Answered step by step

Verified Expert Solution

Question

1 Approved Answer

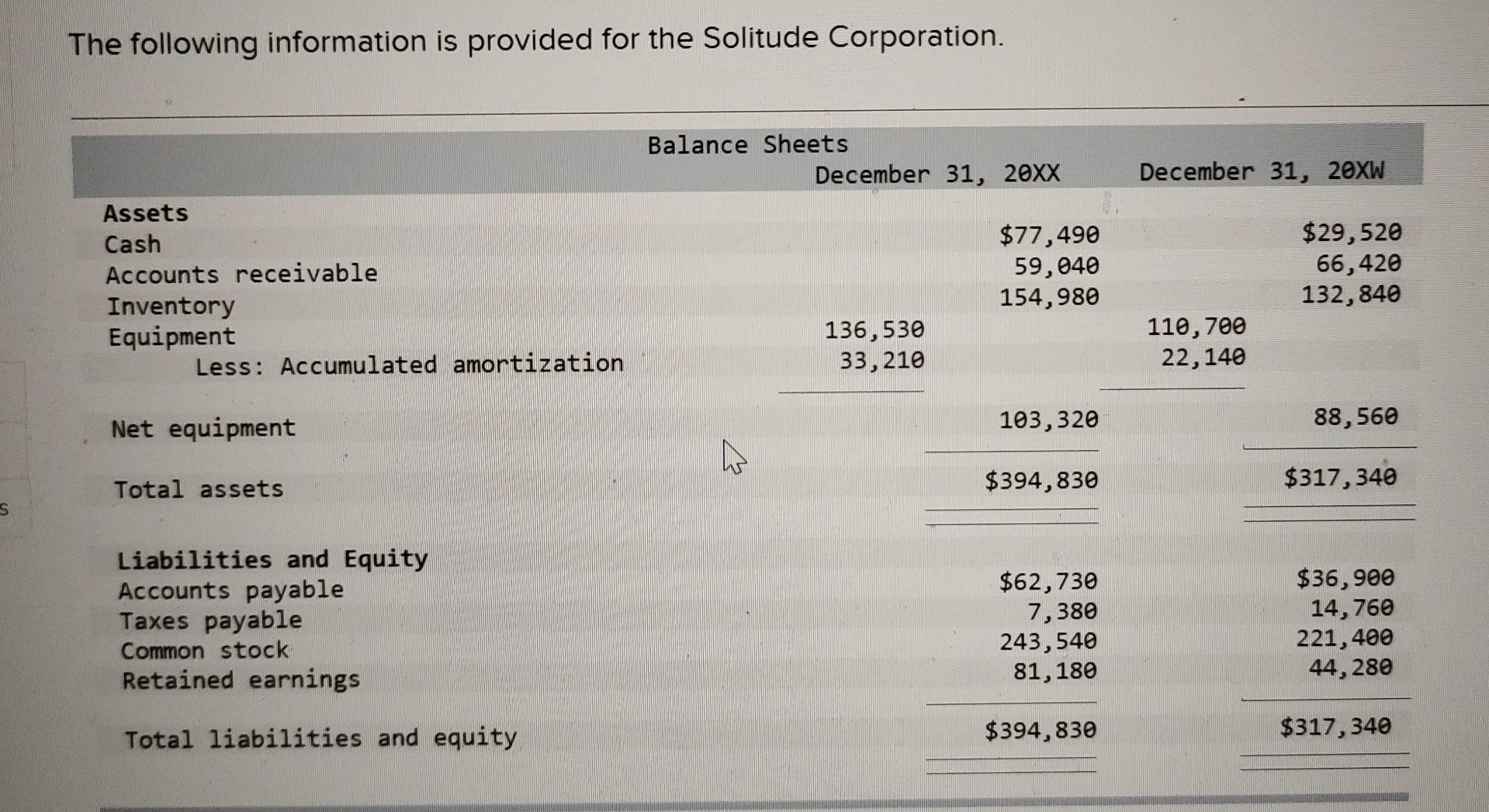

The following information is provided for the Solitude Corporation. During 20XX, the following occurred: 1. Net income was $73,800 2. Equipment was purchased for cash,

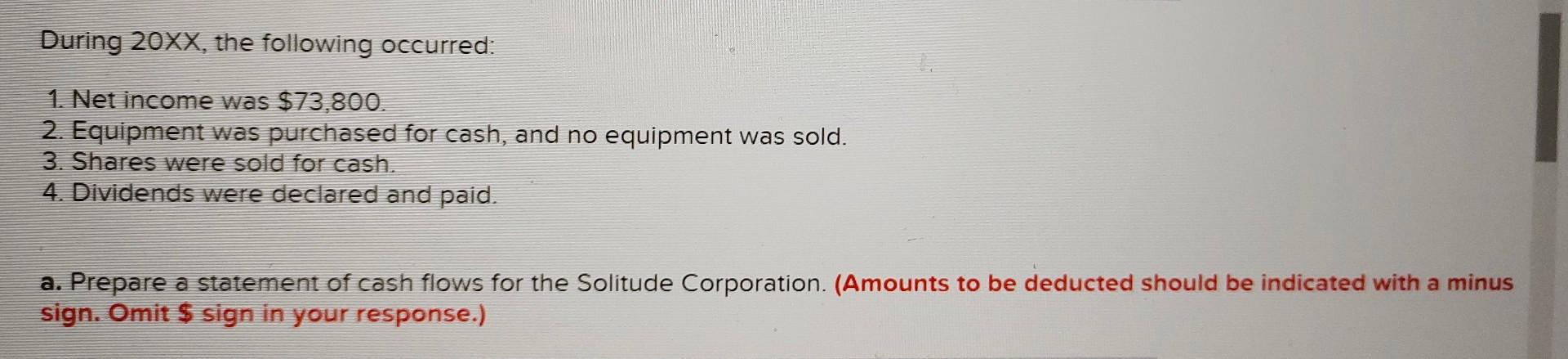

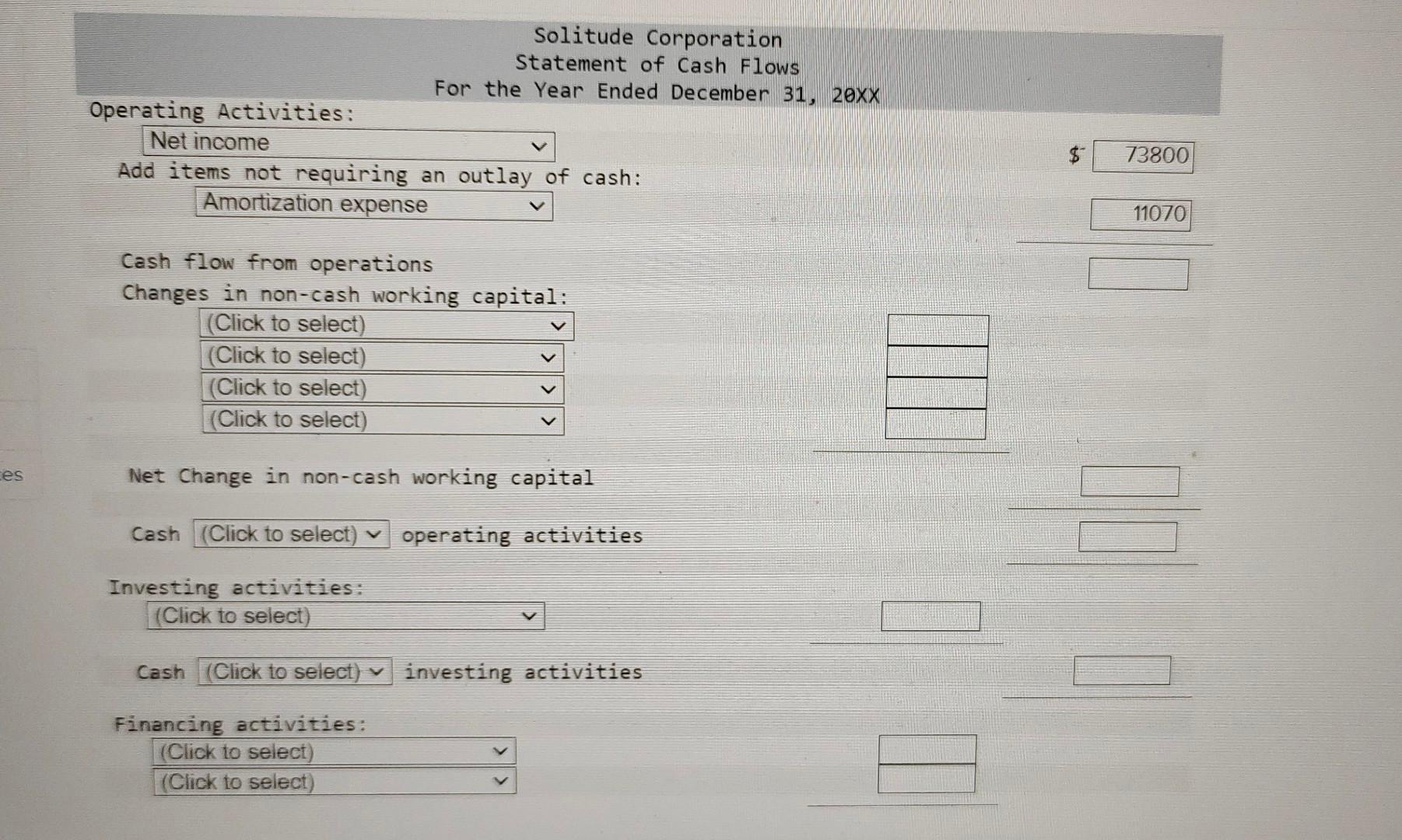

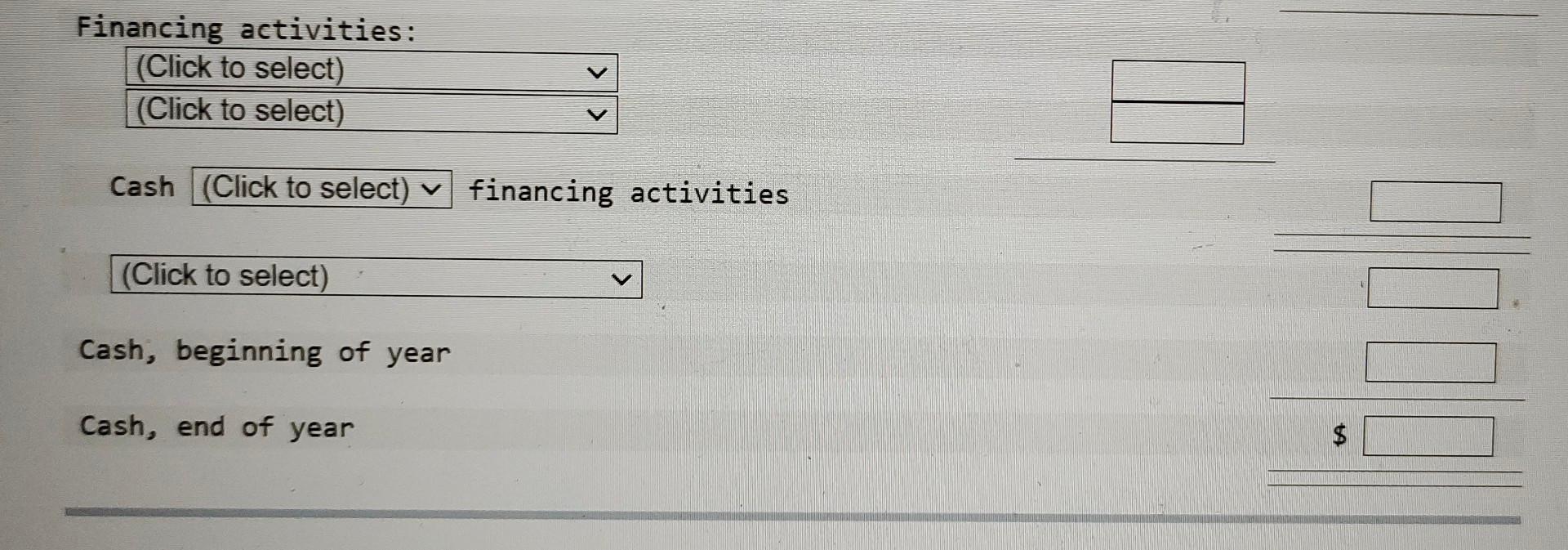

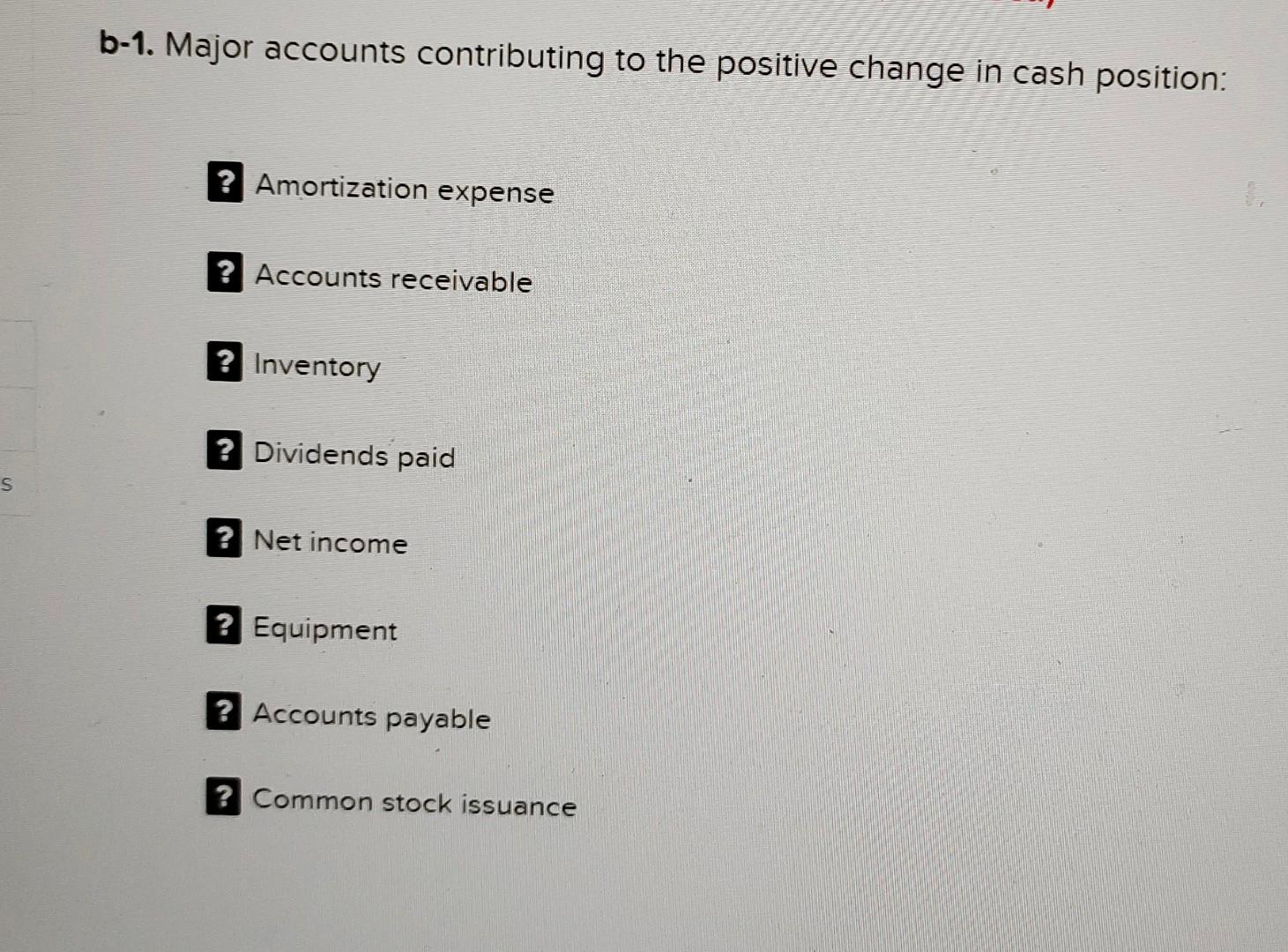

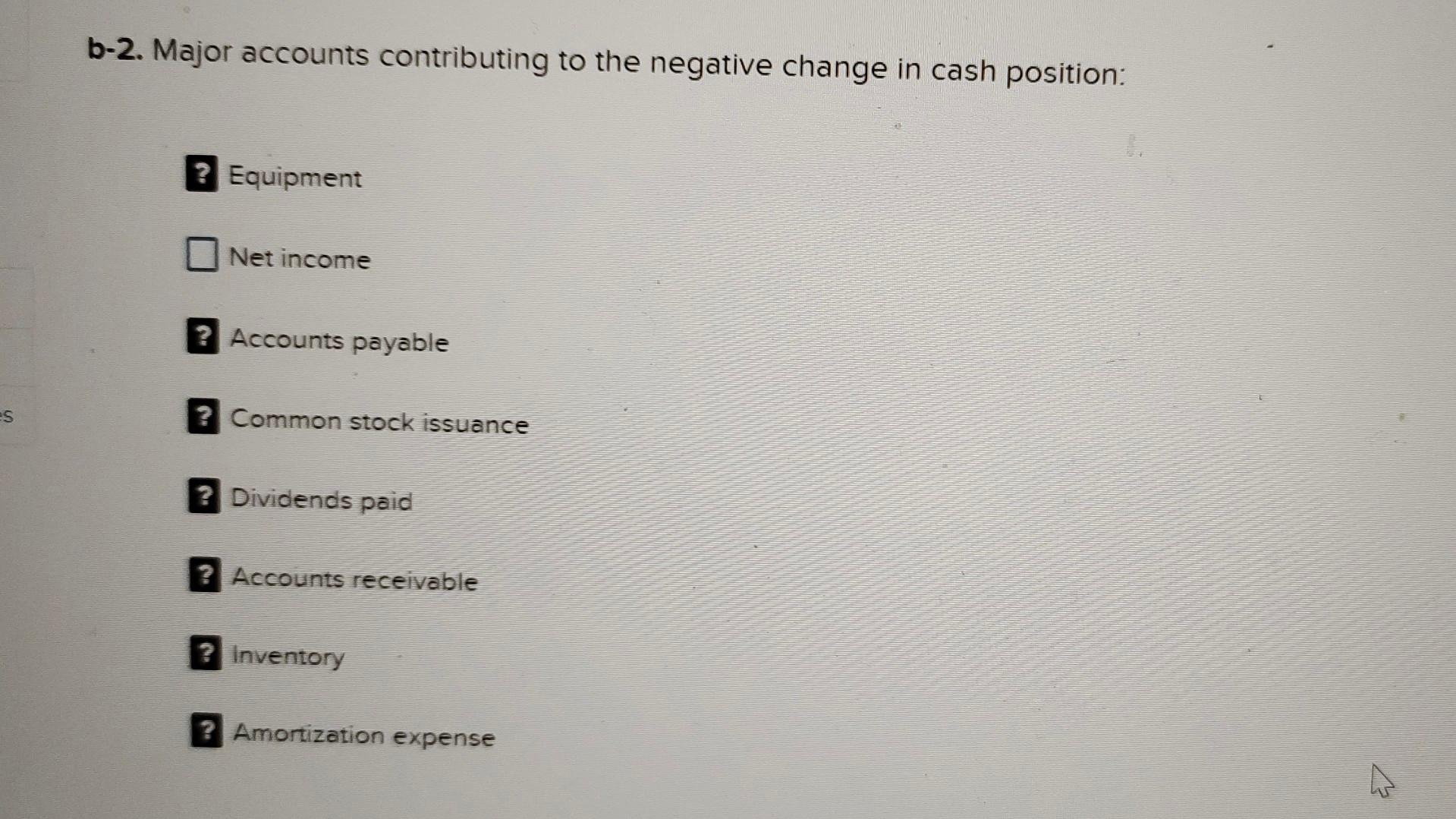

The following information is provided for the Solitude Corporation. During 20XX, the following occurred: 1. Net income was $73,800 2. Equipment was purchased for cash, and no equipment was sold. 3. Shares were sold for cash. 4. Dividends were declared and paid. a. Prepare a statement of cash flows for the Solitude Corporation. (Amounts to be deducted should be indicated with a minus sign. Omit \$ sign in your response.) Solitude Corporation Statement of Cash Flows For the Year Ended December 31, 20XX Operating Activities: Amortization expense Cash flow from operations Changes in non-cash working capital: \begin{tabular}{|lr|} \hline (Click to select) & \\ \hline \hline (Click to select) & \\ \hline (Click to select) & \\ \hline (Click to select) & \\ \hline \end{tabular} Net Change in non-cash working capital Cash (Click to select) operating activities Investing activities: (Click to select) Cash (Click to select) investing activities Financing activities: \begin{tabular}{|ll|} \hline (Click to select) & \\ \hline (Click to select) & \\ \hline \end{tabular} Financing activities: \begin{tabular}{|lr|} \hline (Click to select) & \\ \hline \hline (Click to select) & \\ \hline \end{tabular} Cash (Click to select) financing activities (Click to select) Cash, beginning of year Cash, end of year b. Identify the major accounts contributing to the change in cash position, from the three different components of the cash flow statement. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) b-1. Major accounts contributing to the positive change in cash position: Amortization expense Accounts receivable Inventory Dividends paid Net income Equipment Accounts payable Common stock issuance b-2. Major accounts contributing to the negative change in cash position: Equipment Net income Accounts payable Common stock issuance Dividends paid Accounts receivable Inventory Amortization expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started