Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is from Bowin Inc. for a long-term construction project that is expected to be completed in January of next year. The construction

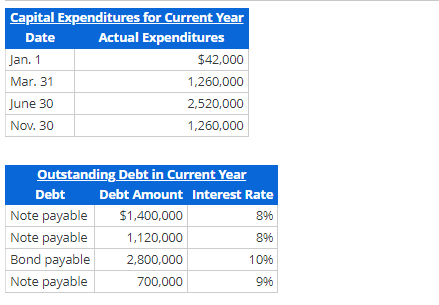

The following information is from Bowin Inc. for a long-term construction project that is expected to be completed in January of next year. The construction project is for a building intended for the companys own use. The capital expenditure on January 1 of the current year is for the purchase of land for the building site. No new construction loans were opened for the project during the year. All debt was outstanding for the full year.

Just need C.

Thank you

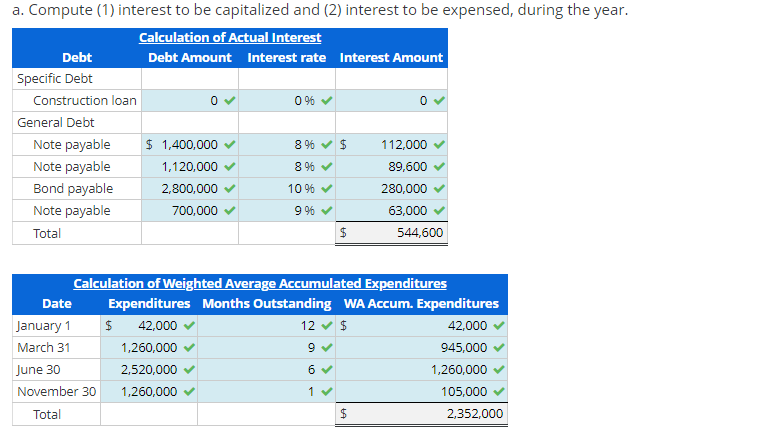

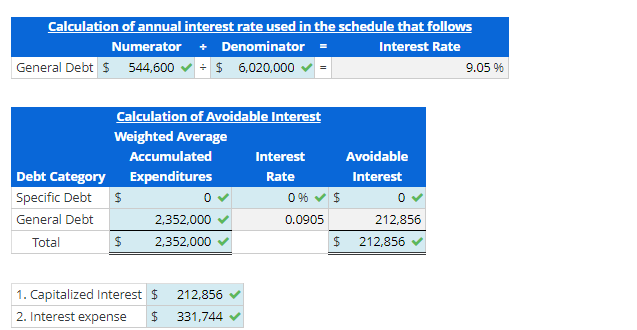

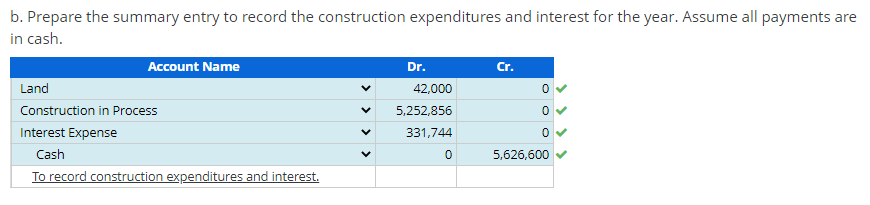

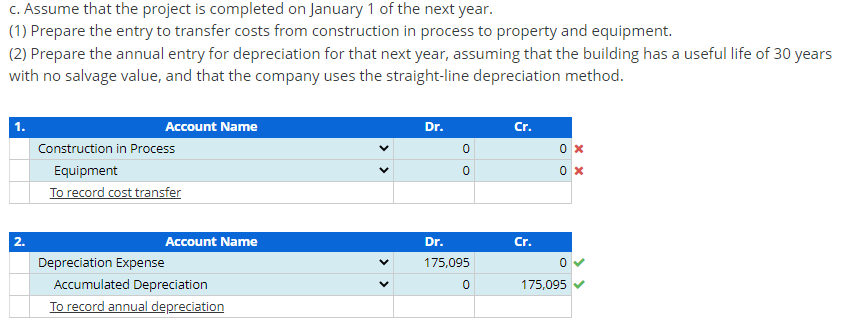

Capital Expenditures for Current Year \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Date } & Actual Expenditures \\ \hline Jan. 1 & $42,000 \\ \hline Mar. 31 & 1,260,000 \\ \hline June 30 & 2,520,000 \\ \hline Nov. 30 & 1,260,000 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|} \hline \multicolumn{2}{|c|}{ Qutstanding Debt in Current Year } \\ \hline Debt & Debt Amount & Interest Rate \\ \hline Note payable & $1,400,000 & 8% \\ \hline Note payable & 1,120,000 & 8% \\ \hline Bond payable & 2,800,000 & 10% \\ \hline Note payable & 700,000 & 9% \\ \hline \end{tabular} a. Compute (1) interest to be capitalized and (2) interest to be expensed, during the year. Calculation of annual interest rate used in the schedule that follows NumeratorDenominatorGeneralDebt$544,6006,020,000==InterestRate9.05% 1. Capitalized Interest \$ $212,856 2. Interest expense $331,744 b. Prepare the summary entry to record the construction expenditures and interest for the year. Assume all payments are in cash. c. Assume that the project is completed on January 1 of the next year. (1) Prepare the entry to transfer costs from construction in process to property and equipment. (2) Prepare the annual entry for depreciation for that next year, assuming that the building has a useful life of 30 years with no salvage value, and that the company uses the straight-line depreciation methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started