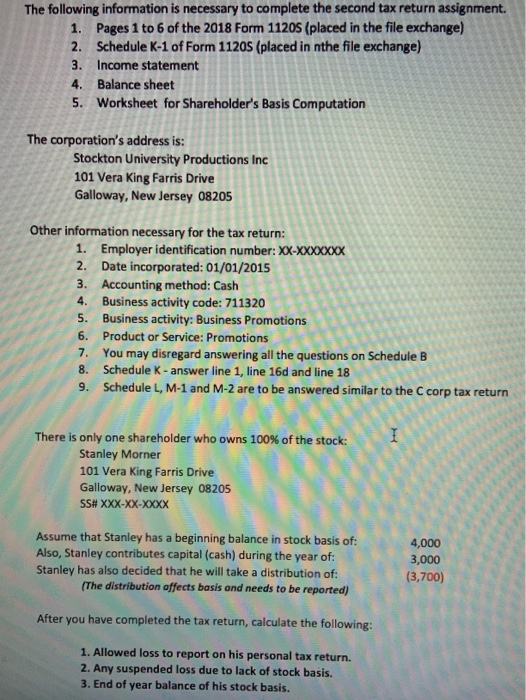

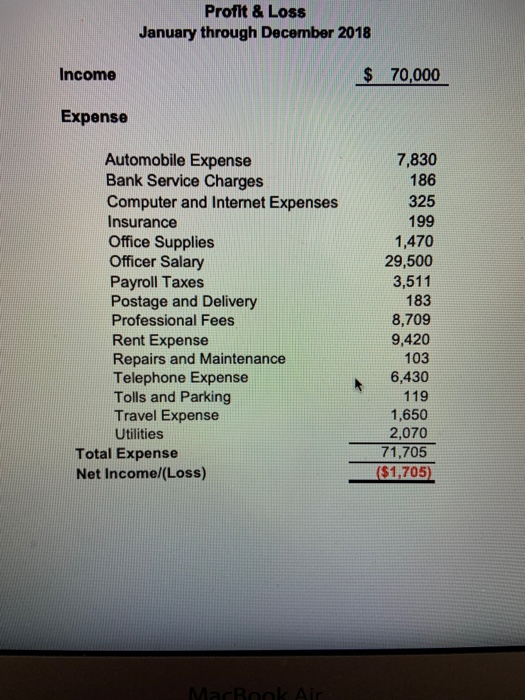

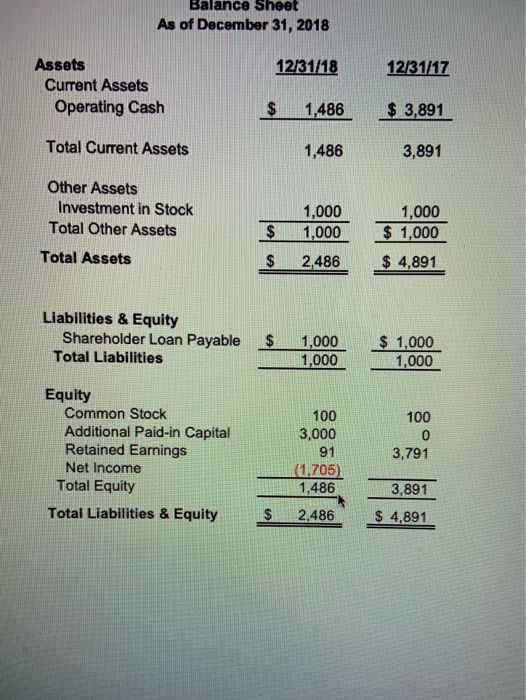

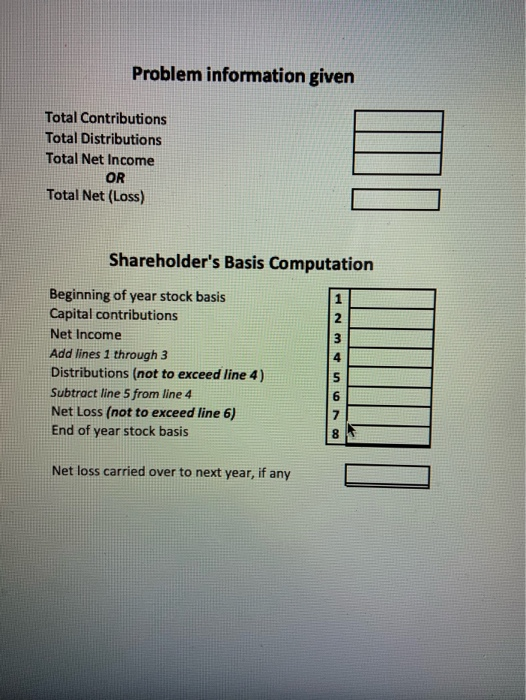

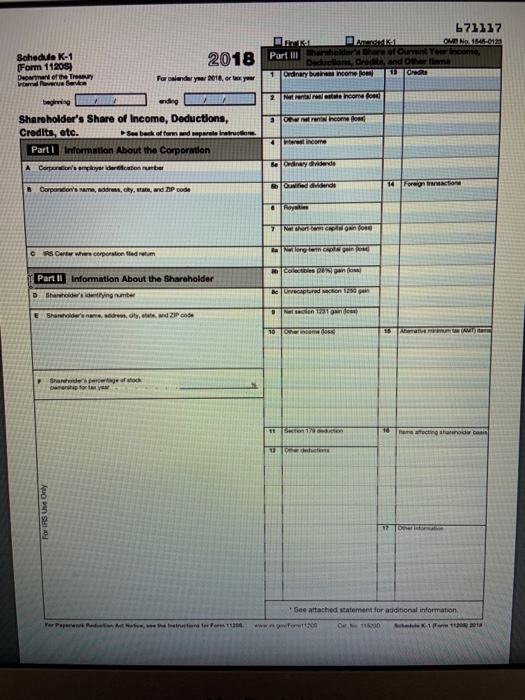

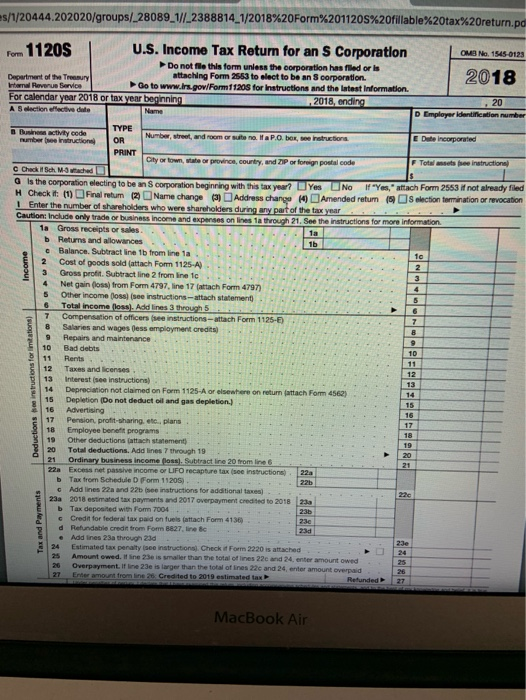

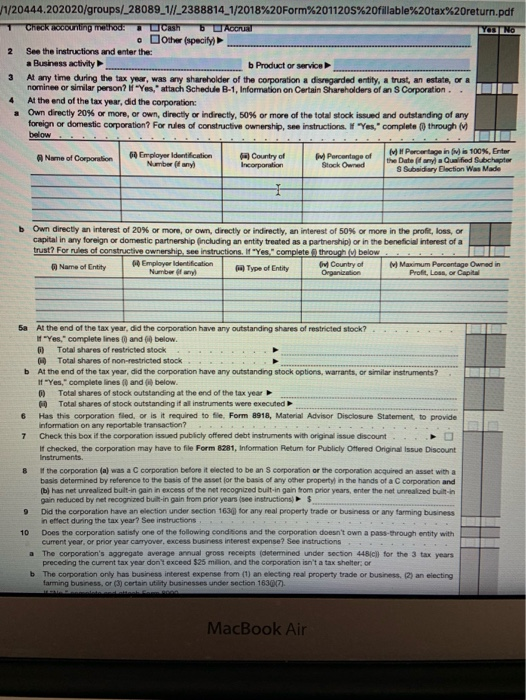

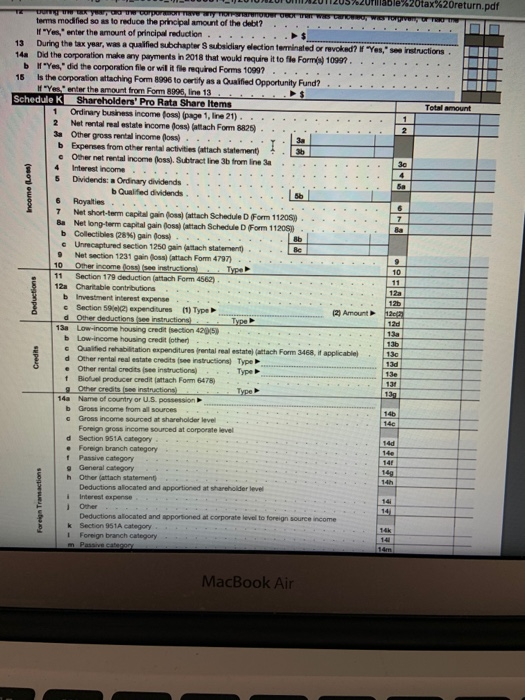

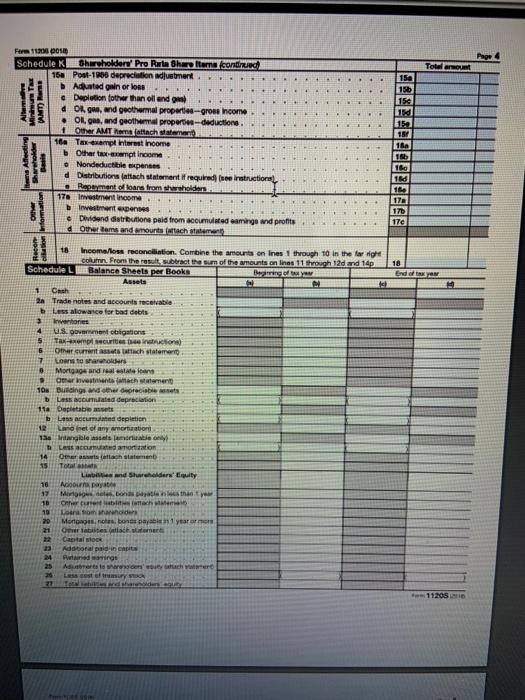

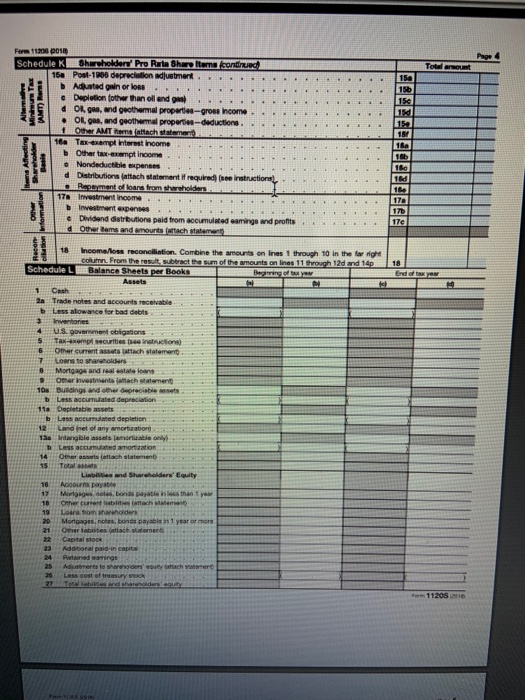

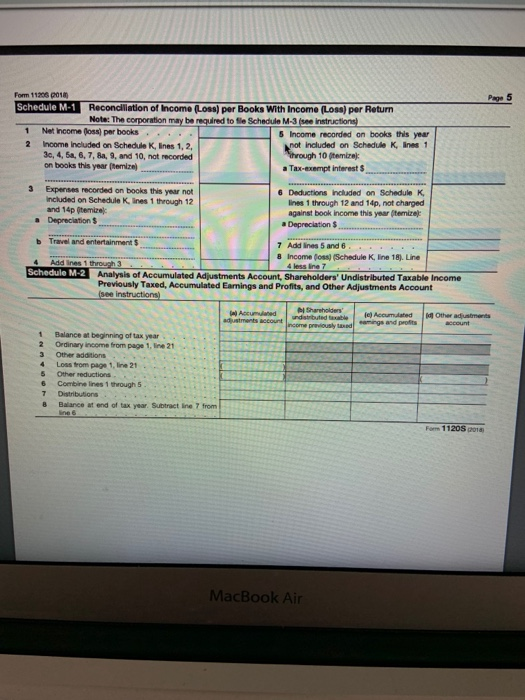

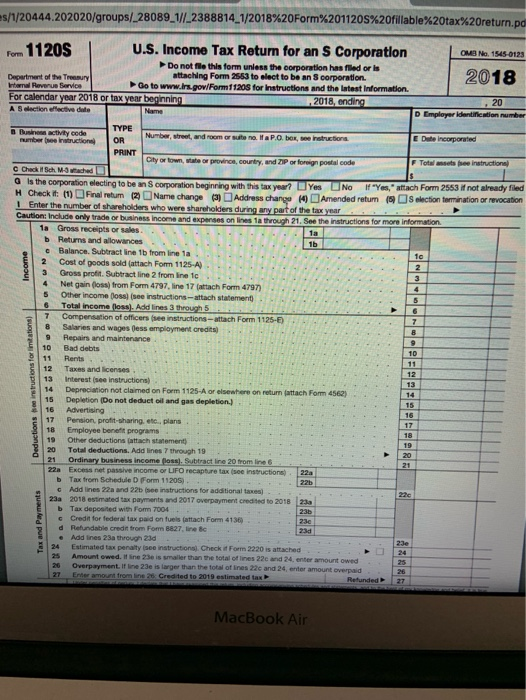

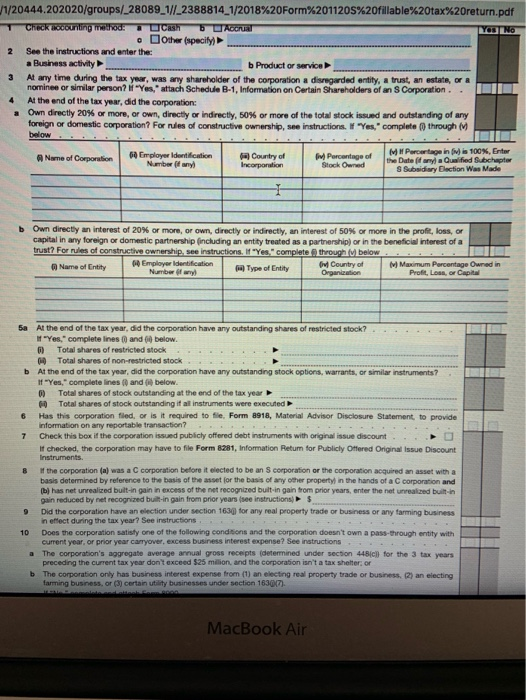

The following information is necessary to complete the second tax return assignment. 1. Pages 1 to 6 of the 2018 Form 11205 (placed in the file exchange) 2. Schedule K-1 of Form 11205 (placed in the file exchange) 3. Income statement 4. Balance sheet 5. Worksheet for Shareholder's Basis Computation The corporation's address is: Stockton University Productions Inc 101 Vera King Farris Drive Galloway, New Jersey 08205 Other information necessary for the tax return: 1. Employer identification number: XX-XXXXXXX 2. Date incorporated: 01/01/2015 3. Accounting method: Cash 4. Business activity code: 711320 5. Business activity: Business Promotions 6. Product or Service: Promotions 7. You may disregard answering all the questions on Schedule B 8. Schedule K-answer line 1, line 16d and line 18 9. Schedule L, M-1 and M-2 are to be answered similar to the corp tax return There is only one shareholder who owns 100% of the stock: Stanley Morner 101 Vera King Farris Drive Galloway, New Jersey 08205 SS# XXX-XX-XXXX Assume that Stanley has a beginning balance in stock basis of: Also, Stanley contributes capital (cash) during the year of: Stanley has also decided that he will take a distribution of: (The distribution affects basis and needs to be reported) 4,000 3,000 (3,700) After you have completed the tax return, calculate the following: 1. Allowed loss to report on his personal tax return. 2. Any suspended loss due to lack of stock basis. 3. End of year balance of his stock basis. Profit & Loss January through December 2018 Income $ 70,000 Expense Automobile Expense Bank Service Charges Computer and Internet Expenses Insurance Office Supplies Officer Salary Payroll Taxes Postage and Delivery Professional Fees Rent Expense Repairs and Maintenance Telephone Expense Tolls and Parking Travel Expense Utilities Total Expense Net Income (Loss) 7,830 186 325 199 1,470 29,500 3,511 183 8,709 9.420 103 6,430 119 1,650 2,070 71,705 ($1,705) Balance Sheet As of December 31, 2018 12/31/18 12/31/17 Assets Current Assets Operating Cash $ 1,486 $ 3,891 Total Current Assets 1,486 3,891 Other Assets Investment in Stock Total Other Assets Total Assets $ $ 1,000 1,000 2,486 1,000 $ 1,000 $ 4,891 Liabilities & Equity Shareholder Loan Payable Total Liabilities $ 1,000 1,000 $ 1,000 1,000 100 Equity Common Stock Additional Paid-in Capital Retained Earnings Net Income Total Equity Total Liabilities & Equity 3,791 100 3,000 91 (1,705) 1,486 2,486 3,891 $ $ 4,891 Problem information given Total Contributions Total Distributions Total Net Income OR Total Net (Loss) Shareholder's Basis Computation Nm Beginning of year stock basis Capital contributions Net Income Add lines 1 through 3 Distributions (not to exceed line 4) Subtract line 5 from line 4 Net Loss (not to exceed line 6) End of year stock basis 00 Net loss carried over to next year, if any Schedule K-1 (Form 11208) power of the 671117 KK-1 un No 1545-0123 Part Ill her holder Share of Current Yen heme Dediler. Cred and the Home Ordinary encome OSB para For salender yer 2016. or texy Netrett encome fol being and Shareholder's Share of Income, Deductions, Credits, etc. Seeback to print Parti Information About the Corporation A Corporation's employer deration number Corporation's name, address, aly, state, and DP code N CRON C Center where corporation filed retum Part II Information About the Shareholder She ' rlying number E Shareholders are ty d ZIP code For IRS Use Only See attached statement for additional information C 1150 R Farm 11 s/1/20444.202020/groups/_28089.1//2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pa Form 11205 OMB No. 1545-012 2018 U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filled or is Department of the Treasury attaching Form 2553 to elect to be an corporation Internal Revenue Service Go to www.in.gov/Form11208 for instructions and the latest Information. For calendar year 2018 or tax year beginning S 2018, ending 20 A Section active delle Name D Employer identification number TYPE B B a ctivity code OR number the instruction IN Numbw, street and room or suite no Ia P.O. box, se retructions E Dute Incorporated DRIVI City or town, wate or province, country, and ZIP or foreign postal code F Total se he instructions Check Sch. M-3 wached Is the corporation electing to be an corporation beginning with this tax year? Yes UNO "Yes," attach Form 2553 f not already filed H Check it: (1) Final retum (2) Name change (3) Address change (4 Amended return selection termination or revocation Enter the number of shareholders who were shareholders during any part of the tax year Caution: Include only trade or business Income and expenses online ta through 21. See the instructions for more information 1a Gross receipts or sales. . . . . . . . . . 1a Returns and allowances . . . . . . . Balance. Subtract line 1b from line la Cost of goods sold attach Form 1125-A) 3 Gross profit. Subtract line 2 from line to . 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 5 Other income loss) (see instructions-attach statement Total income foss). Add lines 3 through 5 . 7 Compensation of officers (see instructions-attach Form 1125-E 8 Salaries and wages (less employment credits 9 Repairs and maintenance E 10 Bad debts Rents 3 12 Taxes and licenses. 13 Interest (see instructions) 14 Depreciation not claimed on Form 1125-A or elsewhere on return attach Form 4562) 15 Depletion (Do not deduct oil and gas depletion.) 16 Advertising 17 Pension profit-sharing, etc., plans 18 Employee benefit programs 3 19 Other deductions attach statement 3 20 Total deductions. Add lines 7 through 19 21 Ordinary business income foss). Subtract line 20 from line 6 22a Excess net passive income or LIFO recapture tax see instructions b Tax from Schedule D Form 11205) .. Add lines 22a and 22 see instructions for additional taxes). 23 2018 estimated tax payments and 2017 overpayment credited to 2018 23 b Tax deposited with Form 7004 - 23b Credit for federal tax padon fuels attach Form 4136 d Refundable credit from Form 8827. line Bc . Add lines 23a through 230 24 Estimated tax penalty see instructions. Check Form 2220 is attached 25 Amount owed. If line 23e is smaller than the total of lines 22 and 24. enter amount owed 26 Overpayment. If line 23e is larger than the total of lines 22 and 24. enter amount overpaid er amount from line 25 Credited to 2019 estimated tax Refunded 27 instructions for imitations) MacBook Air 1/20444.202020/groups/_28089_11_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pdf 1 Check bocounting method: Ch b Accrual other specity 2 See the instructions and enter the a Business activity b Product or service 3 At any time during the tax yww, was any shareholder of the corporation a garded entity, a trust, an estat, or a nominee or similar person? W "Yes, attach Schedule B-1, Information on Certain Shareholders of ans Corporation. - 4 At the end of the tax year, did the corporation: Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? Fornies of constructive ownership, see instructions. "Yes, complete through below ......... MH Percorage in Mis 100N, ter Name of Corporation Employer Identification the Date Qualified hamor correc chapter Number Incorporation Stock Owned S Subsidiary Election Was Made Own directly an interest of 20% or more or own direct or indirectly an interest of 50% or more in the pro, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership or in the beneficial interest of a trust? For rules of constructive owner seeingtructions. "Yes" complete through Mbelow. Name of my gyer Identification Country of M Maximum Percentage Owned in Organo Proft Loop 5a b 6 7 Al the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . "Yes," complete lines and below. Total shares of restricted stock . . . . Total shares of non-restricted stock. At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? If "Yes," complete lines and below. 0) Total shares of stock outstanding at the end of the tax year Total shares of stock outstanding it all instruments were executed Has this corporation filed or is it required to file Form 8918, Material Advisor Disclosure Statement to provide information on any reportable transaction? Check this box if the corporation is publicly offered debt instruments with originale discount checked the corporation may have to le Form 1281, Information Retum for publicly Othered Original Issue Discount Instruments the corporation (a) was a C corporation before it clected to be an scorporation or the corporation acquired an asset with a basis determined by reference to the basis of these for the basis of any other property in the hands of a C corporation and has net unrealized built-in gain in excess of the recognized built-in gain from prior years, enter the naturrealized built-in gain reduced by not recognized bue-in gain from prior years see instructions Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions. Does the corporation satisfy one of the following conditions and the corporation doesn't own a pass-through entity with current year, or prior year Carryover, excess business interest expense? See instructions The corporation's aggregate average annual gross receipts determined under section 44 for the 3 years preceding the current tax year don't exceed $25 mion, and the corporation isn't a tax shelter or The corporation only has business interest expense from (l) an electing real property trade or business, an electing farming business or certain tility businesses under section 163007 B 10 MacBook Air UJRZUUERIZUEur. . . . . retractions TE DOKTY O wy TORTOR OR TWO , WITO terms modified so as to reduce the principal amount of the debt? . . . . . . . . . . . "Yes" enter the amount of principal reduction ........ 13 During the bax yow, was a qualified subchapter Ssubsidiary election feminded or rwoked? Y es, 148 Did the corporation make any payments in 2018 that would require it to fle Forms) 10901. .... "Yes," did the corporation file or wil it file required Forms 10997.. 15 is the corporation attaching Form 8996 to certify as a unified Opportunity Fund? ... Yenter the amount from Form8998Ine 13 Schedule K Shareholders' Pro Rata Share Items 1 Ordinary business income foss) page 1, line 21) ........ 2 Net rental real estate income foss) attach Form 1829 Sa Other gross rental income foss..... b Expernes from other rental activities attach statement e Othernet rental income foss). Subtract line 3b from line 30. 4 Interest income . . . . - - 5 Dividends a Ordinary dividends.. . b unified dividends.. Income Low Deduction 7 Net short-term capital gainos (attach Schedule D Form 112050. ... Netlong term capital gain fosttach Schedule D Form 11209 Collectibles 28 ) gaindows . . Unrecaptured section 1250 gain atach statement... Be Net section 1231 gain foss) attach Form 4797) 10 Other income fosse instruction Type 11 Section 179 deduction latach Form 6562 - - - - - - - - - - - 12 Charitable contributions - b investment interest expense. . . - - - Section 5 2 ) expenditures (1) Type Amount d Other deductions a ctions Type 188 Low-income hung hection 2015) b Low-income housing credit then Qualified rehabilitation expenditures frontal real estate attach Form 3468, if applicable) d Other rental real estate credits instructions Type Other rental credits I nstructions Type 1 Bioproducere ach Fon 6476 Other credits instructions Type 14a Name of country or U.S. possession b Gross income from all sources Gross income sourced shareholdere Foreign gross income sourced at corporate level d Section 951A category- Foreign branch category # Passive category General Category h Other nach statement Deductions allocated and apportioned at whareholder level interese pense Other Deductions located and portioned corporateve te for Section 51A category 1 Foreign branch category- m Passicago MacBook Air Alleme AMT) Rens Format PDR Schedule K h acholders Pro Ruta Bharu terme contre 156 Post-1906 depreciation Industment.. Austad gain or loss , e Depletion other thanoll and d Olgus, and geothermal properties-groue incom Olgas, and geothermal propertie-deduct O AMT (nach semen 16 Tax-exempt Wrest income Other taxempt income Nanded expenses. d Distribution cha rt required Payment loans fru wchode Ta investment income... . Inwestent expens . . e Dividend distruttore paid from accumulated earings d Others and amour attach statemen Affecting incomalos concion. Combine the amounts on Ines 1 through 10 in the form pou . From there subtract them of them Balance Sheets per Book Schedule L 2 Tradenotes and accounts receivable b less allowance for bad de Thrones US govermentions 5 Tampecurities tractions Other current AS ach statement 7 Loew to and 8 Mortgage and restos D 10 Bunge D e accumulated depreciation 11a Depletas b ass munused depletion 12 Land het of any ac tion 1. Igles are only amon 14 O chste 15 To and Share Equity 16 hours pays 12 Mongo, Bondsteethany 18 Other Male 15 Loara m areholders 20 Mar t es, bones paint year of mer 23 A ral paidat 24 Renderings 25 A rred to 26 Lanset of rury cher Alleme AMT) Rens Format PDR Schedule K h acholders Pro Ruta Bharu terme contre 156 Post-1906 depreciation Industment.. Austad gain or loss , e Depletion other thanoll and d Olgus, and geothermal properties-groue incom Olgas, and geothermal propertie-deduct O AMT (nach semen 16 Tax-exempt Wrest income Other taxempt income Nanded expenses. d Distribution cha rt required Payment loans fru wchode Ta investment income... . Inwestent expens . . e Dividend distruttore paid from accumulated earings d Others and amour attach statemen Affecting incomalos concion. Combine the amounts on Ines 1 through 10 in the form pou . From there subtract them of them Balance Sheets per Book Schedule L 2 Tradenotes and accounts receivable b less allowance for bad de Thrones US govermentions 5 Tampecurities tractions Other current AS ach statement 7 Loew to and 8 Mortgage and restos D 10 Bunge D e accumulated depreciation 11a Depletas b ass munused depletion 12 Land het of any ac tion 1. Igles are only amon 14 O chste 15 To and Share Equity 16 hours pays 12 Mongo, Bondsteethany 18 Other Male 15 Loara m areholders 20 Mar t es, bones paint year of mer 23 A ral paidat 24 Renderings 25 A rred to 26 Lanset of rury cher Page 5 Form 11200 201 Schedule M.1 Reconciliation of Income (Los) per Books With Income (Los) per Return Note: The corporation may be required to file Schedule M-3 see Instructions 1 Net Income (os) per books. ... 5 Income recorded on books this year 2 Income included on Schedule K, Ines 1, 2, not included on Schedule K ines 1 30, 4, 5, 6, 7, 8, 9, and 10, not recorded through 10 temizaj: on books this year temize a Tax-exempt interest Expenses recorded on books this year not Included on Schedule K, lines 1 through 12 and 14p temize Depreciations ... 6 Deductions Included on Schedule K, lines 1 through 12 and 14p, not charged against book income this year temize a Depreciation $ Android b Travel and entertainment 7 Addines 5 and 6 . . . . . . . B Income foss) (Schedule K, line 18). Line Add lines 1 through 3 . . 4 less Ine 7 Schedule M-2 Analysis of Accumulated Adjustments Account, Shareholders' Undistributed Taxable income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account (see instructions) Shareholders fel) Accurated In Other adjustments t ot come previously coming and profits account Balance a beginning of tax year Ordinary income from page 1. line 21 Other additions Loss from page 1. line 21 Other reductions Combine lines 1 though 5. Distributions 8 Balance at end of tax year. Subtract Form 1120S 2018 MacBook Air es/1/20444.202020/groups/_28089.1//_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pa Form 11205 OMB No. 1545-012 2018 U.S. Income Tax Return for an S Corporation Do not fle this form unless the corporation has filed or is Department of the Treasury attaching Form 2553 to elect to be an S corporation. Innal Revenue Service Go to www.in.gov/Form11208 for Instructions and the latest Information For calendar year 2018 or tax year beginning 2018, ending 201 A Section active delle Name D Employer identification number TYPE B Ba c tivity code OR number the instruction IN Number, street, and room or suite no. If a P.O. box, senstructions E Dute Incorporated DIT City or town, wate or province, country, and ZIP or foreign postal code IF Totalt e instructions Check Sch. M-3 tached Is the corporation electing to be an scorporation beginning with this tax year? Yes UNO "Yes,"attach Form 2553 f not already filed H Check it: (1) Final retum (2) Name change (3) Address change (4 Amended return selection termination or revocation | Enter the number of shareholders who were shareholders during any part of the tax year CautionInclude only trade or business Income and expenses online ta through 21. See the instructions for more information 1a Gross receipts or sales. . . . . . . . . . . . 1a 1 Returns and allowances . . 1b Balance. Subtract line 1b from line la. .. Cost of goods sold (attach Form 1125-A.. 3 Gross profit. Subtract line 2 from line to . . 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 5 Other income loss) (see instructions-attach statement Total income foss). Add lines through 5. 7 Compensation of officers (see instructions-attach Form 1125-F 8 Salaries and wages (less employment credits 9 Repairs and maintenance E 10 Bad debts Rents 12 Taxes and licenses. 13 Interest (see instructions) 14 Depreciation not claimed on Form 1125-A or elsewhere on return attach Form 4562) 15 Depletion (Do not deduct oil and gas depletion.) 16 Advertising 17 Pension profit-sharing, etc., plans. 18 Employee benefit programs 3 19 Other deductions attach statement 3 20 Total deductions. Add lines 7 through 19 21 Ordinary business income foss). Subtract line 20 from line 6 22a Excess net passive income or LIFO recapture tax see instructions b Tax from Schedule Form 11205) Add lines 22a and 22 see instructions for additional taxes). 23a 2018 estimated tax payments and 2017 overpayment credited to 2018 233 b Tax deposited with Form 7004 . Credit for federal tax padon fuels attach Form 41360 d Refundable credit from Form 8827. line Bc Add lines 23a through 230 24 Estimated tax penalty see instructions. Check it Form 2220 is attached 25 Amount owed. If line 23e is smaller than the total of lines 22 and 24. enter amount owed 26 Overpayment. If line 23e is larger than the total of lines 22 and 24. enter amount overpaid Enter amount from line 25 Credited to 2019 estimated tax Retunded 27 instructions for and Pa MacBook Air 1/20444.202020/groups/_28089_11_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pdf 1 Checkocouriling method: U b U Accrual o other specity 2 See the instructions and enter the Business activity b Product or service 3 Alany time during the tax yow, was any shareholder of the corporation a dagarded entity, a trust, an estate, or nominee or similar person? W "Yes, attach Schedule B-1, Information on Certain Shareholders of ans Corporation. - 4 At the end of the tax yeur, did the corporation: Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? Fornies of constructive ownership, see instructions. "Yes, complete through below ......... IM Percentage in Mis 100N, ter Name of Employer Idention Country of M Percentage of Name of Corporacion Date n sified chapter Number incorporation Stock Owned S Subsidiary Election Was Made Own directly an interest of 20% or more or own direct or indirectly an interest of 50% or more in the proe, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership or in the beneficial interest of a trust? For rules of constructive ownership, seestructions. "Yes" complete through Mbelow. Name Employer identification Country of M Maximum Percentage Oured in Organo Proft Loop 5 b 6 7 Al the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . "Yes," complete lines and below. Total shares of restricted stock . . . Total shares of non-restricted stock. . At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? If "Yes," complete lines and below 0) Total shares of stock outstanding at the end of the tax year Total shares of stock outstanding it all instruments were executed Has this corporation filed or is it required to file Form 8918Material Advisor Disclosure Statement to provide information on any portable transaction? Check this box if the corporation is publicly offered debt instruments with originale discount I checked the corporation may have to file Form 1281, Information Retum for publicly hered Original Issue Discount Instruments the corporation (a) was a corporation before chected to be an scorporation or the corporation acquired an asset with a basis determined by reference to the basis of the set for the basis of any other property in the hands of a C corporation and has net unrealized built-in gain in Excess of the recognized built-in gain from prior years, enter the naturrealized built-in gain reduced by net recognized buin gain from prior years see instructions Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions Does the corporation satisfy one of the following conditions and the corporation doesn't own a pass-through entity with current year, or prior year Carryover, excess business interest expense? See instructions The corporation's aggregate average annual gross receipts determined under section 44 for the 3 years preceding the current tax year don't exceed $25 mion, and the corporation isn't a tax shelter or The corporation only has business interest expense from (t) an electing real property trade or business, an electing farming business or certain utility businesses under section 163907 S 10 a MacBook Air The following information is necessary to complete the second tax return assignment. 1. Pages 1 to 6 of the 2018 Form 11205 (placed in the file exchange) 2. Schedule K-1 of Form 11205 (placed in the file exchange) 3. Income statement 4. Balance sheet 5. Worksheet for Shareholder's Basis Computation The corporation's address is: Stockton University Productions Inc 101 Vera King Farris Drive Galloway, New Jersey 08205 Other information necessary for the tax return: 1. Employer identification number: XX-XXXXXXX 2. Date incorporated: 01/01/2015 3. Accounting method: Cash 4. Business activity code: 711320 5. Business activity: Business Promotions 6. Product or Service: Promotions 7. You may disregard answering all the questions on Schedule B 8. Schedule K-answer line 1, line 16d and line 18 9. Schedule L, M-1 and M-2 are to be answered similar to the corp tax return There is only one shareholder who owns 100% of the stock: Stanley Morner 101 Vera King Farris Drive Galloway, New Jersey 08205 SS# XXX-XX-XXXX Assume that Stanley has a beginning balance in stock basis of: Also, Stanley contributes capital (cash) during the year of: Stanley has also decided that he will take a distribution of: (The distribution affects basis and needs to be reported) 4,000 3,000 (3,700) After you have completed the tax return, calculate the following: 1. Allowed loss to report on his personal tax return. 2. Any suspended loss due to lack of stock basis. 3. End of year balance of his stock basis. Profit & Loss January through December 2018 Income $ 70,000 Expense Automobile Expense Bank Service Charges Computer and Internet Expenses Insurance Office Supplies Officer Salary Payroll Taxes Postage and Delivery Professional Fees Rent Expense Repairs and Maintenance Telephone Expense Tolls and Parking Travel Expense Utilities Total Expense Net Income (Loss) 7,830 186 325 199 1,470 29,500 3,511 183 8,709 9.420 103 6,430 119 1,650 2,070 71,705 ($1,705) Balance Sheet As of December 31, 2018 12/31/18 12/31/17 Assets Current Assets Operating Cash $ 1,486 $ 3,891 Total Current Assets 1,486 3,891 Other Assets Investment in Stock Total Other Assets Total Assets $ $ 1,000 1,000 2,486 1,000 $ 1,000 $ 4,891 Liabilities & Equity Shareholder Loan Payable Total Liabilities $ 1,000 1,000 $ 1,000 1,000 100 Equity Common Stock Additional Paid-in Capital Retained Earnings Net Income Total Equity Total Liabilities & Equity 3,791 100 3,000 91 (1,705) 1,486 2,486 3,891 $ $ 4,891 Problem information given Total Contributions Total Distributions Total Net Income OR Total Net (Loss) Shareholder's Basis Computation Nm Beginning of year stock basis Capital contributions Net Income Add lines 1 through 3 Distributions (not to exceed line 4) Subtract line 5 from line 4 Net Loss (not to exceed line 6) End of year stock basis 00 Net loss carried over to next year, if any Schedule K-1 (Form 11208) power of the 671117 KK-1 un No 1545-0123 Part Ill her holder Share of Current Yen heme Dediler. Cred and the Home Ordinary encome OSB para For salender yer 2016. or texy Netrett encome fol being and Shareholder's Share of Income, Deductions, Credits, etc. Seeback to print Parti Information About the Corporation A Corporation's employer deration number Corporation's name, address, aly, state, and DP code N CRON C Center where corporation filed retum Part II Information About the Shareholder She ' rlying number E Shareholders are ty d ZIP code For IRS Use Only See attached statement for additional information C 1150 R Farm 11 s/1/20444.202020/groups/_28089.1//2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pa Form 11205 OMB No. 1545-012 2018 U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has filled or is Department of the Treasury attaching Form 2553 to elect to be an corporation Internal Revenue Service Go to www.in.gov/Form11208 for instructions and the latest Information. For calendar year 2018 or tax year beginning S 2018, ending 20 A Section active delle Name D Employer identification number TYPE B B a ctivity code OR number the instruction IN Numbw, street and room or suite no Ia P.O. box, se retructions E Dute Incorporated DRIVI City or town, wate or province, country, and ZIP or foreign postal code F Total se he instructions Check Sch. M-3 wached Is the corporation electing to be an corporation beginning with this tax year? Yes UNO "Yes," attach Form 2553 f not already filed H Check it: (1) Final retum (2) Name change (3) Address change (4 Amended return selection termination or revocation Enter the number of shareholders who were shareholders during any part of the tax year Caution: Include only trade or business Income and expenses online ta through 21. See the instructions for more information 1a Gross receipts or sales. . . . . . . . . . 1a Returns and allowances . . . . . . . Balance. Subtract line 1b from line la Cost of goods sold attach Form 1125-A) 3 Gross profit. Subtract line 2 from line to . 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 5 Other income loss) (see instructions-attach statement Total income foss). Add lines 3 through 5 . 7 Compensation of officers (see instructions-attach Form 1125-E 8 Salaries and wages (less employment credits 9 Repairs and maintenance E 10 Bad debts Rents 3 12 Taxes and licenses. 13 Interest (see instructions) 14 Depreciation not claimed on Form 1125-A or elsewhere on return attach Form 4562) 15 Depletion (Do not deduct oil and gas depletion.) 16 Advertising 17 Pension profit-sharing, etc., plans 18 Employee benefit programs 3 19 Other deductions attach statement 3 20 Total deductions. Add lines 7 through 19 21 Ordinary business income foss). Subtract line 20 from line 6 22a Excess net passive income or LIFO recapture tax see instructions b Tax from Schedule D Form 11205) .. Add lines 22a and 22 see instructions for additional taxes). 23 2018 estimated tax payments and 2017 overpayment credited to 2018 23 b Tax deposited with Form 7004 - 23b Credit for federal tax padon fuels attach Form 4136 d Refundable credit from Form 8827. line Bc . Add lines 23a through 230 24 Estimated tax penalty see instructions. Check Form 2220 is attached 25 Amount owed. If line 23e is smaller than the total of lines 22 and 24. enter amount owed 26 Overpayment. If line 23e is larger than the total of lines 22 and 24. enter amount overpaid er amount from line 25 Credited to 2019 estimated tax Refunded 27 instructions for imitations) MacBook Air 1/20444.202020/groups/_28089_11_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pdf 1 Check bocounting method: Ch b Accrual other specity 2 See the instructions and enter the a Business activity b Product or service 3 At any time during the tax yww, was any shareholder of the corporation a garded entity, a trust, an estat, or a nominee or similar person? W "Yes, attach Schedule B-1, Information on Certain Shareholders of ans Corporation. - 4 At the end of the tax year, did the corporation: Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? Fornies of constructive ownership, see instructions. "Yes, complete through below ......... MH Percorage in Mis 100N, ter Name of Corporation Employer Identification the Date Qualified hamor correc chapter Number Incorporation Stock Owned S Subsidiary Election Was Made Own directly an interest of 20% or more or own direct or indirectly an interest of 50% or more in the pro, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership or in the beneficial interest of a trust? For rules of constructive owner seeingtructions. "Yes" complete through Mbelow. Name of my gyer Identification Country of M Maximum Percentage Owned in Organo Proft Loop 5a b 6 7 Al the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . "Yes," complete lines and below. Total shares of restricted stock . . . . Total shares of non-restricted stock. At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? If "Yes," complete lines and below. 0) Total shares of stock outstanding at the end of the tax year Total shares of stock outstanding it all instruments were executed Has this corporation filed or is it required to file Form 8918, Material Advisor Disclosure Statement to provide information on any reportable transaction? Check this box if the corporation is publicly offered debt instruments with originale discount checked the corporation may have to le Form 1281, Information Retum for publicly Othered Original Issue Discount Instruments the corporation (a) was a C corporation before it clected to be an scorporation or the corporation acquired an asset with a basis determined by reference to the basis of these for the basis of any other property in the hands of a C corporation and has net unrealized built-in gain in excess of the recognized built-in gain from prior years, enter the naturrealized built-in gain reduced by not recognized bue-in gain from prior years see instructions Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions. Does the corporation satisfy one of the following conditions and the corporation doesn't own a pass-through entity with current year, or prior year Carryover, excess business interest expense? See instructions The corporation's aggregate average annual gross receipts determined under section 44 for the 3 years preceding the current tax year don't exceed $25 mion, and the corporation isn't a tax shelter or The corporation only has business interest expense from (l) an electing real property trade or business, an electing farming business or certain tility businesses under section 163007 B 10 MacBook Air UJRZUUERIZUEur. . . . . retractions TE DOKTY O wy TORTOR OR TWO , WITO terms modified so as to reduce the principal amount of the debt? . . . . . . . . . . . "Yes" enter the amount of principal reduction ........ 13 During the bax yow, was a qualified subchapter Ssubsidiary election feminded or rwoked? Y es, 148 Did the corporation make any payments in 2018 that would require it to fle Forms) 10901. .... "Yes," did the corporation file or wil it file required Forms 10997.. 15 is the corporation attaching Form 8996 to certify as a unified Opportunity Fund? ... Yenter the amount from Form8998Ine 13 Schedule K Shareholders' Pro Rata Share Items 1 Ordinary business income foss) page 1, line 21) ........ 2 Net rental real estate income foss) attach Form 1829 Sa Other gross rental income foss..... b Expernes from other rental activities attach statement e Othernet rental income foss). Subtract line 3b from line 30. 4 Interest income . . . . - - 5 Dividends a Ordinary dividends.. . b unified dividends.. Income Low Deduction 7 Net short-term capital gainos (attach Schedule D Form 112050. ... Netlong term capital gain fosttach Schedule D Form 11209 Collectibles 28 ) gaindows . . Unrecaptured section 1250 gain atach statement... Be Net section 1231 gain foss) attach Form 4797) 10 Other income fosse instruction Type 11 Section 179 deduction latach Form 6562 - - - - - - - - - - - 12 Charitable contributions - b investment interest expense. . . - - - Section 5 2 ) expenditures (1) Type Amount d Other deductions a ctions Type 188 Low-income hung hection 2015) b Low-income housing credit then Qualified rehabilitation expenditures frontal real estate attach Form 3468, if applicable) d Other rental real estate credits instructions Type Other rental credits I nstructions Type 1 Bioproducere ach Fon 6476 Other credits instructions Type 14a Name of country or U.S. possession b Gross income from all sources Gross income sourced shareholdere Foreign gross income sourced at corporate level d Section 951A category- Foreign branch category # Passive category General Category h Other nach statement Deductions allocated and apportioned at whareholder level interese pense Other Deductions located and portioned corporateve te for Section 51A category 1 Foreign branch category- m Passicago MacBook Air Alleme AMT) Rens Format PDR Schedule K h acholders Pro Ruta Bharu terme contre 156 Post-1906 depreciation Industment.. Austad gain or loss , e Depletion other thanoll and d Olgus, and geothermal properties-groue incom Olgas, and geothermal propertie-deduct O AMT (nach semen 16 Tax-exempt Wrest income Other taxempt income Nanded expenses. d Distribution cha rt required Payment loans fru wchode Ta investment income... . Inwestent expens . . e Dividend distruttore paid from accumulated earings d Others and amour attach statemen Affecting incomalos concion. Combine the amounts on Ines 1 through 10 in the form pou . From there subtract them of them Balance Sheets per Book Schedule L 2 Tradenotes and accounts receivable b less allowance for bad de Thrones US govermentions 5 Tampecurities tractions Other current AS ach statement 7 Loew to and 8 Mortgage and restos D 10 Bunge D e accumulated depreciation 11a Depletas b ass munused depletion 12 Land het of any ac tion 1. Igles are only amon 14 O chste 15 To and Share Equity 16 hours pays 12 Mongo, Bondsteethany 18 Other Male 15 Loara m areholders 20 Mar t es, bones paint year of mer 23 A ral paidat 24 Renderings 25 A rred to 26 Lanset of rury cher Alleme AMT) Rens Format PDR Schedule K h acholders Pro Ruta Bharu terme contre 156 Post-1906 depreciation Industment.. Austad gain or loss , e Depletion other thanoll and d Olgus, and geothermal properties-groue incom Olgas, and geothermal propertie-deduct O AMT (nach semen 16 Tax-exempt Wrest income Other taxempt income Nanded expenses. d Distribution cha rt required Payment loans fru wchode Ta investment income... . Inwestent expens . . e Dividend distruttore paid from accumulated earings d Others and amour attach statemen Affecting incomalos concion. Combine the amounts on Ines 1 through 10 in the form pou . From there subtract them of them Balance Sheets per Book Schedule L 2 Tradenotes and accounts receivable b less allowance for bad de Thrones US govermentions 5 Tampecurities tractions Other current AS ach statement 7 Loew to and 8 Mortgage and restos D 10 Bunge D e accumulated depreciation 11a Depletas b ass munused depletion 12 Land het of any ac tion 1. Igles are only amon 14 O chste 15 To and Share Equity 16 hours pays 12 Mongo, Bondsteethany 18 Other Male 15 Loara m areholders 20 Mar t es, bones paint year of mer 23 A ral paidat 24 Renderings 25 A rred to 26 Lanset of rury cher Page 5 Form 11200 201 Schedule M.1 Reconciliation of Income (Los) per Books With Income (Los) per Return Note: The corporation may be required to file Schedule M-3 see Instructions 1 Net Income (os) per books. ... 5 Income recorded on books this year 2 Income included on Schedule K, Ines 1, 2, not included on Schedule K ines 1 30, 4, 5, 6, 7, 8, 9, and 10, not recorded through 10 temizaj: on books this year temize a Tax-exempt interest Expenses recorded on books this year not Included on Schedule K, lines 1 through 12 and 14p temize Depreciations ... 6 Deductions Included on Schedule K, lines 1 through 12 and 14p, not charged against book income this year temize a Depreciation $ Android b Travel and entertainment 7 Addines 5 and 6 . . . . . . . B Income foss) (Schedule K, line 18). Line Add lines 1 through 3 . . 4 less Ine 7 Schedule M-2 Analysis of Accumulated Adjustments Account, Shareholders' Undistributed Taxable income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account (see instructions) Shareholders fel) Accurated In Other adjustments t ot come previously coming and profits account Balance a beginning of tax year Ordinary income from page 1. line 21 Other additions Loss from page 1. line 21 Other reductions Combine lines 1 though 5. Distributions 8 Balance at end of tax year. Subtract Form 1120S 2018 MacBook Air es/1/20444.202020/groups/_28089.1//_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pa Form 11205 OMB No. 1545-012 2018 U.S. Income Tax Return for an S Corporation Do not fle this form unless the corporation has filed or is Department of the Treasury attaching Form 2553 to elect to be an S corporation. Innal Revenue Service Go to www.in.gov/Form11208 for Instructions and the latest Information For calendar year 2018 or tax year beginning 2018, ending 201 A Section active delle Name D Employer identification number TYPE B Ba c tivity code OR number the instruction IN Number, street, and room or suite no. If a P.O. box, senstructions E Dute Incorporated DIT City or town, wate or province, country, and ZIP or foreign postal code IF Totalt e instructions Check Sch. M-3 tached Is the corporation electing to be an scorporation beginning with this tax year? Yes UNO "Yes,"attach Form 2553 f not already filed H Check it: (1) Final retum (2) Name change (3) Address change (4 Amended return selection termination or revocation | Enter the number of shareholders who were shareholders during any part of the tax year CautionInclude only trade or business Income and expenses online ta through 21. See the instructions for more information 1a Gross receipts or sales. . . . . . . . . . . . 1a 1 Returns and allowances . . 1b Balance. Subtract line 1b from line la. .. Cost of goods sold (attach Form 1125-A.. 3 Gross profit. Subtract line 2 from line to . . 4 Net gain (loss) from Form 4797, line 17 (attach Form 4797) 5 Other income loss) (see instructions-attach statement Total income foss). Add lines through 5. 7 Compensation of officers (see instructions-attach Form 1125-F 8 Salaries and wages (less employment credits 9 Repairs and maintenance E 10 Bad debts Rents 12 Taxes and licenses. 13 Interest (see instructions) 14 Depreciation not claimed on Form 1125-A or elsewhere on return attach Form 4562) 15 Depletion (Do not deduct oil and gas depletion.) 16 Advertising 17 Pension profit-sharing, etc., plans. 18 Employee benefit programs 3 19 Other deductions attach statement 3 20 Total deductions. Add lines 7 through 19 21 Ordinary business income foss). Subtract line 20 from line 6 22a Excess net passive income or LIFO recapture tax see instructions b Tax from Schedule Form 11205) Add lines 22a and 22 see instructions for additional taxes). 23a 2018 estimated tax payments and 2017 overpayment credited to 2018 233 b Tax deposited with Form 7004 . Credit for federal tax padon fuels attach Form 41360 d Refundable credit from Form 8827. line Bc Add lines 23a through 230 24 Estimated tax penalty see instructions. Check it Form 2220 is attached 25 Amount owed. If line 23e is smaller than the total of lines 22 and 24. enter amount owed 26 Overpayment. If line 23e is larger than the total of lines 22 and 24. enter amount overpaid Enter amount from line 25 Credited to 2019 estimated tax Retunded 27 instructions for and Pa MacBook Air 1/20444.202020/groups/_28089_11_2388814_1/2018%20Form%201120S%20fillable%20tax%20return.pdf 1 Checkocouriling method: U b U Accrual o other specity 2 See the instructions and enter the Business activity b Product or service 3 Alany time during the tax yow, was any shareholder of the corporation a dagarded entity, a trust, an estate, or nominee or similar person? W "Yes, attach Schedule B-1, Information on Certain Shareholders of ans Corporation. - 4 At the end of the tax yeur, did the corporation: Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? Fornies of constructive ownership, see instructions. "Yes, complete through below ......... IM Percentage in Mis 100N, ter Name of Employer Idention Country of M Percentage of Name of Corporacion Date n sified chapter Number incorporation Stock Owned S Subsidiary Election Was Made Own directly an interest of 20% or more or own direct or indirectly an interest of 50% or more in the proe, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership or in the beneficial interest of a trust? For rules of constructive ownership, seestructions. "Yes" complete through Mbelow. Name Employer identification Country of M Maximum Percentage Oured in Organo Proft Loop 5 b 6 7 Al the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . "Yes," complete lines and below. Total shares of restricted stock . . . Total shares of non-restricted stock. . At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? If "Yes," complete lines and below 0) Total shares of stock outstanding at the end of the tax year Total shares of stock outstanding it all instruments were executed Has this corporation filed or is it required to file Form 8918Material Advisor Disclosure Statement to provide information on any portable transaction? Check this box if the corporation is publicly offered debt instruments with originale discount I checked the corporation may have to file Form 1281, Information Retum for publicly hered Original Issue Discount Instruments the corporation (a) was a corporation before chected to be an scorporation or the corporation acquired an asset with a basis determined by reference to the basis of the set for the basis of any other property in the hands of a C corporation and has net unrealized built-in gain in Excess of the recognized built-in gain from prior years, enter the naturrealized built-in gain reduced by net recognized buin gain from prior years see instructions Did the corporation have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions Does the corporation satisfy one of the following conditions and the corporation doesn't own a pass-through entity with current year, or prior year Carryover, excess business interest expense? See instructions The corporation's aggregate average annual gross receipts determined under section 44 for the 3 years preceding the current tax year don't exceed $25 mion, and the corporation isn't a tax shelter or The corporation only has business interest expense from (t) an electing real property trade or business, an electing farming business or certain utility businesses under section 163907 S 10 a MacBook Air