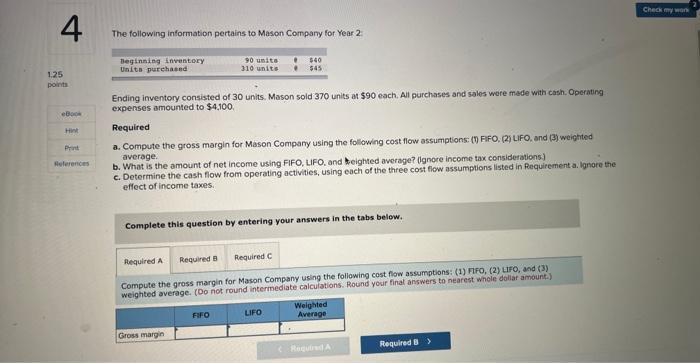

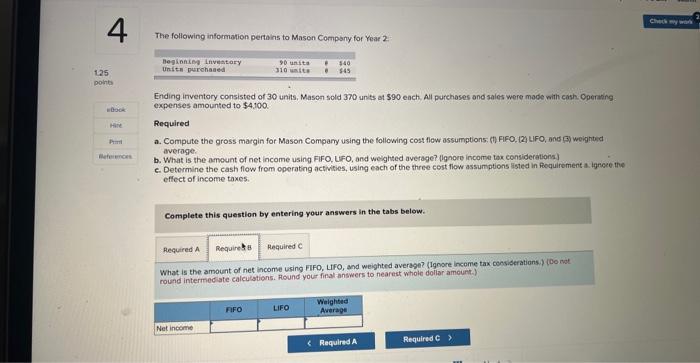

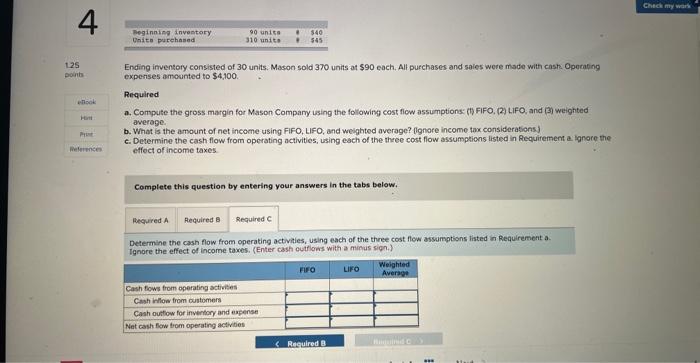

The following information pertains to Mason Company for Year 2 Ending inventory consisted of 30 units. Mason sold 370 units at 590 each, All purchases and sales wore made with cash. Operating expenses amounted to $4.100 Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (7) FFFO, (2) LIFO, and (3) weighted average. b. What is the amount of net income using FIFO, LFFO, and heighted average? (ignore income tax considerations) c. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement a. Ignore the effect of income taxes. Complete this question by entering your answers in the tabs below. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FFO, (2) LFFO, and (3) weiatited overage. (Do not round intermediate calculations. Round your final answers to nearest whele dollar amount.) The following information pertains to Mason Compary for Year 2 . Ending inventory consisted of 30 units, Masen sold 370 unts at $90 ench, All purchases and sales were mode with cash. Operaing: expenses amounted to $4,100 Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FFO, (2) UFO, and (a) weightid average. b. What is the amount of net income using FFF,UFO, and weighted average? (lignore income tax considerations) c. Determine the cash flow from operating activities, using each of the three cost flow assumptions isted in fiequirement as ignoce the effect of income taxes. Complete this question by entering your answers in the tabs below. What is the amount of net inconve using FIFO, LIFO, and weighted average? (Ignore income tax conviserations.) (Do not round intermed ate calculstions. lound your fifal answers to nearest whole dollar amount.) Ending inventory consisted of 30 units. Mason sold 370 units at $90 each. All purchases and sales were made with cash. Operating experises amounted to $4,100. Refquired a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted averase. b. What is the amount of net income using FIFO, LIFO, and weighted average? (ignore income tax considerations) c. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Reguirement a ignore the effect of income taxes. Complete this question by entering your answers in the tabs below. Determine the cash flow from operating activities, using each of the three cost flow assumptions listed in Requirement a. Ignore the effect of income taxes. (Enter cash outflons with a minus sign.)