Answered step by step

Verified Expert Solution

Question

1 Approved Answer

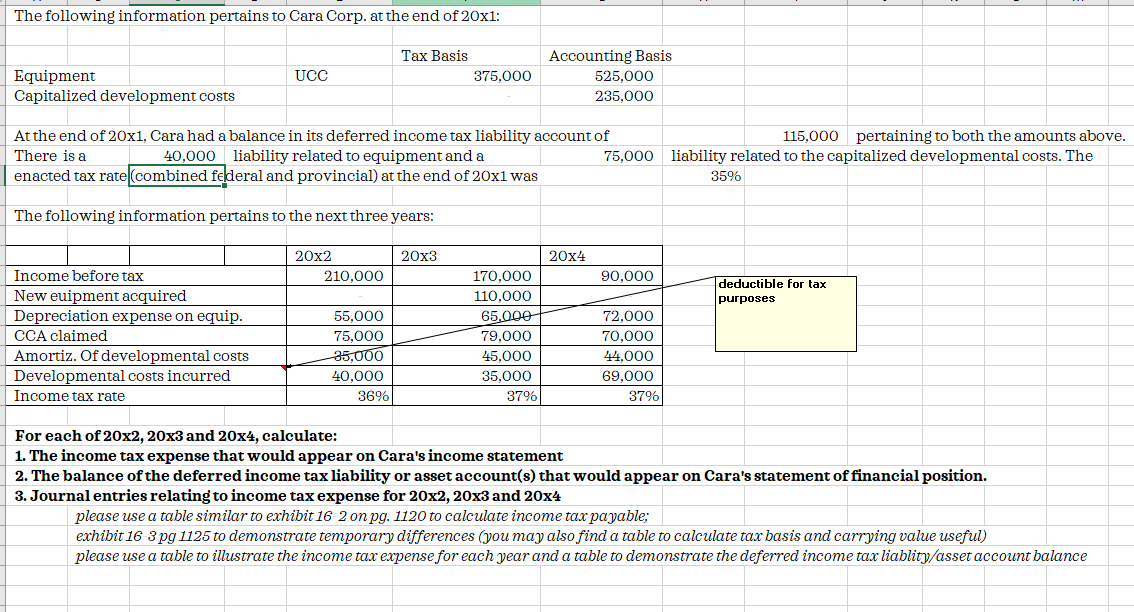

The following information pertains to Cara Corp. at the end of 20x1: Tax Basis Accounting Basis Equipment Capitalized development costs UCC 375,000 525,000 235,000

The following information pertains to Cara Corp. at the end of 20x1: Tax Basis Accounting Basis Equipment Capitalized development costs UCC 375,000 525,000 235,000 At the end of 20x1, Cara had a balance in its deferred income tax liability account of There is a 115,000 pertaining to both the amounts above. 75,000 liability related to the capitalized developmental costs. The 40,000 liability related to equipment and a enacted tax rate (combined federal and provincial) at the end of 20x1 was 35% The following information pertains to the next three years: 20x2 20x3 20x4 Income before tax 210,000 170,000 90,000 deductible for tax New euipment acquired Depreciation expense on equip. CCA claimed Amortiz. Of developmental costs Developmental costs incurred 110,000 purposes 55,000 65.000 72,000 75,000 35,000 79,000 70,000 45.000 44,000 40,000 35,000 69,000 Income tax rate 369% 379% 379% For each of 20x2, 20x3 and 20x4, calculate: 1. The income tax expense that would appear on Cara's income statement 2. The balance of the deferred income tax liability or asset account(s) that would appear on Cara's statement of financial position. 3. Journal entries relating to income tax expense for 20x2, 20x3 and 20x4 please use a table similar to exhibit 16 2 on pg. 1120 to calculate income tax payable; exhibit 16 3 pg 1125 to demonstrate temporary differences (you may also find a table to calculate tax basis and carrying value useful) please use a table to illustrate the income tax expense for each year and a table to demonstrate the deferred income tax liablity/asset account balance

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started