Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? The following information is taken from the books of Motsepe Traders: Bank Reconciliation Statement of Motsepe Traders as at 30 June 2019 Favourable

?

?

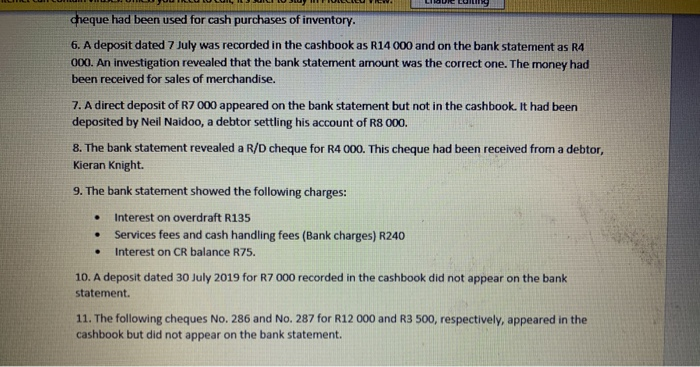

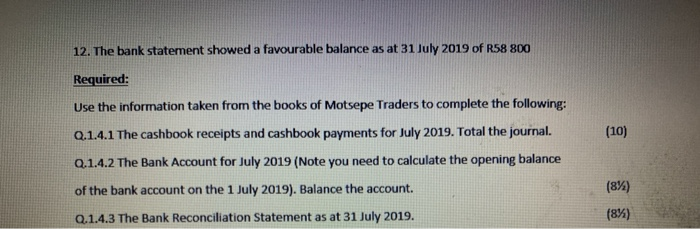

The following information is taken from the books of Motsepe Traders: Bank Reconciliation Statement of Motsepe Traders as at 30 June 2019 Favourable balance as per bank statement Outstanding deposit Outstanding cheques: No. 202 No. 273 No. 275 Balance as per bank account 23600 18600 22400 6600 14600 ??? Bonisile Dube's comparison with the above reconciliation statement, the cashbooks for July 2019 and the Bank Statement for July revealed the following: 1. Provisional totals in the Cashbook Receipts and the Cashbook Payments on July 2019 were R221 000 and R193 000, respectively. 2. The outstanding cheque No. 202 did not appear on the bank statement. The cheque was originally issued to Monk Studios more than six months ago for advertising. 3. Cheque No. 273 which was issued during the previous month still did not appear on the bank statement. 4. Cheque No. 275 and the outstanding deposit of R18 600 appeared on the bank statement. 5. Cheque No. 285 appeared on the bank statement as R12 400 and had been recorded in the cashbook as R14 400. An investigation revealed that the amount in the cashbook was the correct amount. The cheque had been used for cash purchases of inventory. 6. A deposit dated 7 July was recorded in the cashbook as R14 000 and on the bank statement as R4 CMK ... Focus B cheque had been used for cash purchases of inventory. 6. A deposit dated 7 July was recorded in the cashbook as R14 000 and on the bank statement as R4 000. An investigation revealed that the bank statement amount was the correct one. The money had been received for sales of merchandise. 7. A direct deposit of R7 000 appeared on the bank statement but not in the cashbook. It had been deposited by Neil Naidoo, a debtor settling his account of R8 000. 8. The bank statement revealed a R/D cheque for R4 000. This cheque had been received from a debtor, Kieran Knight. 9. The bank statement showed the following charges: . Interest on overdraft R135 Services fees and cash handling fees (Bank charges) R240 . Interest on CR balance R75. . 10. A deposit dated 30 July 2019 for R7 000 recorded in the cashbook did not appear on the bank statement. 11. The following cheques No. 286 and No. 287 for R12 000 and R3 500, respectively, appeared in the cashbook but did not appear on the bank statement. 12. The bank statement showed a favourable balance as at 31 July 2019 of R58 800 Required: Use the information taken from the books of Motsepe Traders to complete the following: Q.1.4.1 The cashbook receipts and cashbook payments for July 2019. Total the journal. Q.1.4.2 The Bank Account for July 2019 (Note you need to calculate the opening balance of the bank account on the 1 July 2019). Balance the account. Q.1.4.3 The Bank Reconciliation Statement as at 31 July 2019. (10) (8%) (8%)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Jun19 1 Cash Book Receipts Payments Total Cheque No 202 expired Incorrect depos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started