Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is given for a privately owned company: This company has taken out a bank loan for $300,000. They do not have any

The following information is given for a privately owned company:

This company has taken out a bank loan for $300,000. They do not have any equity infusion at this time. What would their first year monthly cash budget look like?

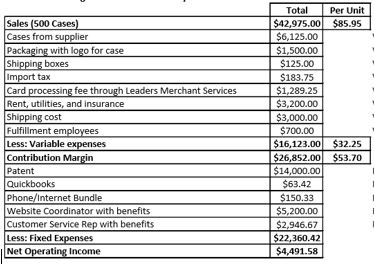

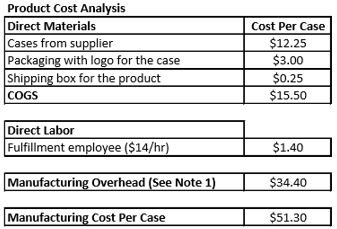

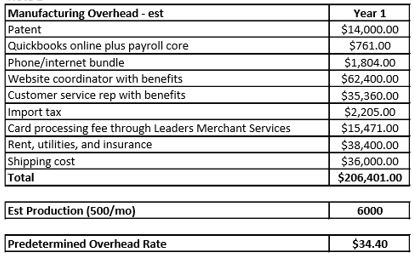

Sales (500 Cases) Cases from supplier Packaging with logo for case Shipping boxes Import tax Card processing fee through Leaders Merchant Services Rent, utilities, and insurance Shipping cost Fulfillment employees Less: Variable expenses Contribution Margin Patent Quickbooks Phone/Internet Bundle Website Coordinator with benefits Customer Service Rep with benefits Less: Fixed Expenses Net Operating Income Total Per Unit $42,975.00 $85.95 $6,125.00 $1,500.00 $125.00 $183.75 $1,289.25 $3,200.00 $3,000.00 $700.00 $16,123.00 $32.25 $26,852.00 $53.70 $14,000.00 $63.42 $150.33 $5,200.00 $2,946.67 $22,360.42 $4,491.58 Product Cost Analysis Direct Materials Cases from supplier Packaging with logo for the case Shipping box for the product COGS Cost Per Case $12.25 $3.00 $0.25 $15.50 Direct Labor Fulfillment employee ($14/hr) $1.40 Manufacturing Overhead (See Note 1) 1 $34.40 Manufacturing Cost Per Case $51.30 Manufacturing Overhead - est Patent Quickbooks online plus payroll core Phone/internet bundle Website coordinator with benefits Customer service rep with benefits Import tax Card processing fee through Leaders Merchant Services Rent, utilities, and insurance Shipping cost Total Year 1 $14,000.00 $761.00 $1,804.00 $62,400.00 $35,360.00 $2,205.00 $15,471.00 $38,400.00 $36,000.00 $206,401.00 Est Production (500/mo) 6000 Predetermined Overhead Rate $34.40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started