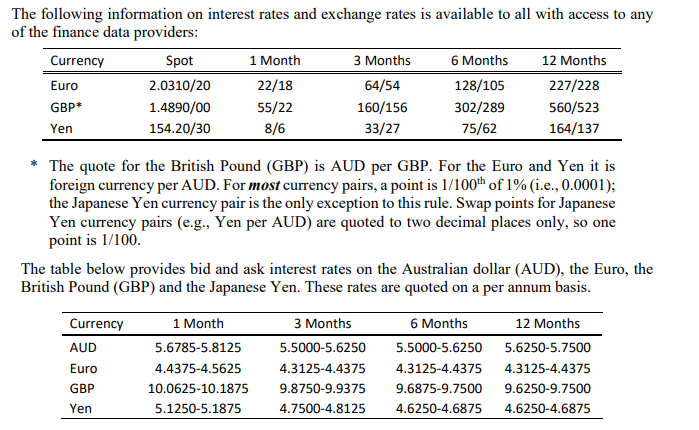

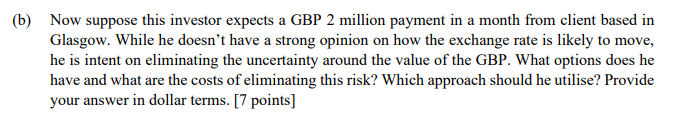

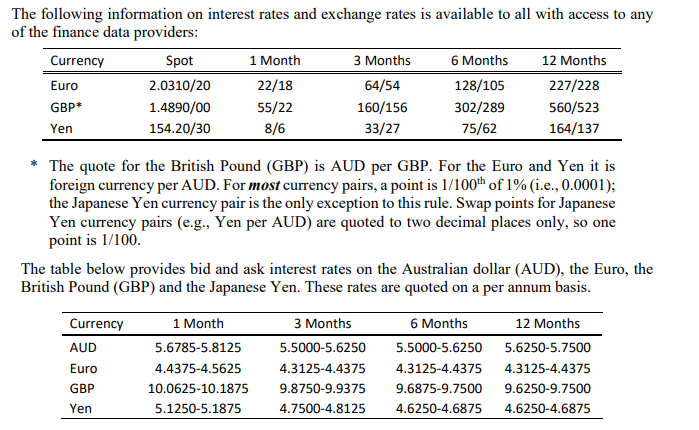

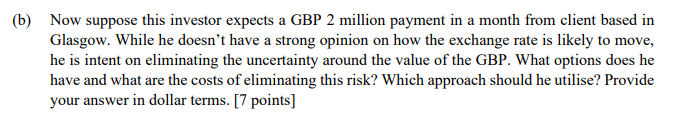

The following information on interest rates and exchange rates is available to all with access to any of the finance data providers: Currency Spot 1 Month 3 Months 6 Months 12 Months Euro 2.0310/20 22/18 128/105 GBP* 1.4890/00 154.20/30 55/22 8/6 64/54 160/156 33/27 302/289 75/62 227/228 560/523 164/137 Yen * The quote for the British Pound (GBP) is AUD per GBP. For the Euro and Yen it is foreign currency per AUD. For most currency pairs, a point is 1/100th of 1% (i.e., 0.0001); the Japanese Yen currency pair is the only exception to this rule. Swap points for Japanese Yen currency pairs (e.g., Yen per AUD) are quoted to two decimal places only, so one point is 1/100. The table below provides bid and ask interest rates on the Australian dollar (AUD), the Euro, the British Pound (GBP) and the Japanese Yen. These rates are quoted on a per annum basis. Currency 1 Month 3 Months 6 Months 12 Months AUD 5.6785-5.8125 5.5000-5.6250 5.5000-5.6250 5.6250-5.7500 Euro 4.4375-4.5625 4.3125-4.4375 4.3125-4.4375 4.3125-4.4375 GBP 10.0625-10.1875 9.8750-9.9375 9.6875-9.7500 9.6250-9.7500 Yen 5.1250-5.1875 4.7500-4.8125 4.6250-4.6875 4.6250-4.6875 (b) Now suppose this investor expects a GBP 2 million payment in a month from client based in Glasgow. While he doesn't have a strong opinion on how the exchange rate is likely to move, he is intent on eliminating the uncertainty around the value of the GBP. What options does he have and what are the costs of eliminating this risk? Which approach should he utilise? Provide your answer in dollar terms. [7 points] The following information on interest rates and exchange rates is available to all with access to any of the finance data providers: Currency Spot 1 Month 3 Months 6 Months 12 Months Euro 2.0310/20 22/18 128/105 GBP* 1.4890/00 154.20/30 55/22 8/6 64/54 160/156 33/27 302/289 75/62 227/228 560/523 164/137 Yen * The quote for the British Pound (GBP) is AUD per GBP. For the Euro and Yen it is foreign currency per AUD. For most currency pairs, a point is 1/100th of 1% (i.e., 0.0001); the Japanese Yen currency pair is the only exception to this rule. Swap points for Japanese Yen currency pairs (e.g., Yen per AUD) are quoted to two decimal places only, so one point is 1/100. The table below provides bid and ask interest rates on the Australian dollar (AUD), the Euro, the British Pound (GBP) and the Japanese Yen. These rates are quoted on a per annum basis. Currency 1 Month 3 Months 6 Months 12 Months AUD 5.6785-5.8125 5.5000-5.6250 5.5000-5.6250 5.6250-5.7500 Euro 4.4375-4.5625 4.3125-4.4375 4.3125-4.4375 4.3125-4.4375 GBP 10.0625-10.1875 9.8750-9.9375 9.6875-9.7500 9.6250-9.7500 Yen 5.1250-5.1875 4.7500-4.8125 4.6250-4.6875 4.6250-4.6875 (b) Now suppose this investor expects a GBP 2 million payment in a month from client based in Glasgow. While he doesn't have a strong opinion on how the exchange rate is likely to move, he is intent on eliminating the uncertainty around the value of the GBP. What options does he have and what are the costs of eliminating this risk? Which approach should he utilise? Provide your answer in dollar terms. [7 points]