Answered step by step

Verified Expert Solution

Question

1 Approved Answer

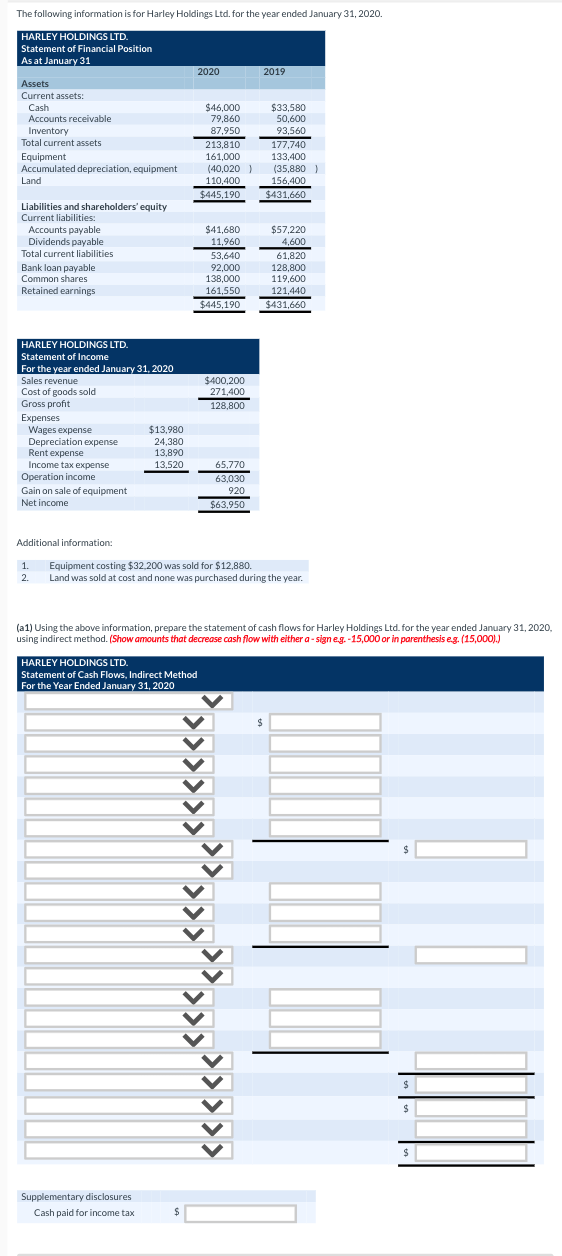

The following information is for Harley Holdings Ltd. for the year ended January 31, 2020. HARLEY HOLDINGS LTD. Statement of Financial Position As at

The following information is for Harley Holdings Ltd. for the year ended January 31, 2020. HARLEY HOLDINGS LTD. Statement of Financial Position As at January 31 2020 2019 Assets Current assets: Cash Accounts receivable Inventory Total current assets Equipment Accumulated depreciation, equipment Land Liabilities and shareholders' equity Current liabilities: Accounts payable Dividends payable Total current liabilities. Bank loan payable Common shares Retained earnings HARLEY HOLDINGS LTD. Statement of Income For the year ended January 31, 2020 Sales revenue $400,200 271,400 Cost of goods sold Gross profit 128,800 Expenses Wages expense $13,980 24,380 Depreciation expense Rent expense 13,890 Income tax expense 13,520 65,770 Operation income 63,030 Gain on sale of equipment 920 Net income $63,950 Additional information: 1. Equipment costing $32,200 was sold for $12,880. 2. Land was sold at cost and none was purchased during the year. (a1) Using the above information, prepare the statement of cash flows for Harley Holdings Ltd. for the year ended January 31, 2020, using indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) HARLEY HOLDINGS LTD. Statement of Cash Flows, Indirect Method For the Year Ended January 31, 2020 $ Supplementary disclosures Cash paid for income tax $ $46,000 79,860 87,950 213,810 161,000 (40,020) 110,400 $445,190 $41,680 11,960 53,640 92,000 138,000 161,550 $445,190 $33,580 50,600 93,560 177,740 133,400 (35,880) 156.400 $431,660 $57,220 4,600 61,820 128,800 119,600 121,440 $431,660 $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

HARLEY HOLDINGS LTD Statement of Cash Flows For the Year ended December 31 2020 A Cash Flows from Op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started