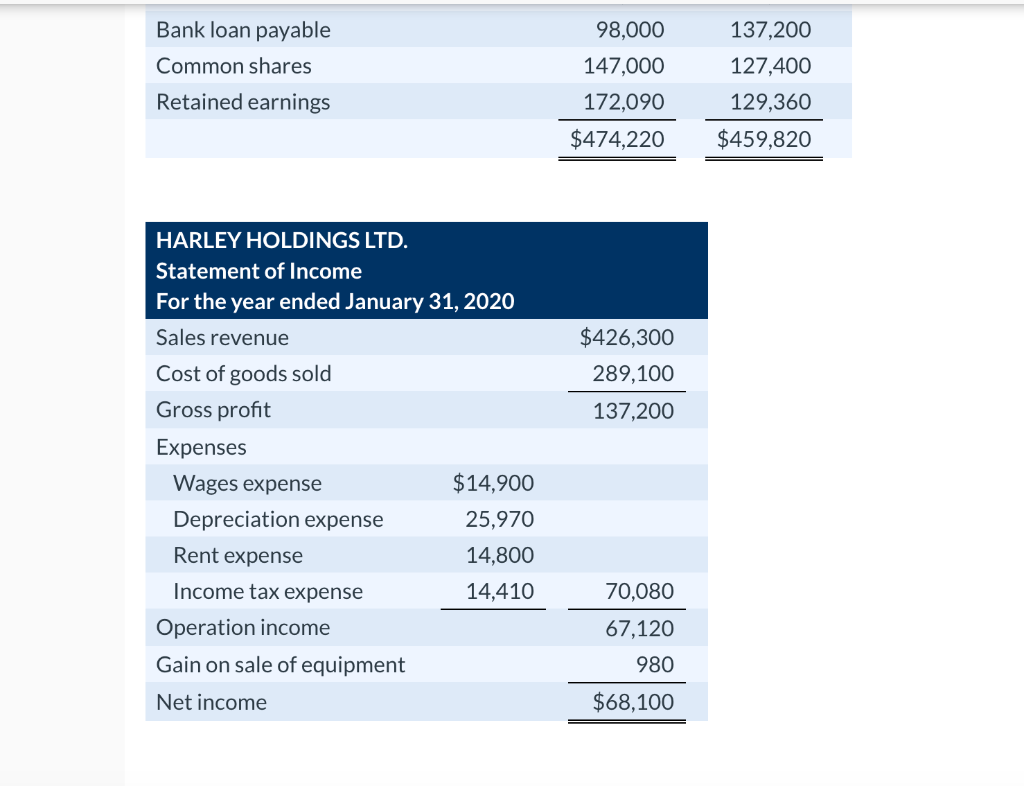

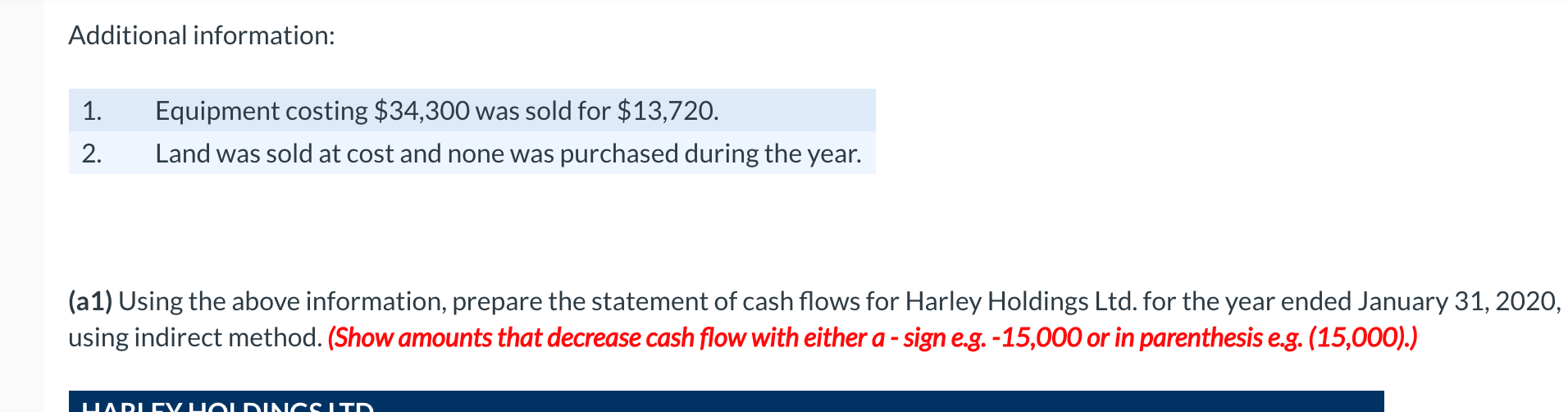

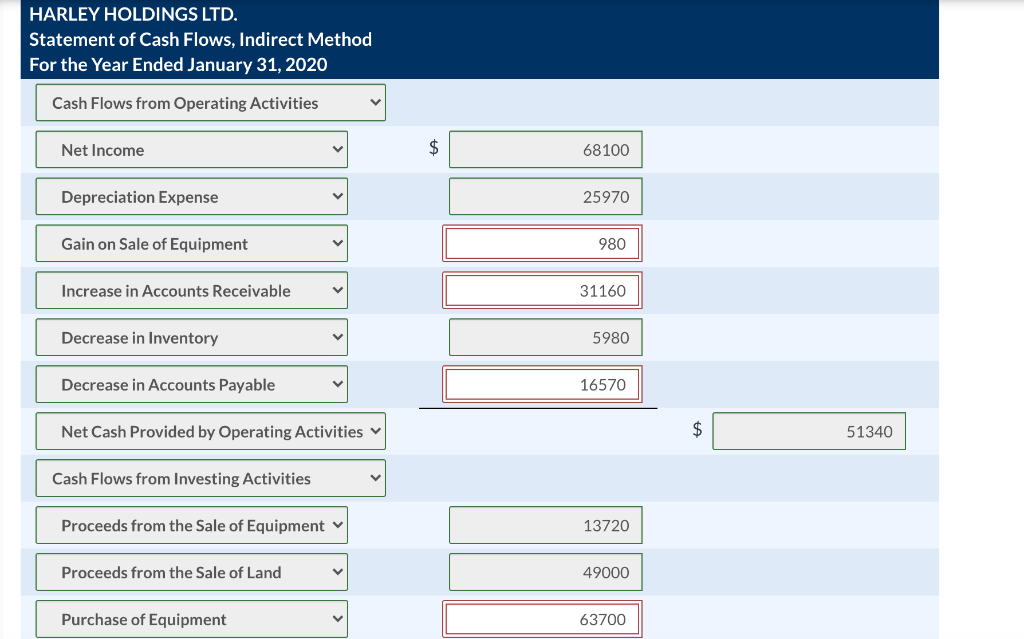

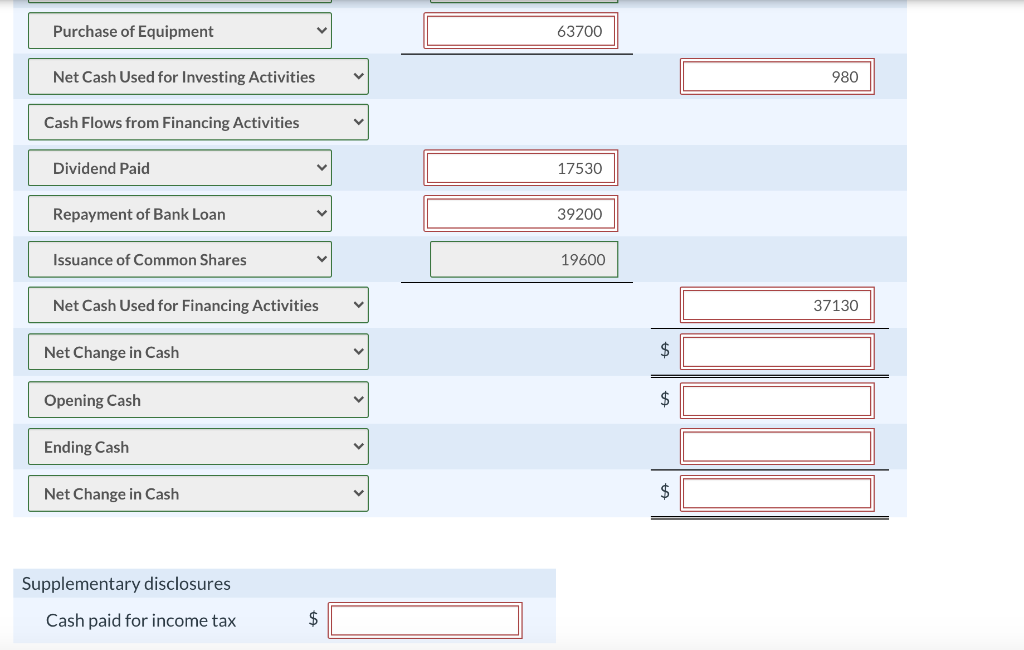

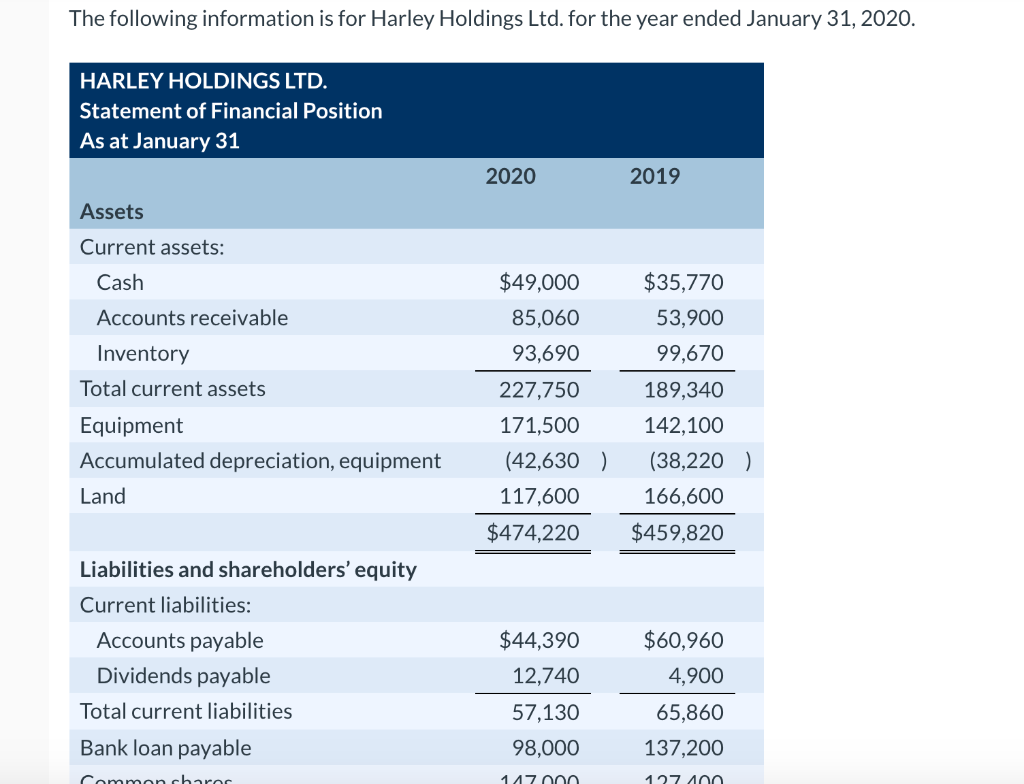

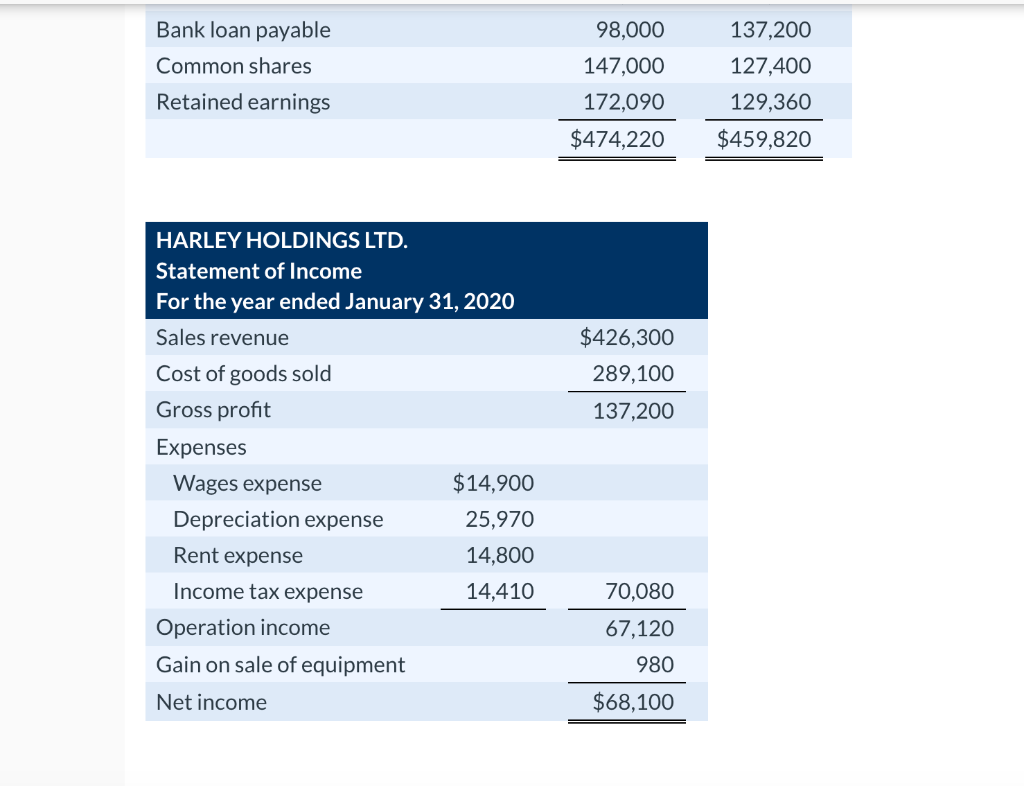

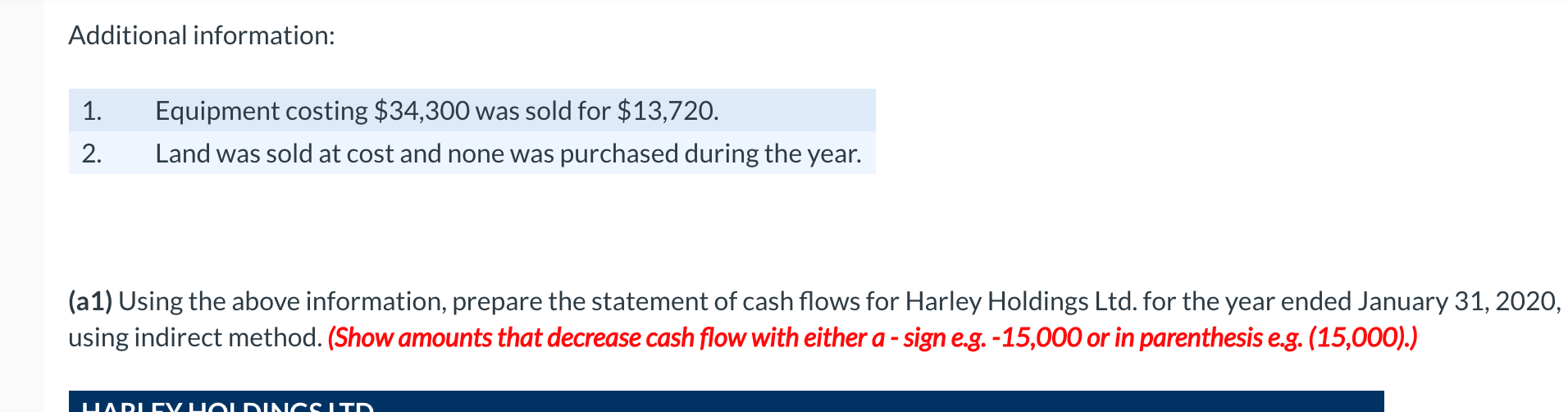

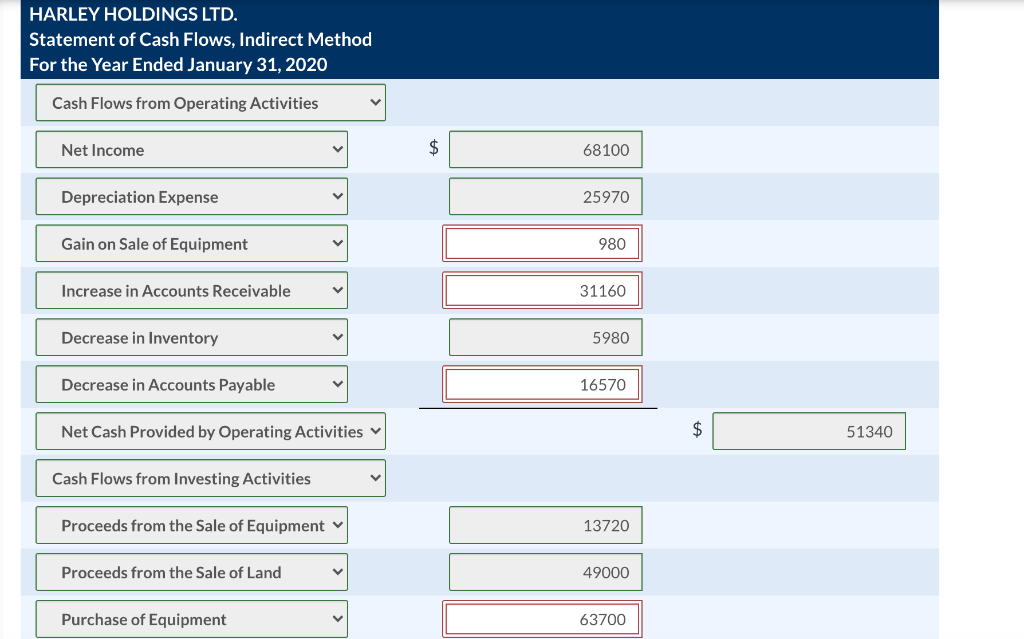

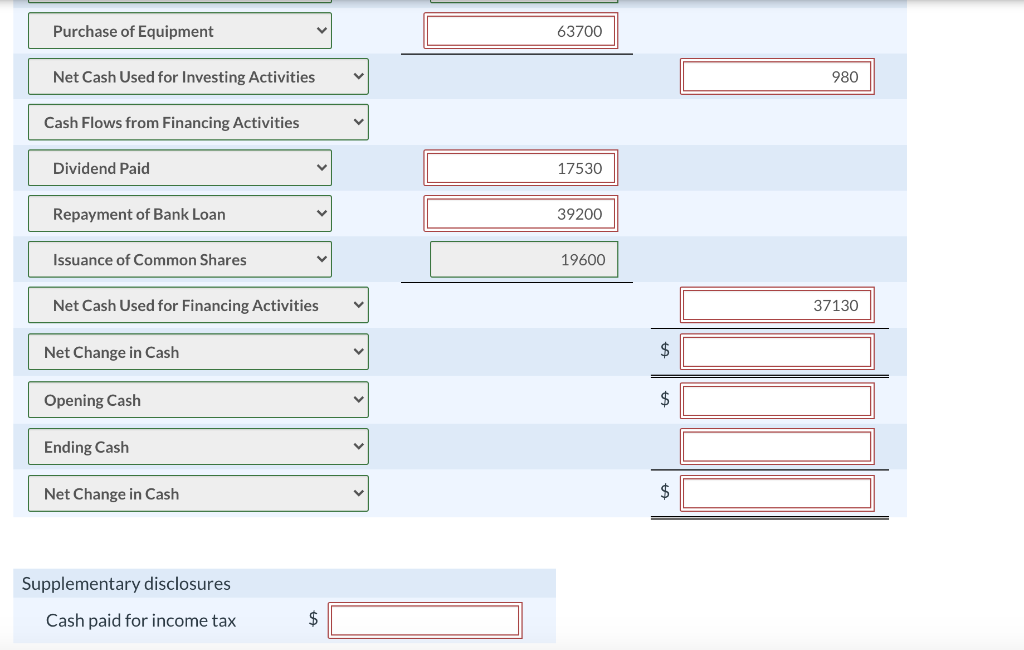

The following information is for Harley Holdings Ltd. for the year ended January 31, 2020. HARLEY HOLDINGS LTD. Statement of Financial Position As at January 31 2020 2019 Assets Current assets: Cash Accounts receivable $35,770 53,900 99,670 Inventory Total current assets 189,340 $49,000 85,060 93,690 227,750 171,500 (42,630) 117,600 $474,220 Equipment Accumulated depreciation, equipment Land 142,100 (38,220) 166,600 $459,820 $44,390 Liabilities and shareholders' equity Current liabilities: Accounts payable Dividends payable Total current liabilities Bank loan payable Common charor 12,740 57,130 98,000 $60,960 4,900 65,860 137,200 147 nnn 127 ann Bank loan payable Common shares Retained earnings 98,000 147,000 172,090 $474,220 137,200 127,400 129,360 $459,820 $426,300 289,100 137,200 HARLEY HOLDINGS LTD. Statement of Income For the year ended January 31, 2020 Sales revenue Cost of goods sold Gross profit Expenses Wages expense $14,900 Depreciation expense 25,970 Rent expense 14,800 Income tax expense 14,410 Operation income Gain on sale of equipment Net income 70,080 67,120 980 $68,100 Additional information: 1. Equipment costing $34,300 was sold for $13,720. Land was sold at cost and none was purchased during the year. 2. (a1) Using the above information, prepare the statement of cash flows for Harley Holdings Ltd. for the year ended January 31, 2020, using indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) WADLEV UOLDINGSID HARLEY HOLDINGS LTD. Statement of Cash Flows, Indirect Method For the Year Ended January 31, 2020 Cash Flows from Operating Activities Net Income $ 68100 Depreciation Expense 25970 Gain on Sale of Equipment 980 Increase in Accounts Receivable 31160 Decrease in Inventory 5980 Decrease in Accounts Payable 16570 Net Cash Provided by Operating Activities $ 51340 Cash Flows from Investing Activities Proceeds from the sale of Equipment 13720 Proceeds from the Sale of Land 49000 Purchase of Equipment 63700 Purchase of Equipment 63700 Net Cash Used for Investing Activities 980 Cash Flows from Financing Activities V Dividend Paid 17530 Repayment of Bank Loan 39200 Issuance of Common Shares 19600 Net Cash Used for Financing Activities 37130 Net Change in Cash $ Opening Cash $ Ending Cash V Net Change in Cash $ Supplementary disclosures Cash paid for income tax $