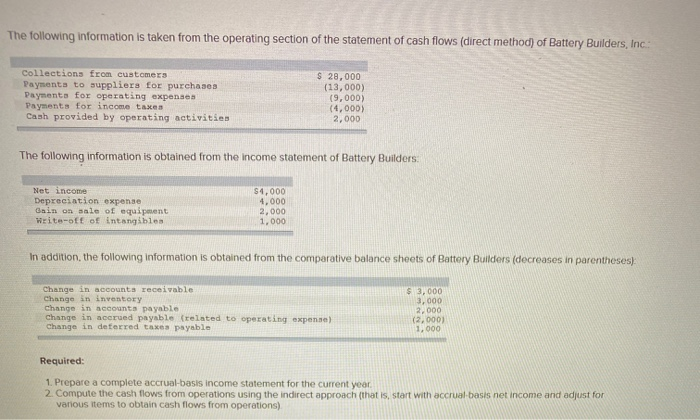

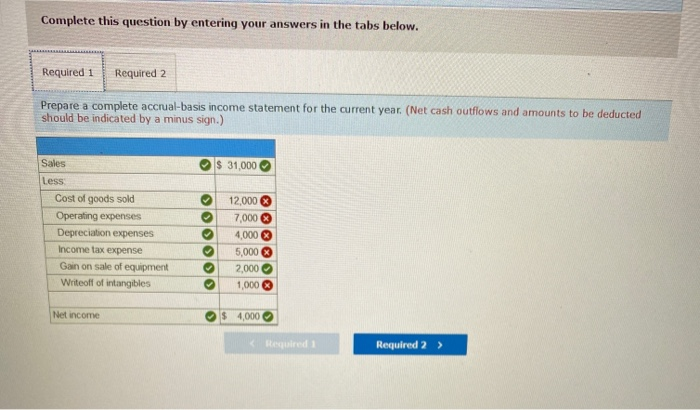

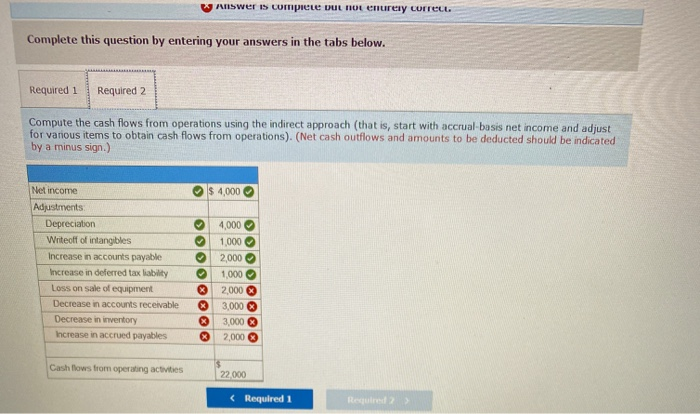

The following information is taken from the operating section of the statement of cash flows (direct method) of Battery Builders, Inc: Collections from customers Payments to suppliers for purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities $ 28,000 (13,000) (9,000) (4,000) 2,000 The following information is obtained from the income statement of Battery Builders. Net income Depreciation expense Gain on sale of equipment Write-off of intangibles $4,000 4,000 2,000 1,000 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payable related change in deterred taxes payable $3,000 3,000 2.000 (2.000) 1,000 operating expense) Required: 1. Prepare a complete accrual-basis income statement for the current year 2. Compute the cash flows from operations using the indirect approach (that is, start with accrual basis net income and adjust for various items to obtain cash flows from operations) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a complete accrual-basis income statement for the current year. (Net cash outflows and amounts to be deducted should be indicated by a minus sign.) Sales $ 31,000 Less Cost of goods sold Operating expenses Depreciation expenses Income tax expense Gain on sale of equipment Writeoff of intangibles OOO 12,000 7,000 4,000 3 5,000 2,000 1,000 Net income $ 4,000 Red Required 2 > Answer is complete vul mot crurey correct Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cash flows from operations using the indirect approach (that is, start with accrual basis net income and adjust for various items to obtain cash flows from operations). (Net cash outflows and amounts to be deducted should be indicated by a minus sign.) $ 4,000 Net income Adjustments Depreciation Writeoff of intangibles Increase in accounts payable Increase in deferred tax liability Loss on sale of equipment Decrease in accounts receivable Decrease in inventory Increase in accrued payables 4,000 1.000 2,000 1,000 2,000 3 3,000 3,000 3 2,000 000 Slox Cash flows from operating activities 22.000