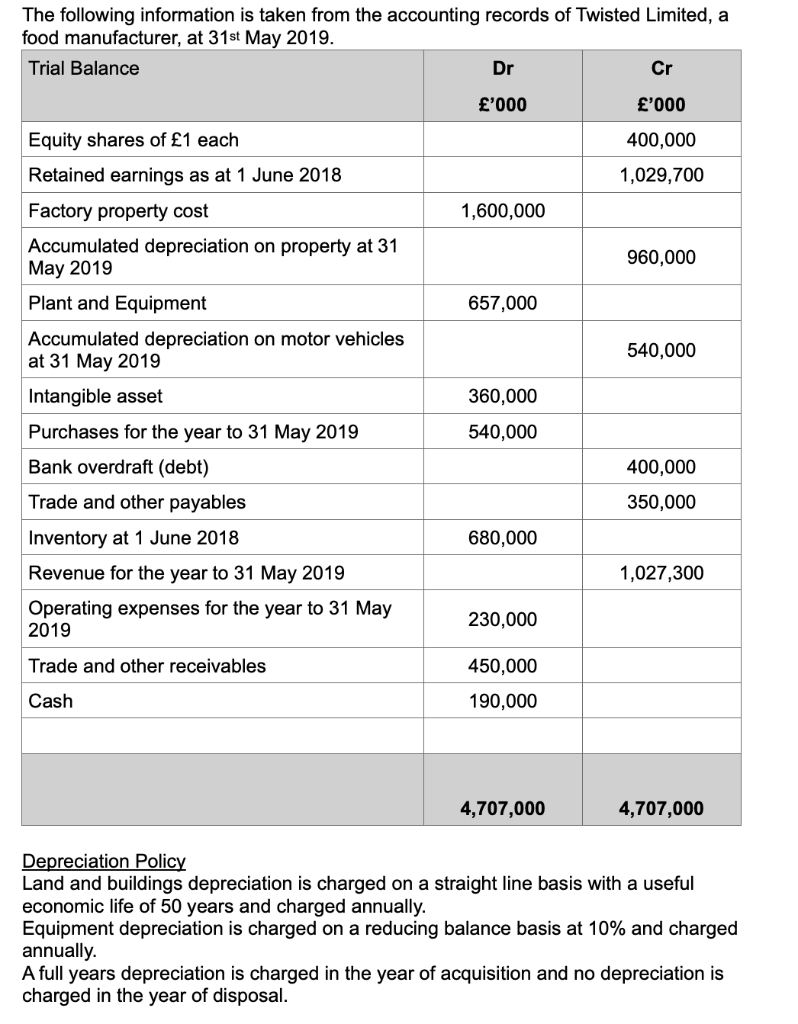

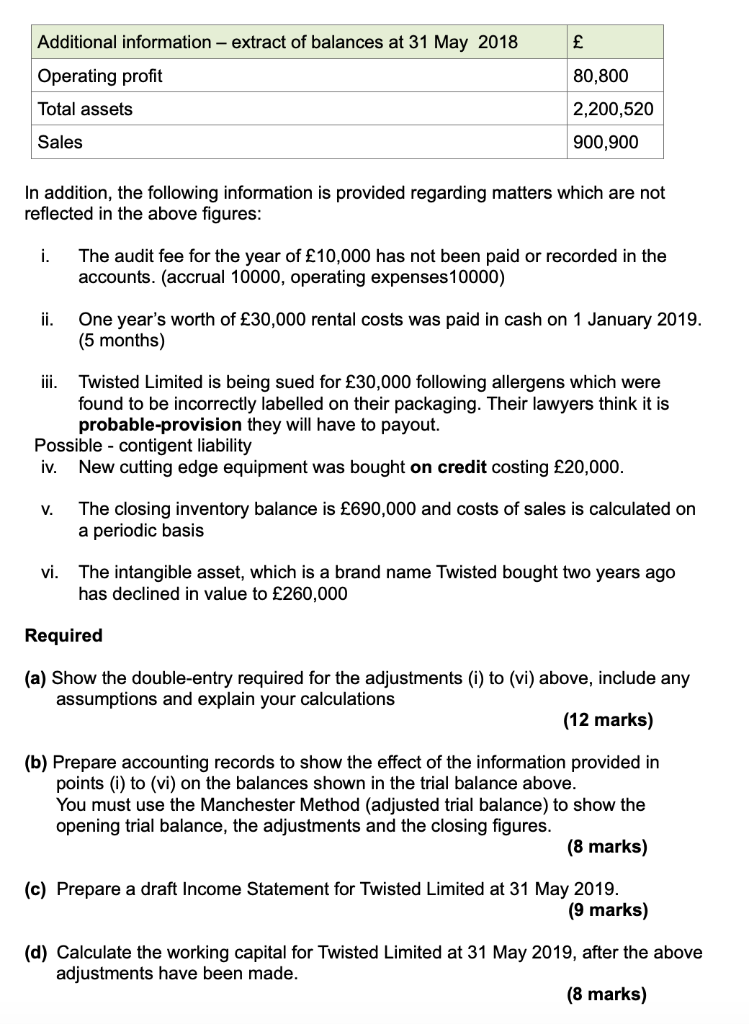

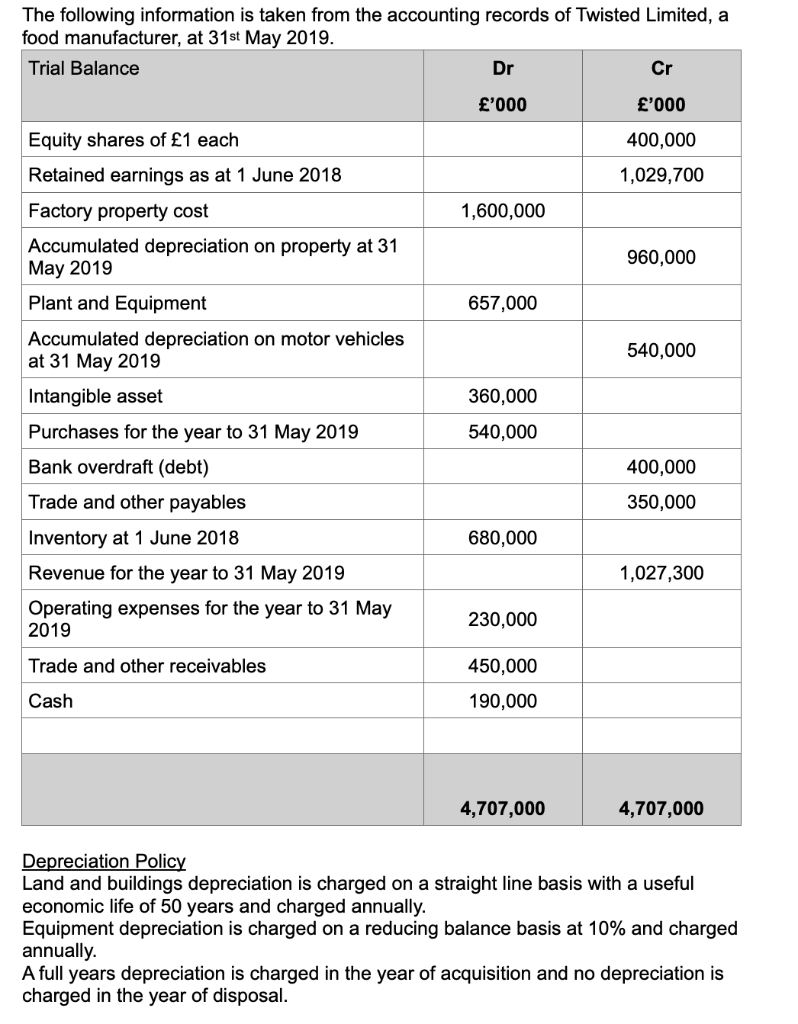

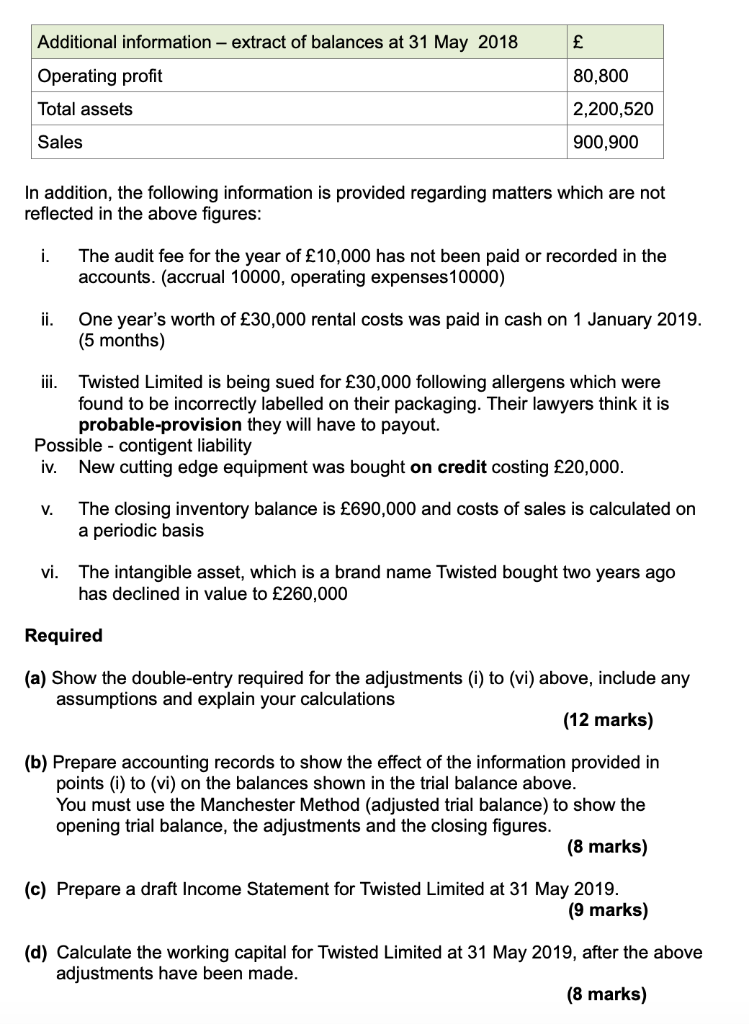

The following information is taken from the accounting records of Twisted Limited, a food manufacturer, at 31st May 2019. Trial Balance Dr Cr '000 '000 400,000 1,029,700 1,600,000 960,000 657,000 540,000 Equity shares of 1 each Retained earnings as at 1 June 2018 Factory property cost Accumulated depreciation on property at 31 May 2019 Plant and Equipment Accumulated depreciation on motor vehicles at 31 May 2019 Intangible asset Purchases for the year to 31 May 2019 Bank overdraft (debt) Trade and other payables Inventory at 1 June 2018 Revenue for the year to 31 May 2019 Operating expenses for the year to 31 May 2019 360,000 540,000 400,000 350,000 680,000 1,027,300 230,000 Trade and other receivables 450,000 190,000 Cash 4,707,000 4,707,000 Depreciation Policy Land and buildings depreciation is charged on a straight line basis with a useful economic life of 50 years and charged annually. Equipment depreciation is charged on a reducing balance basis at 10% and charged annually. A full years depreciation is charged in the year of acquisition and no depreciation is charged in the year of disposal. Additional information - extract of balances at 31 May 2018 Operating profit Total assets 80,800 2,200,520 Sales 900,900 In addition, the following information is provided regarding matters which are not reflected in the above figures: i. The audit fee for the year of 10,000 has not been paid or recorded in the accounts. (accrual 10000, operating expenses10000) ii. One year's worth of 30,000 rental costs was paid in cash on 1 January 2019. (5 months) iii. Twisted Limited is being sued for 30,000 following allergens which were found to be incorrectly labelled on their packaging. Their lawyers think it is probable-provision they will have to payout. Possible - contigent liability iv. New cutting edge equipment was bought on credit costing 20,000. V. The closing inventory balance is 690,000 and costs of sales is calculated on a periodic basis vi. The intangible asset, which is a brand name Twisted bought two years ago has declined in value to 260,000 Required (a) Show the double-entry required for the adjustments (i) to (vi) above, include any assumptions and explain your calculations (12 marks) (b) Prepare accounting records to show the effect of the information provided in points (i) to (vi) on the balances shown in the trial balance above. You must use the Manchester Method (adjusted trial balance) to show the opening trial balance, the adjustments and the closing figures. (8 marks) (c) Prepare a draft Income Statement for Twisted Limited at 31 May 2019. (9 marks) (d) Calculate the working capital for Twisted Limited at 31 May 2019, after the above adjustments have been made. (8 marks)