Question

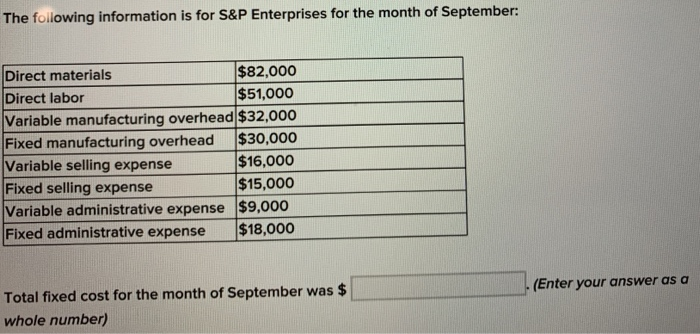

The following information is for S&P Enterprises for the month of September: Direct materials $82,000 $51,000 Direct labor Variable manufacturing overhead $32,000 Fixed manufacturing

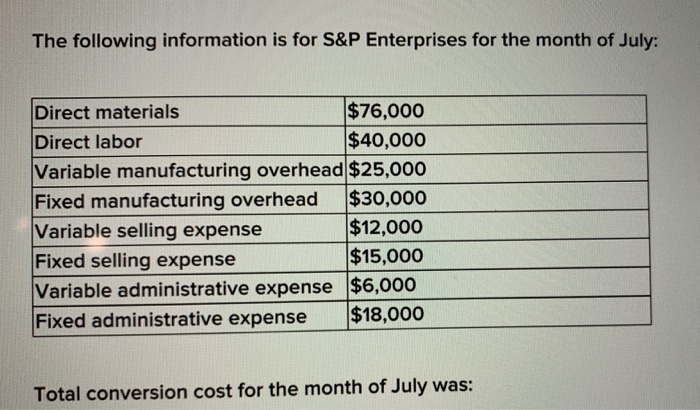

The following information is for S&P Enterprises for the month of September: Direct materials $82,000 $51,000 Direct labor Variable manufacturing overhead $32,000 Fixed manufacturing overhead $30,000 Variable selling expense $16,000 Fixed selling expense Variable administrative expense Fixed administrative expense $15,000 $9,000 $18,000 Total fixed cost for the month of September was $ whole number) (Enter your answer as a The following information is for S&P Enterprises for the month of July: $76,000 $40,000 Variable manufacturing overhead $25,000 Fixed manufacturing overhead $30,000 Variable selling expense $12,000 Fixed selling expense $15,000 Variable administrative expense $6,000 Fixed administrative expense $18,000 Direct materials Direct labor Total conversion cost for the month of July was:

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App