Answered step by step

Verified Expert Solution

Question

1 Approved Answer

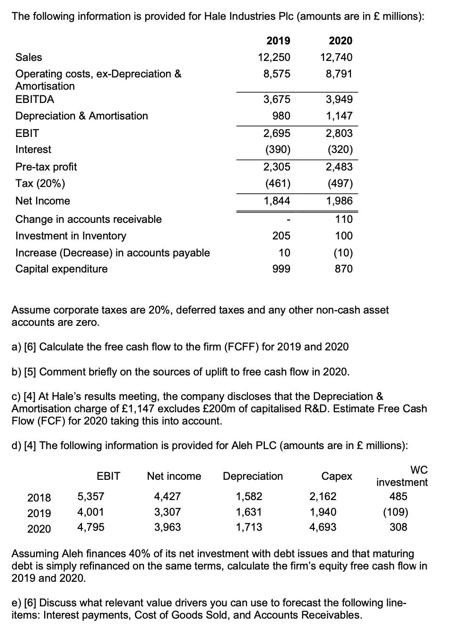

The following information is provided for Hale Industries Plc (amounts are in millions): 2019 2020 12,250 12,740 8,575 8,791 Sales Operating costs, ex-Depreciation &

The following information is provided for Hale Industries Plc (amounts are in millions): 2019 2020 12,250 12,740 8,575 8,791 Sales Operating costs, ex-Depreciation & Amortisation EBITDA Depreciation & Amortisation EBIT Interest Pre-tax profit Tax (20%) Net Income Change in accounts receivable Investment in Inventory Increase (Decrease) in accounts payable Capital expenditure 2018 2019 2020 EBIT 5,357 4,001 4,795 3,675 980 2,695 (390) Net income 4,427 3,307 3,963 2,305 (461) 1,844 205 10 999 Assume corporate taxes are 20%, deferred taxes and any other non-cash asset accounts are zero. a) [6] Calculate the free cash flow to the firm (FCFF) for 2019 and 2020 b) [5] Comment briefly on the sources of uplift to free cash flow in 2020. c) [4] At Hale's results meeting, the company discloses that the Depreciation & Amortisation charge of 1,147 excludes 200m of capitalised R&D. Estimate Free Cash Flow (FCF) for 2020 taking this into account. d) [4] The following information is provided for Aleh PLC (amounts are in millions): 3,949 1,147 2,803 (320) 2,483 Depreciation 1,582 1,631 1,713 (497) 1,986 110 100 (10) 870 Capex 2,162 1,940 4,693 WC investment 485 (109) 308 Assuming Aleh finances 40% of its net investment with debt issues and that maturing debt is simply refinanced on the same terms, calculate the firm's equity free cash flow in 2019 and 2020. e) [6] Discuss what relevant value drivers you can use to forecast the following line- items: Interest payments, Cost of Goods Sold, and Accounts Receivables.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Calculation of Free Cash Flow to the Firm FCFF for 2019 and 2020 FCFF EBIT1 Tax Rate Depreciation Amortisation Change in Working Capital Capital Expenditure For 2019 FCFF 23051 02 980 8791 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started