Question

Jump Company currently produces 12,000 units per year of a component part of its products. The cost per unit of this component part is

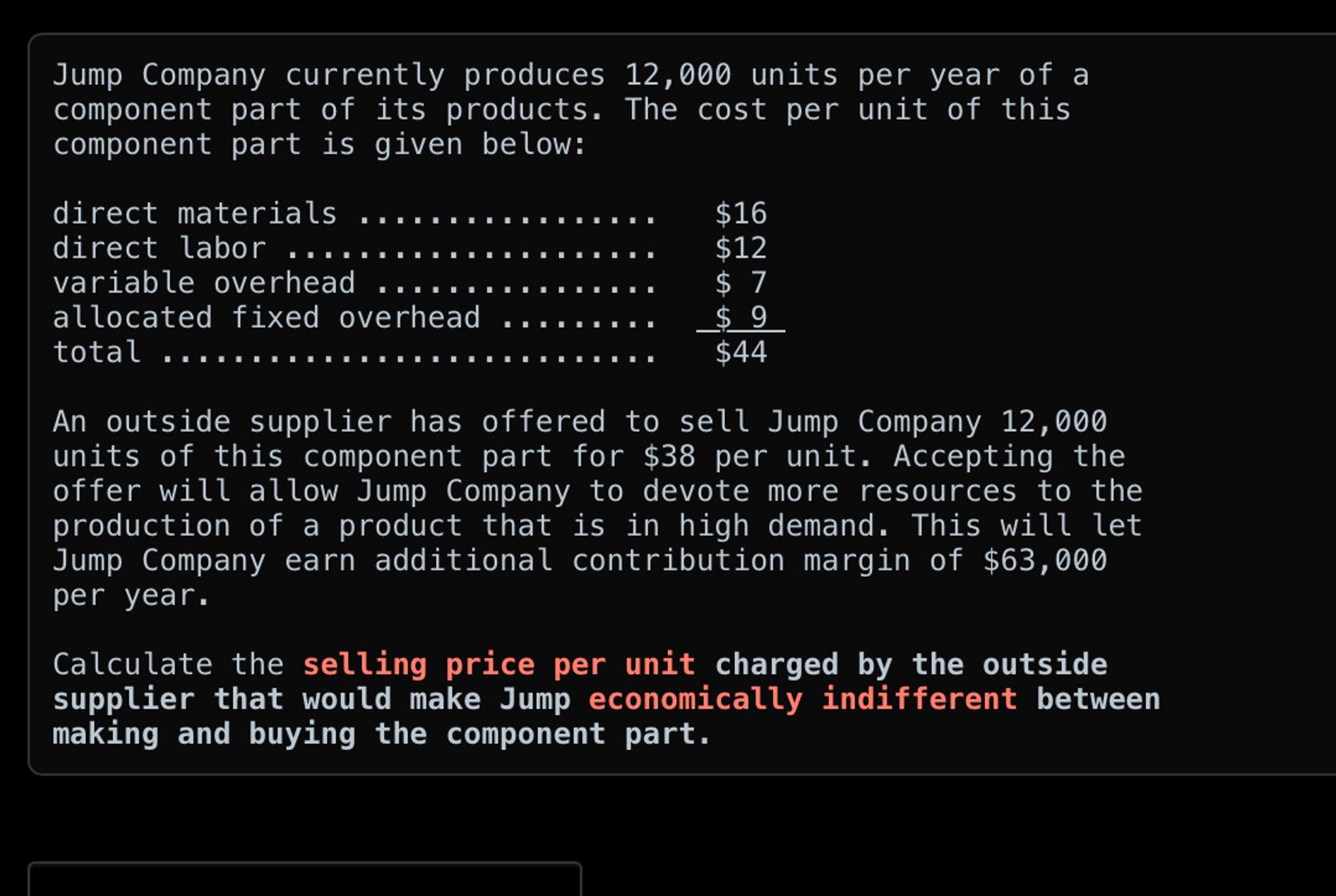

Jump Company currently produces 12,000 units per year of a component part of its products. The cost per unit of this component part is given below: direct materials direct labor ... variable overhead allocated fixed overhead total ... $16 $12 $ 7 $ 9 $44 An outside supplier has offered to sell Jump Company 12,000 units of this component part for $38 per unit. Accepting the offer will allow Jump Company to devote more resources to the production of a product that is in high demand. This will let Jump Company earn additional contribution margin of $63,000 per year. Calculate the selling price per unit charged by the outside supplier that would make Jump economically indifferent between making and buying the component part.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

17th edition

007802577X, 978-0078025778

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App