Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. After completing the pro forma income statement in problem 6-4, Mr. Tine now realizes he should also complete a pro forma balance sheet.

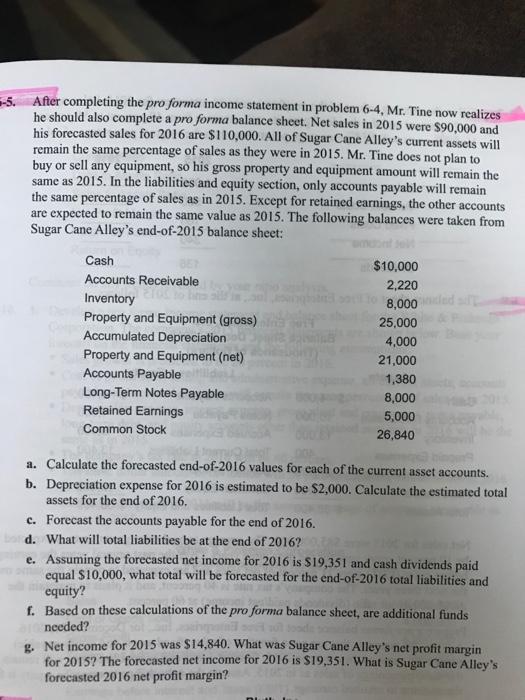

5. After completing the pro forma income statement in problem 6-4, Mr. Tine now realizes he should also complete a pro forma balance sheet. Net sales in 2015 were $90,000 and his forecasted sales for 2016 are $110,000. All of Sugar Cane Alley's current assets will remain the same percentage of sales as they were in 2015. Mr. Tine does not plan to buy or sell any equipment, so his gross property and equipment amount will remain the same as 2015. In the liabilities and equity section, only accounts payable will remain the same percentage of sales as in 2015. Except for retained earnings, the other accounts are expected to remain the same value as 2015. The following balances were taken from Sugar Cane Alley's end-of-2015 balance sheet: Cash $10,000 Accounts Receivable 2,220 Inventory 8,000led a Property and Equipment (gross) Accumulated Depreciation Property and Equipment (net) Accounts Payable Long-Term Notes Payable Retained Earnings 25,000 4,000 21,000 1,380 8,000 5,000 Common Stock 26,840 a. Calculate the forecasted end-of-2016 values for each of the current asset accounts. b. Depreciation expense for 2016 is estimated to be $2,000. Calculate the estimated total assets for the end of 2016. c. Forecast the accounts payable for the end of 2016. d. What will total liabilities be at the end of 2016? e. Assuming the forecasted net income for 2016 is $19,351 and cash dividends paid equal $10,000, what total will be forecasted for the end-of-2016 total liabilities and equity? f. Based on these calculations of the pro forma balance sheet, are additional funds needed? g. Net income for 2015 was S14,840. What was Sugar Cane Alley's net profit margin for 2015? The forecasted net income for 2016 is $19,351. What is Sugar Cane Alley's forecasted 2016 net profit margin?

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Forecasted Current Assets value at the end of 2019 Particulars 2018 2019 Net sales 90000 110000 Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started