Question

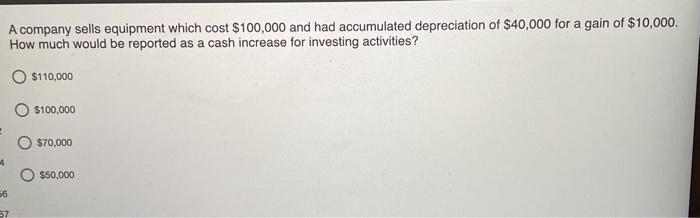

4 56 A company sells equipment which cost $100,000 and had accumulated depreciation of $40,000 for a gain of $10,000. How much would be

4 56 A company sells equipment which cost $100,000 and had accumulated depreciation of $40,000 for a gain of $10,000. How much would be reported as a cash increase for investing activities? O $110,000 57 $100,000 $70,000 $50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost of Equipment 100000 Less Accumulated Depreciat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

9th Edition

978-0470317549, 9780470387085, 047031754X, 470387084, 978-0470533475

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App