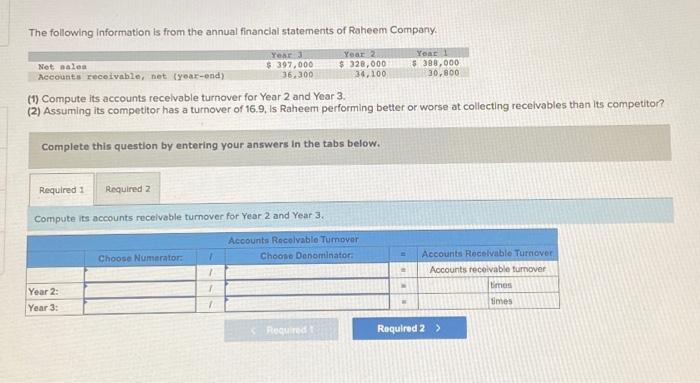

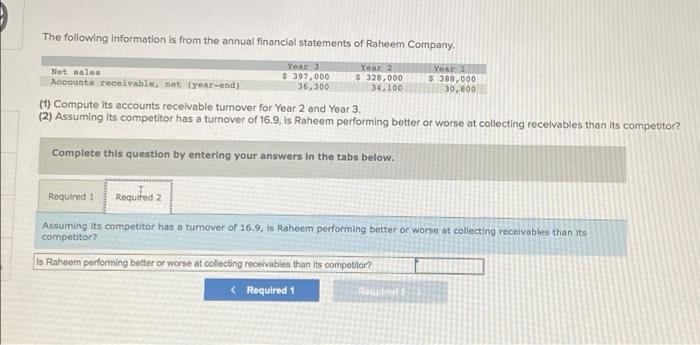

The following Information is from the annual financial statements of Raheem Company. Year 1 Year 3 $397,000 36,300 Year 2 $ 328,000 34,100 S

The following Information is from the annual financial statements of Raheem Company. Year 1 Year 3 $397,000 36,300 Year 2 $ 328,000 34,100 S 300,000 30,800 Net aalea Accounts receivable, net (year-end) (1) Compute its accounts recelvable turnover for Year 2 and Year 3. (2) Assuming its competitor has a turnover of 16.9, is Raheem performing better or worse at collecting receivables than Its competitor? Complete this question by entering your answers In the tabs below. Required 1 Required 2 Compute its accounts recelvable turnover for Year 2 and Year 3. Accounts Recelvable Tumover Choose Denominator: Accounts Recelvable Turnover Choose Numerator: Accounts receivable turmover times imes Year 2: Year 3: Required Required 2> The following Information is from the annual financial statements of Raheem Company. Year 3 $ 397,000 36,300 Xear 2 Year Net sales $ 328,000 34.100 S 388,000 30, 800 Accounts receivable, net (year-end) (1) Compute Its accounts receivable turnover for Year 2 and Year 3. (2) Assuming Its competitor has a turnover of 16.9, is Raheem performing better or worse at collecting recelvables than Its competitor? Complete this question by entering your answers in the tabs below. Required 1 Requited 2 Assuming Its competitor has a turnover of 16.9, is Raheem performing better or worse at collecting recelvables than its competitor? Is Raheem performing better or worse at collecting receivables than its competitor? < Required 1

Step by Step Solution

3.40 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Account Receirable Turnoner nce Sales Aug Thade Receivablee y...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started