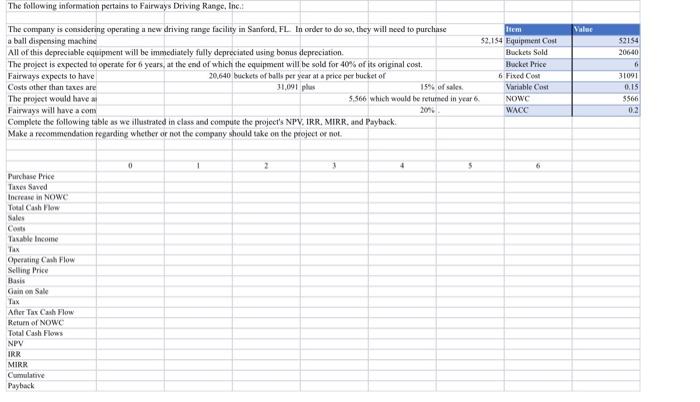

The following information pertains to Fairways Driving Range, Inc. Value 52154 20640 The company is considering operating a new driving range facility in Sanford, FL In order to do so, they will need to purchase liem a ball dispensing machine 52,154 Equipment Cost All of this depreciable equipment will be immediately fully depreciated using bonus depreciation Backets Sold The project is expected to operate for 6 years, at the end of which the equipment will be sold for 40% of its original cost Bucket Price Fairways expects to have 20,640 buckets of balls per year at a price per bucket of 6 Fixed Com Costs other than taxes are 31.001 plus 15% of sales Variable Cast The project would have 5.566 which would be returned in year 6 NOWC Fairways will have a com 20% WACC Complete the following table as we illustrated in class and compute the project's NTV, IRR. MIRR. and Payback Make a recommendation regarding whether or not the company should take on the project or not. 31091 0,15 5566 0.2 0 1 2 1 4 5 6 Purchase Price Taxes Saved Increase in NOW Total Cashow Sales Cout Taxable income Tax Operating Cash Flow Selling Price Basis) Gain on Sale Tax After Tax Cash Flow Return of NOW Total Cash Flows NPV IRR MIRR Cumulative Payback The following information pertains to Fairways Driving Range, Inc. Value 52154 20640 The company is considering operating a new driving range facility in Sanford, FL In order to do so, they will need to purchase liem a ball dispensing machine 52,154 Equipment Cost All of this depreciable equipment will be immediately fully depreciated using bonus depreciation Backets Sold The project is expected to operate for 6 years, at the end of which the equipment will be sold for 40% of its original cost Bucket Price Fairways expects to have 20,640 buckets of balls per year at a price per bucket of 6 Fixed Com Costs other than taxes are 31.001 plus 15% of sales Variable Cast The project would have 5.566 which would be returned in year 6 NOWC Fairways will have a com 20% WACC Complete the following table as we illustrated in class and compute the project's NTV, IRR. MIRR. and Payback Make a recommendation regarding whether or not the company should take on the project or not. 31091 0,15 5566 0.2 0 1 2 1 4 5 6 Purchase Price Taxes Saved Increase in NOW Total Cashow Sales Cout Taxable income Tax Operating Cash Flow Selling Price Basis) Gain on Sale Tax After Tax Cash Flow Return of NOW Total Cash Flows NPV IRR MIRR Cumulative Payback