Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information pertains to Plato Industries' inventory. The company keeps perpetual inventory records using the FIFO method and then uses the dollar-value LIFO

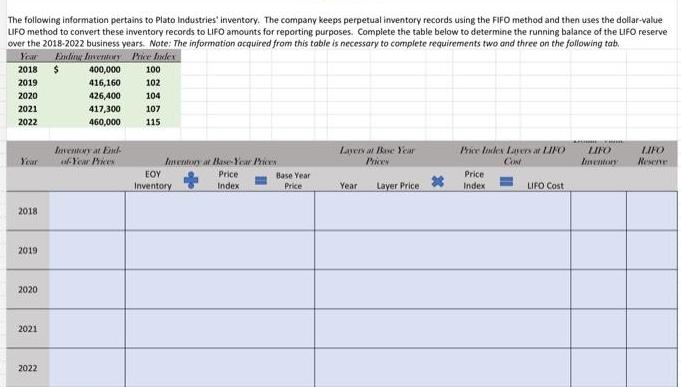

The following information pertains to Plato Industries' inventory. The company keeps perpetual inventory records using the FIFO method and then uses the dollar-value LIFO method to convert these inventory records to LIFO amounts for reporting purposes. Complete the table below to determine the running balance of the LIFO reserve over the 2018-2022 business years. Note: The information acquired from this table is necessary to complete requirements two and three on the following tab. Year Ending Inventory Price Index 2018 $ 400,000 2019 416,160 2020 426,400 2021 417,300 2022 460,000 Year 2018 2019 2020 2021 2022 Inventory at End of-Year Prices 100 102 104 107 115 Inventory at Base-Year Prices Price Index EOY Inventory Base Year Price Layers at Bose Year Prices Year Layer Price * Price Indes Layers at LIFO Cont Price Index LIFO Cost LIFO Inventory LIFO Resene

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the running balance of the LIFO reserve over the 20182022 business ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started