Question

The following information is provided to you from the pension administration firm of your client Jacks Speed Wash, Inc: Service Cost . . . .

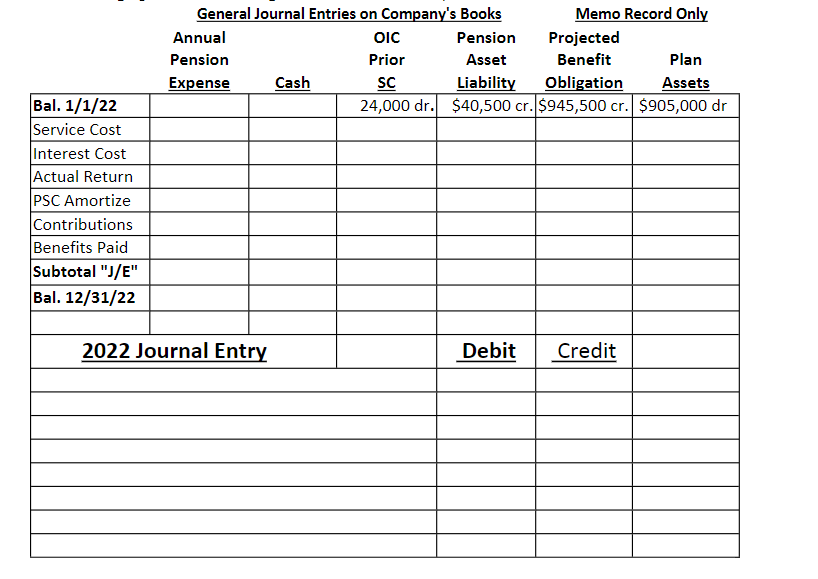

The following information is provided to you from the pension administration firm of your client Jacks Speed Wash, Inc:

Service Cost . . . . . . . . . . . . . . . . . . $86,450

Contribution to plan . . . . . . . . . . . . . . 104,500

Prior Service Cost Amortization. . . . . . . . . 4,800

Actual and Expected Return on Assets . . . . . . 96,650

Benefits Paid. . . . . . . . . . . . . . . . . . 64,900

Plan Assets, January 1, 2022 . . . . . . . . . . 905,000

Projected Benefit Obligation, January 1, 2022. . 945,500

Interest/Discount (settlement) rate. . . . . . . 6%

Accumulated OIC (PSC), January 1, 2022 . . . . . 24,000

Required Complete the pension worksheet below for 2022, and prepare the necessary journal entry at December 31, 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started