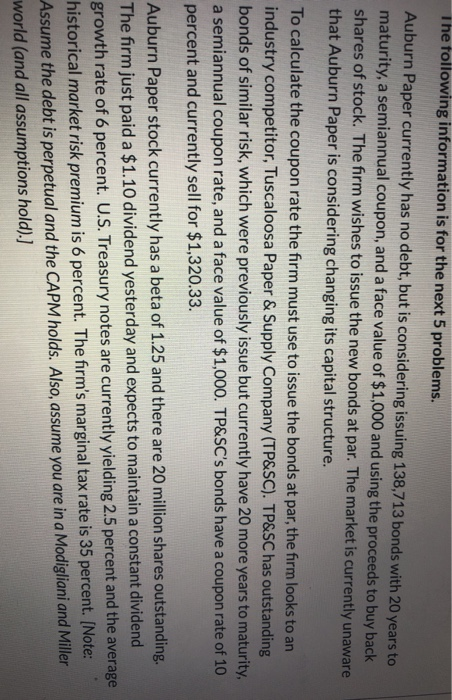

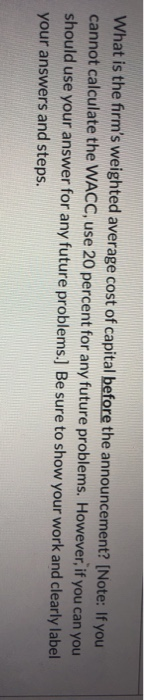

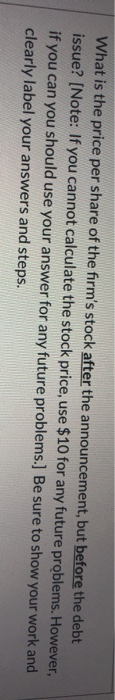

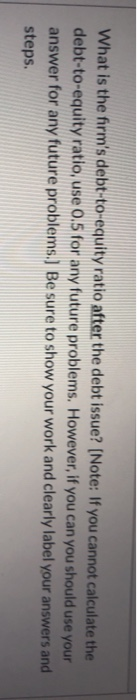

The following information is for the next 5 problems. Auburn Paper currently has no debt, but is considering issuing 138,713 bonds with 20 years to maturity, a semiannual coupon, and a face value of $1,000 and using the proceeds to buy back shares of stock. The firm wishes to issue the new bonds at par. The market is currently unaware that Auburn Paper is considering changing its capital structure. To calculate the coupon rate the firm must use to issue the bonds at par, the firm looks to an industry competitor, Tuscaloosa Paper & Supply Company (TP&SC). TP&SC has outstanding bonds of similar risk, which were previously issue but currently have 20 more years to maturity, a semiannual coupon rate, and a face value of $1,000. TP&SC's bonds have a coupon rate of 10 percent and currently sell for $1,320.33. Auburn Paper stock currently has a beta of 1.25 and there are 20 million shares outstanding. The firm just paid a $1.10 dividend yesterday and expects to maintain a constant dividend growth rate of 6 percent. U.S. Treasury notes are currently yielding 2.5 percent and the average historical market risk premium is 6 percent. The firm's marginal tax rate is 35 percent. [Note: Assume the debt is perpetual and the CAPM holds. Also, assume you are in a Modigliani and Miller world (and all assumptions hold).] What is the firm's weighted average cost of capital before the announcement? [Note: If you cannot calculate the WACC, use 20 percent for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the price per share of the firm's stock after the announcement, but before the debt issue? (Note: If you cannot calculate the stock price, use $10 for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the firm's debt-to-equity ratio after the debt issue? (Note: If you cannot calculate the debt-to-equity ratio, use 0.5 for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the yield to maturity on the firm's newly issued debt? (Note: If you cannot calculate the yield to maturity, use 12 percent for any future problems. However, if you can you should use your answer for any future problems.] Be sure to show your work and/or calculator steps and clearly label your answers and steps. What is the firm's weighted average cost of capital after the debt issue? (Note: If you cannot calculate the WACC, use 15 percent for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and/or calculator steps and clearly label your answers and steps. The following information is for the next 5 problems. Auburn Paper currently has no debt, but is considering issuing 138,713 bonds with 20 years to maturity, a semiannual coupon, and a face value of $1,000 and using the proceeds to buy back shares of stock. The firm wishes to issue the new bonds at par. The market is currently unaware that Auburn Paper is considering changing its capital structure. To calculate the coupon rate the firm must use to issue the bonds at par, the firm looks to an industry competitor, Tuscaloosa Paper & Supply Company (TP&SC). TP&SC has outstanding bonds of similar risk, which were previously issue but currently have 20 more years to maturity, a semiannual coupon rate, and a face value of $1,000. TP&SC's bonds have a coupon rate of 10 percent and currently sell for $1,320.33. Auburn Paper stock currently has a beta of 1.25 and there are 20 million shares outstanding. The firm just paid a $1.10 dividend yesterday and expects to maintain a constant dividend growth rate of 6 percent. U.S. Treasury notes are currently yielding 2.5 percent and the average historical market risk premium is 6 percent. The firm's marginal tax rate is 35 percent. [Note: Assume the debt is perpetual and the CAPM holds. Also, assume you are in a Modigliani and Miller world (and all assumptions hold).] What is the firm's weighted average cost of capital before the announcement? [Note: If you cannot calculate the WACC, use 20 percent for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the price per share of the firm's stock after the announcement, but before the debt issue? (Note: If you cannot calculate the stock price, use $10 for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the firm's debt-to-equity ratio after the debt issue? (Note: If you cannot calculate the debt-to-equity ratio, use 0.5 for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and clearly label your answers and steps. What is the yield to maturity on the firm's newly issued debt? (Note: If you cannot calculate the yield to maturity, use 12 percent for any future problems. However, if you can you should use your answer for any future problems.] Be sure to show your work and/or calculator steps and clearly label your answers and steps. What is the firm's weighted average cost of capital after the debt issue? (Note: If you cannot calculate the WACC, use 15 percent for any future problems. However, if you can you should use your answer for any future problems.) Be sure to show your work and/or calculator steps and clearly label your answers and steps