Question

Wayland custom woodworking is located at 12850 Old Highway 50, Glenbrook, Nevada, 89413. Phone number 775-555-9877. The owner is Mark Wayland. Wayland EIN is 91-7444533,

Wayland custom woodworking is located at 12850 Old Highway 50, Glenbrook, Nevada, 89413. Phone number 775-555-9877. The owner is Mark Wayland. Wayland EIN is 91-7444533, and the Nevada employer account number is E6462582020-6. Wayland has determined it will pay theri employees on a semimonthly basis.

Employees are paid for the following holidays:

Thanksgiving November 26-27.

Christmas December 24-25th.

Employees info: All employees are hired October 1st.

Anthony Chinson - $48,000/Year plus commission exempt employee. Contribute 3 percent to a 401(k), and health insurance is $50 per pay period.

Mark Wayland - $85,000/year exempt employee. Contribute 6 percent to a 401(k), and health insurance is $75 per pay period.

Sylvia Peppinico - $ $58,500/year exempt employee. Contribute 6% to a 401(k), and health insurance is $75 per pay period.

Stevon Cooper - $62,000/year nonexempt employee. Contribute 4 percent to a 401(k), and health insurance is $50 per pay period.

Leonard Hissop - $51,500/year nonexempt. Contribute 3 percent to a 401(k), and health insurance is $75 per pay period.

Student - $42,000/year nonexempt. Contribute 3 percent to a 401(k), and health insurance is $50 per pay period.

October 15 is the end of the first pay period for the month of October. Employee pay will be disbursed on October 19, 2020. Any time worked in excess of 88 hours during this pay period is considered overtime for nonexempt employees. Remember that the employees are paid on a semimonthly basis.

Required:

Calculate hourly rates, regular and overtime. Amount of Commission pay is provided. Complete the Payroll Register for October 15. Round wages to five decimal points and all other final answers to two decimal points. Update the Employees' Earning Records for the period's pay and update the YTD amount. Insurance qualifies for Section 125 treatment.

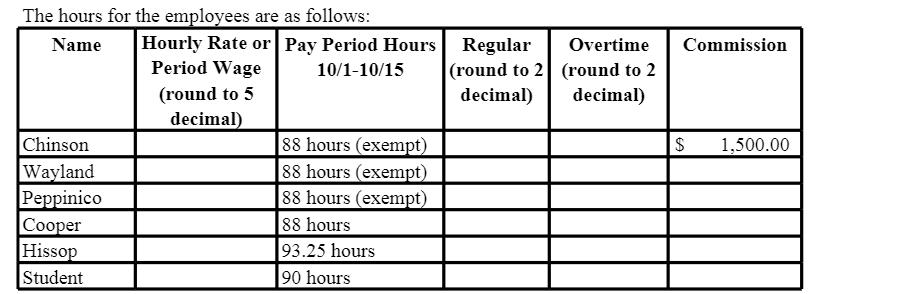

The hours for the employees are as follows: Name Chinson Wayland Peppinico Cooper Hissop Student Hourly Rate or Pay Period Hours Period Wage 10/1-10/15 (round to 5 decimal) 88 hours (exempt) 88 hours (exempt) 88 hours (exempt) 88 hours 93.25 hours 90 hours Regular Overtime (round to 2 (round to 2 decimal) decimal) Commission $ 1,500.00

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the payroll for October 15 we need to determine the hourly rates regular and overtime wages and update the employees earning records and yeartodate YTD amounts Lets go through each step f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started