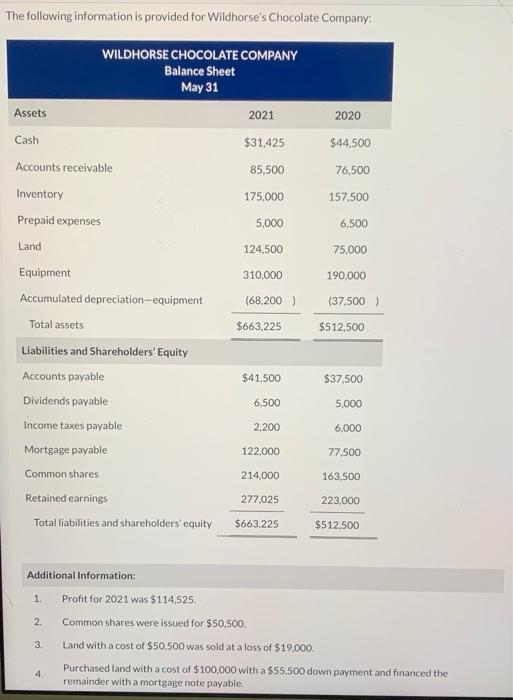

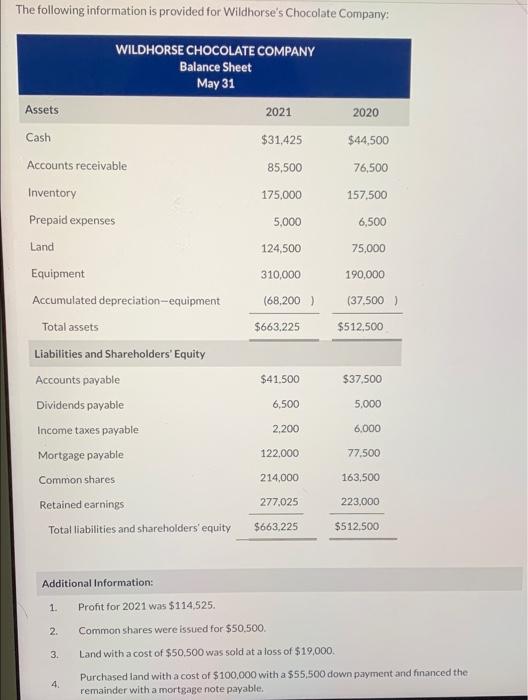

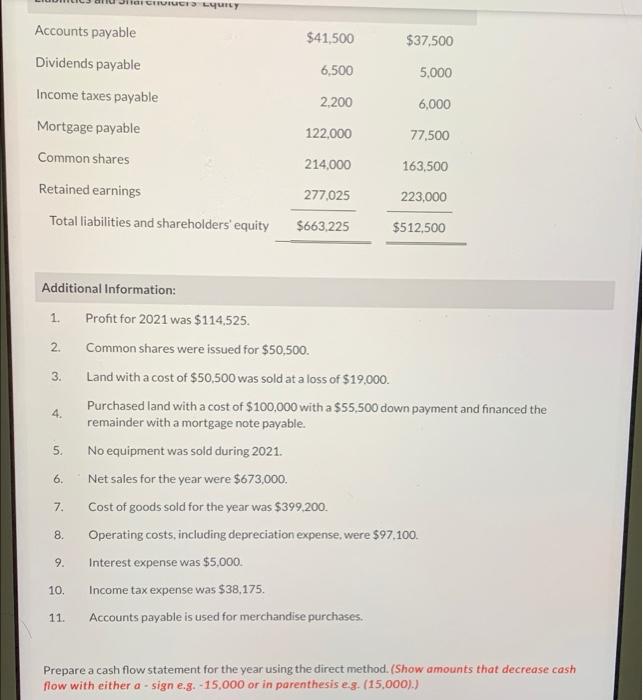

The following information is provided for Wildhorse's Chocolate Company: WILDHORSE CHOCOLATE COMPANY Balance Sheet May 31 2021 Assets 2020 Cash $31,425 $44,500 85,500 76,500 175,000 157.500 5,000 6,500 124,500 75,000 310,000 (68,200) $663,225 190,000 (37.500) $512,500 Accounts receivable Inventory Prepaid expenses Land Equipment Accumulated depreciation-equipment Total assets Liabilities and Shareholders' Equity Accounts payable Dividends payable Income taxes payable Mortgage payable Common shares Retained earnings Total liabilities and shareholders' equity $41,500 $37,500 6,500 5,000 2.200 6.000 122,000 77.500 214,000 163,500 277,025 223.000 $512,500 $663,225 1. 2. Additional Information: Profit for 2021 was $114,525. Common shares were issued for $50.500. Land with a cost of $50,500 was sold at a loss of $19.000 Purchased land with a cost of $100,000 with a $55.500 down payment and financed the remainder with a mortgage note payable. 3. 4 The following information is provided for Wildhorse's Chocolate Company: WILDHORSE CHOCOLATE COMPANY Balance Sheet May 31 Assets 2021 2020 Cash $31,425 $44,500 Accounts receivable 85,500 76,500 175,000 157.500 Inventory Prepaid expenses 5,000 6,500 Land 124,500 75,000 Equipment 310,000 190,000 (68,200) $663,225 (37,500) $512,500 $41.500 $37.500 6,500 5.000 Accumulated depreciation-equipment Total assets Liabilities and Shareholders' Equity Accounts payable Dividends payable Income taxes payable Mortgage payable Common shares Retained earnings Total liabilities and shareholders' equity 2.200 6,000 122.000 77.500 214,000 163,500 277,025 223,000 $663,225 $512,500 Additional Information: 1. Profit for 2021 was $114,525. 2. 3. 3. Common shares were issued for $50,500. Land with a cost of $50,500 was sold at a loss of $19,000. Purchased land with a cost of $100,000 with a $55,500 down payment and financed the remainder with a mortgage note payable, a 4. CIVILICE LYUTLY $41,500 $37,500 6,500 5,000 2.200 6,000 Accounts payable Dividends payable Income taxes payable Mortgage payable Common shares Retained earnings Total liabilities and shareholders' equity 122,000 77,500 214,000 163,500 277,025 223,000 $512,500 $663,225 2 4. Additional Information: 1. Profit for 2021 was $114,525. Common shares were issued for $50,500. 3. Land with a cost of $50,500 was sold at a loss of $19.000. Purchased land with a cost of $100,000 with a $55,500 down payment and financed the remainder with a mortgage note payable. No equipment was sold during 2021. Net sales for the year were $673,000. Cost of goods sold for the year was $399,200. Operating costs, including depreciation expense, were $97,100 Interest expense was $5,000 Income tax expense was $38,175. Accounts payable is used for merchandise purchases. 5. 6. 7. N 8. 9. 10. 11. Prepare a cash flow statement for the year using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. - 15,000 or in parenthesis eg. (15,000).)