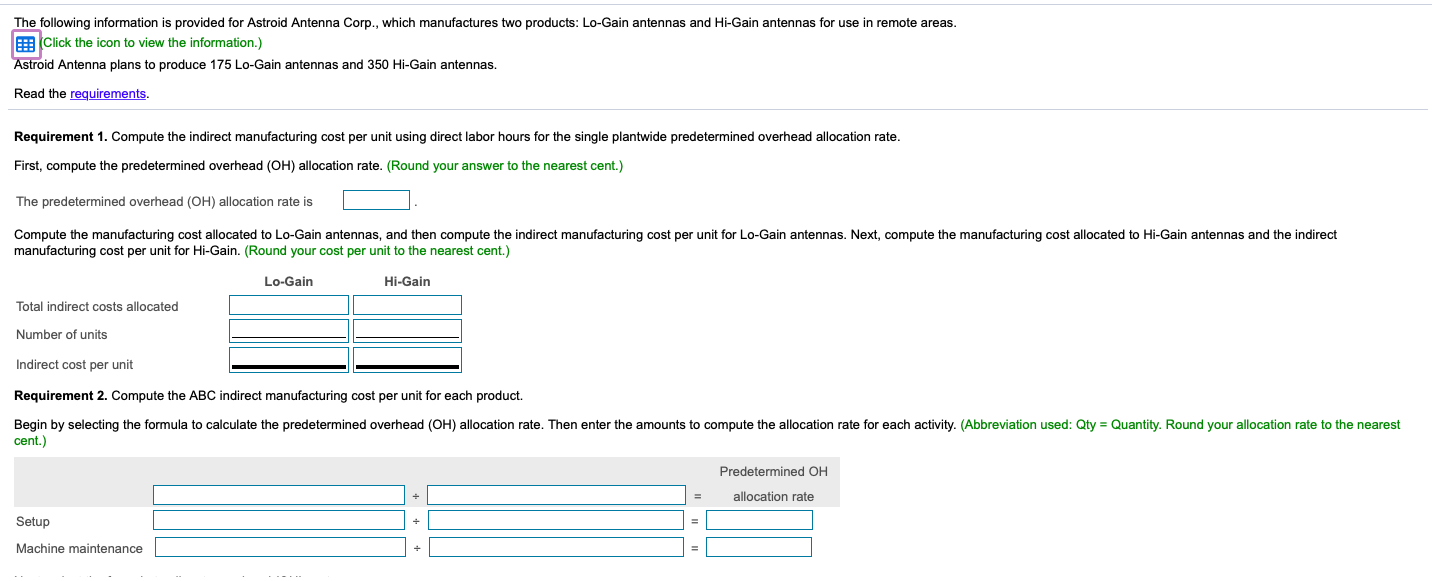

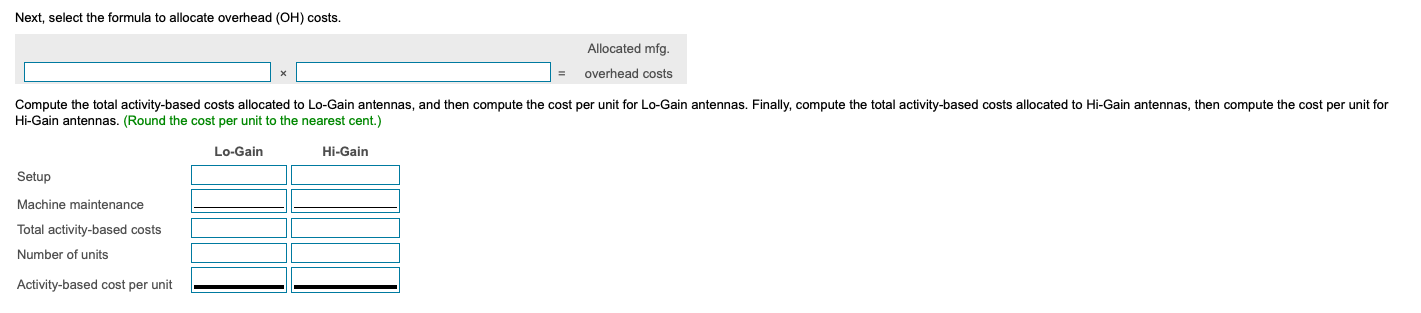

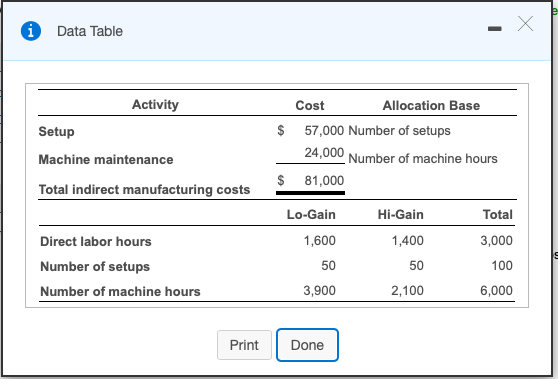

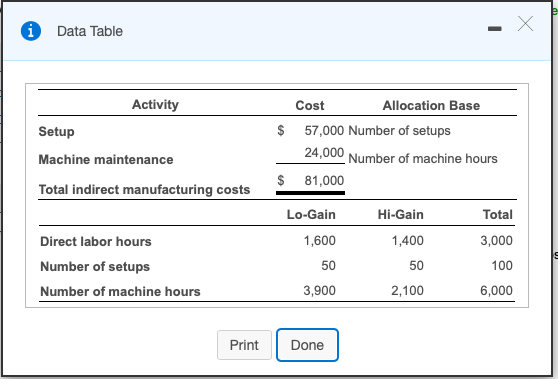

The following information is provided for Astroid Antenna Corp., which manufactures two products: Lo-Gain antennas and Hi-Gain antennas for use in remote areas. Click the icon to view the information.) Astroid Antenna plans to produce 175 Lo-Gain antennas and 350 Hi-Gain antennas. Read the requirements. Requirement 1. Compute the indirect manufacturing cost per unit using direct labor hours for the single plantwide predetermined overhead allocation rate. First, compute the predetermined overhead (OH) allocation rate. (Round your answer to the nearest cent.) The predetermined overhead (OH) allocation rate is Compute the manufacturing cost allocated to Lo-Gain antennas, and then compute the indirect manufacturing cost per unit for Lo-Gain antennas. Next, compute the manufacturing cost allocated to Hi-Gain antennas and the indirect manufacturing cost per unit for Hi-Gain. (Round your cost per unit to the nearest cent.) Lo-Gain Hi-Gain Total indirect costs allocated Number of units Indirect cost per unit Requirement 2. Compute the ABC indirect manufacturing cost per unit for each product. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate for each activity. (Abbreviation used: Qty = Quantity. Round your allocation rate to the nearest cent.) Predetermined OH . = allocation rate Setup Machine maintenance Next, select the formula to allocate overhead (OH) costs. Allocated mfg overhead costs Compute the total activity-based costs allocated to Lo-Gain antennas, and then compute the cost per unit for Lo-Gain antennas. Finally, compute the total activity-based costs allocated to Hi-Gain antennas, then compute the cost per unit for Hi-Gain antennas. (Round the cost per unit to the nearest cent.) Lo-Gain Hi-Gain Setup Machine maintenance Total activity-based costs Number of units Activity-based cost per unit i X Data Table Activity Setup Machine maintenance Total indirect manufacturing costs Cost Allocation Base $ 57,000 Number of setups 24,000 Number of machine hours $ 81,000 Hi-Gain Total 1,400 3,000 Direct labor hours Number of setups Number of machine hours Lo-Gain 1,600 50 3,900 50 100 2,100 6,000 Print Done