Question

The following information pertains to an entity as at December 31, 2020: Trade notes payable 1,890,000 Accounts payable 1,575,000 Deferred tax liability 840,000 Stock

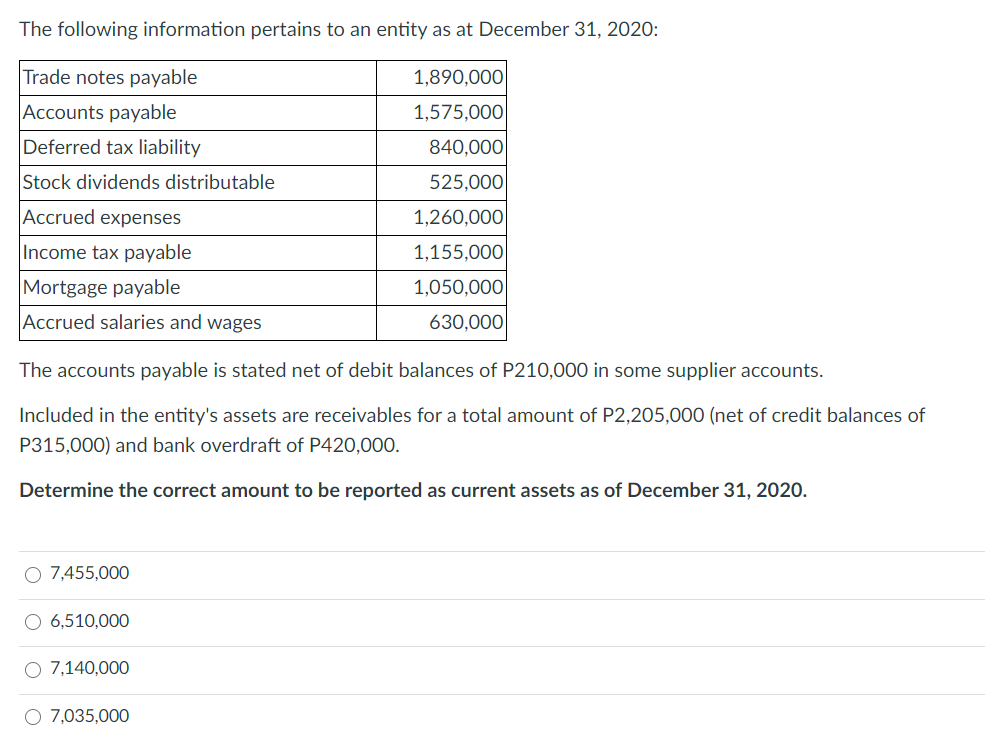

The following information pertains to an entity as at December 31, 2020: Trade notes payable 1,890,000 Accounts payable 1,575,000 Deferred tax liability 840,000 Stock dividends distributable 525,000 Accrued expenses 1,260,000 Income tax payable 1,155,000 Mortgage payable 1,050,000 Accrued salaries and wages 630,000 The accounts payable is stated net of debit balances of P210,000 in some supplier accounts. Included in the entity's assets are receivables for a total amount of P2,205,000 (net of credit balances of P315,000) and bank overdraft of P420,000. Determine the correct amount to be reported as current assets as of December 31, 2020. O 7,455,000 6,510,000 O 7,140,000 O 7,035,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option A is cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Flawrence Revsine, Daniel Collins, Bruce, Mittelstaedt, Leon

6th edition

9780077632182, 78025672, 77632184, 978-0078025679

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App