Answered step by step

Verified Expert Solution

Question

1 Approved Answer

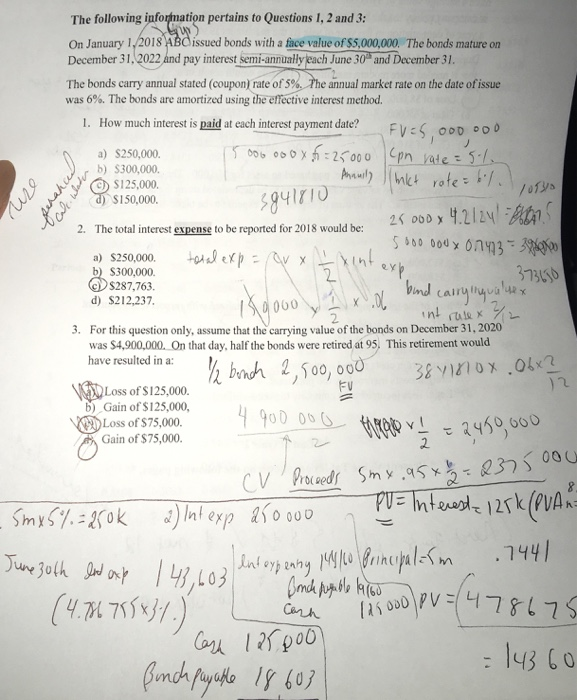

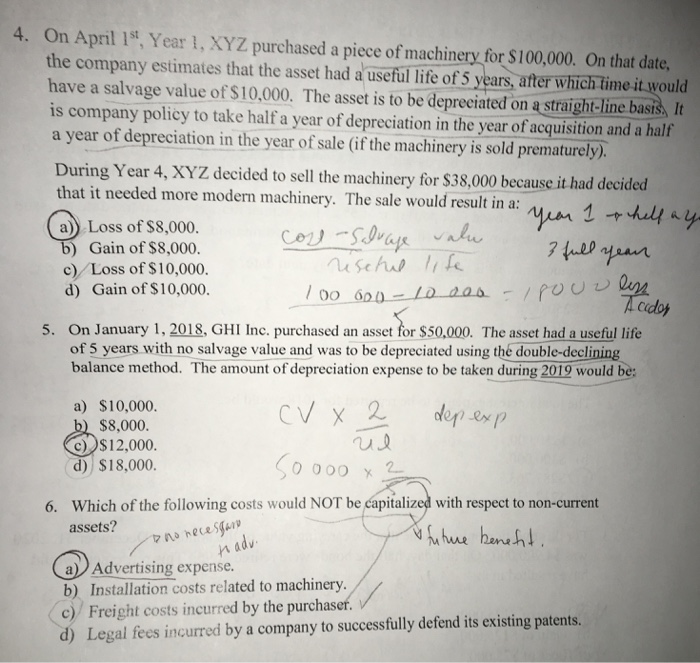

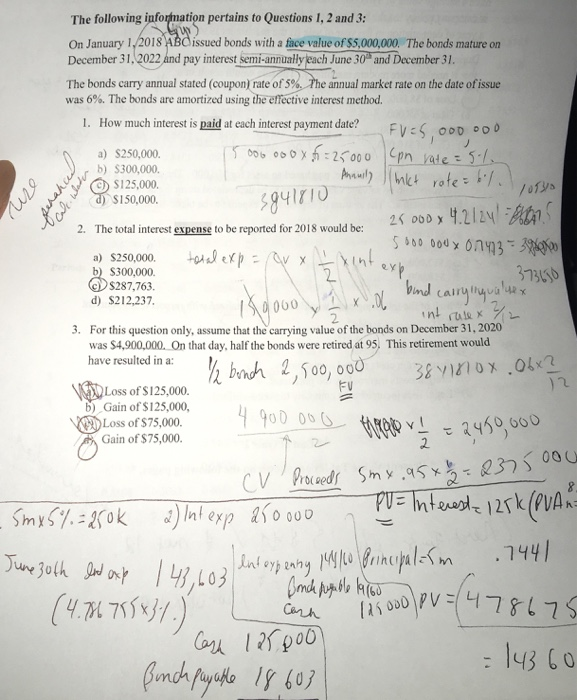

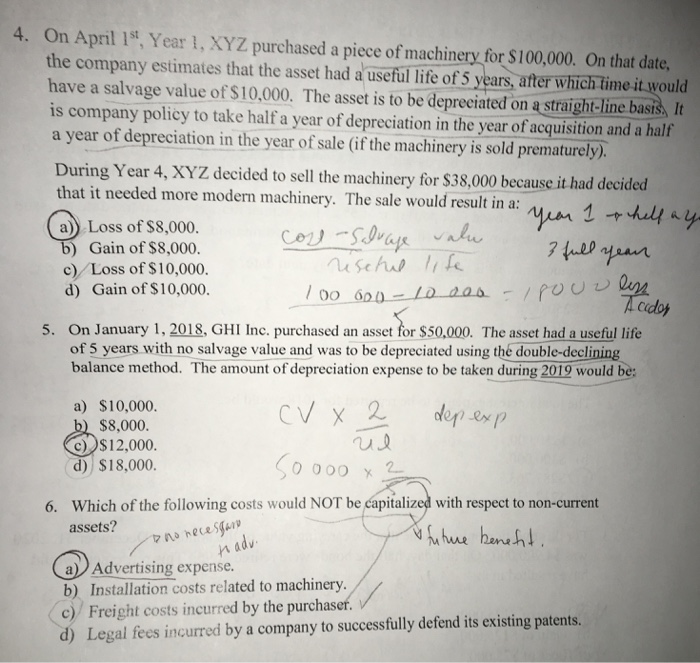

The following information pertains to Questions 1, 2 and 3: On January 1,/2018 ABCissued bonds with a face value of $5,000,000. The bonds mature on

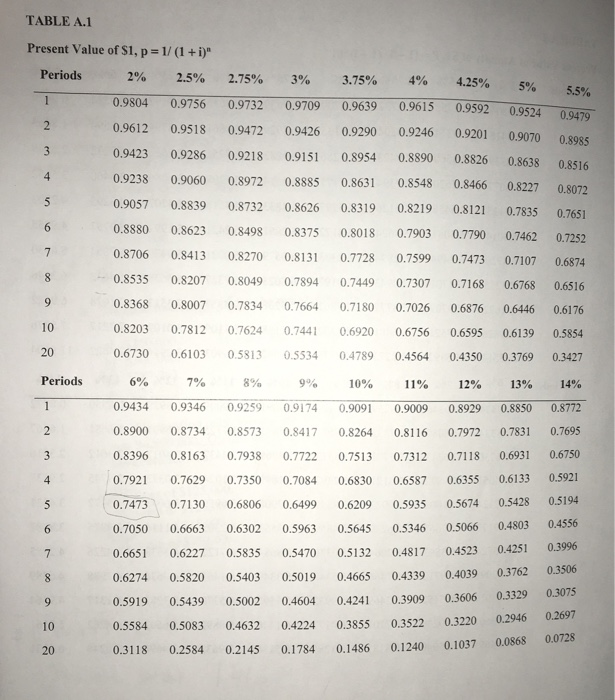

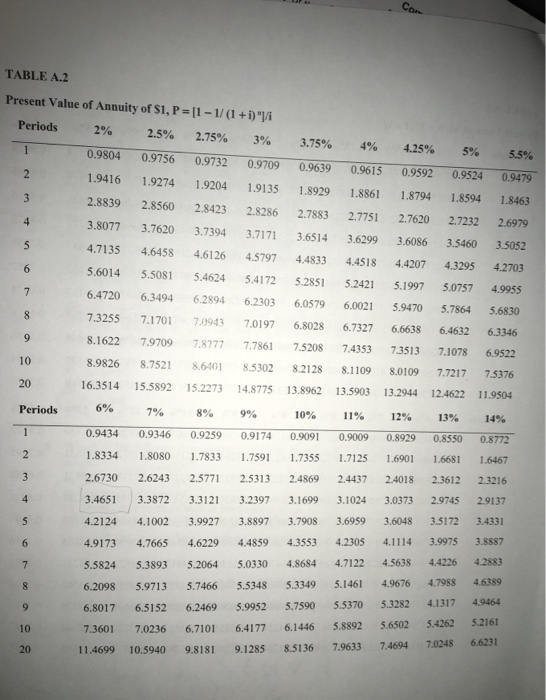

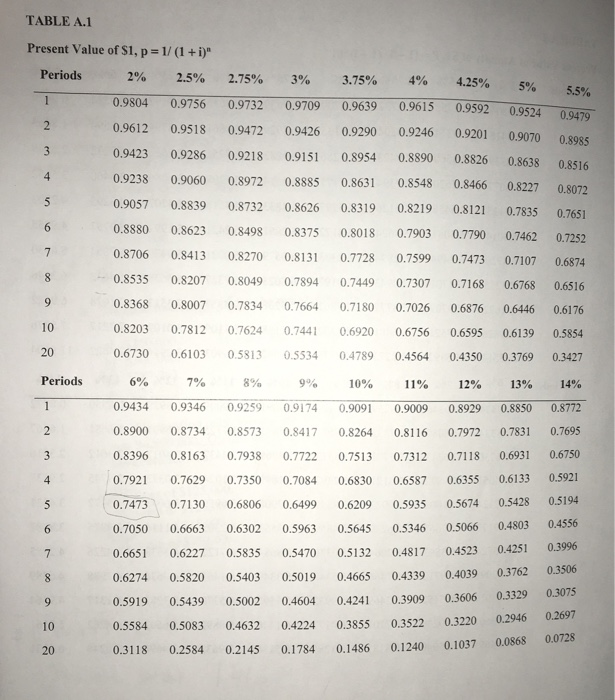

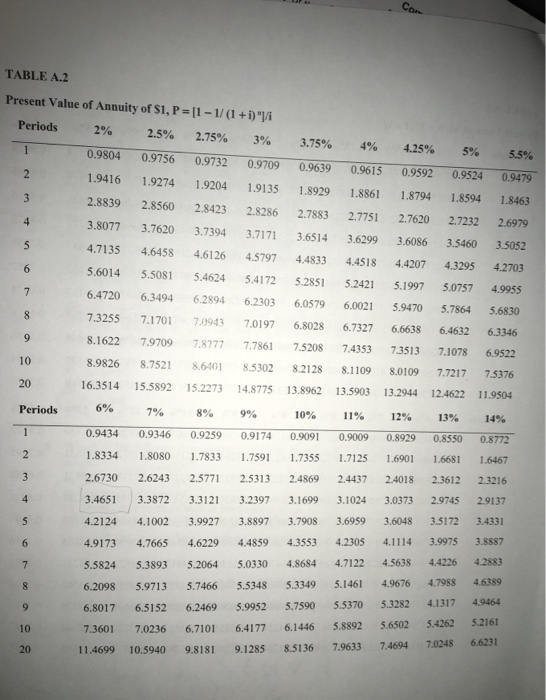

The following information pertains to Questions 1, 2 and 3: On January 1,/2018 ABCissued bonds with a face value of $5,000,000. The bonds mature on December 31.2022 and pay interest Semi-annunly rah June 30 and Decmber 31. The bonds carry annual stated (coupon! rate of 5%.-The annual market rate on the date ofissue was 6%. The bonds are amortized using theemective interest method. 1. How much interest is paid at each interest payment date? a) S250,000. b) S300,000. S125,000 S150,000. 2. The total interest expense to be reported for 2018 would be: b) S300,000. $287,763 d) S212,237 2. For this question only, assume that the carrying value of the bonds on December 31, 2020 was $4,900,000. On that day, half the bonds were retired at 95. This retirement would 3. 2,500, 00 900 00 have resulted in a: abwh Loss of$125,000, b)Gain of $125,000, Loss of $75,000 Gain of $75,000 2460,600 2 alim : 143 C0 TABLE A1 Present Value of Si, p-1/ (1 + i)n Periods 2% 2.5% 2.75% 3% 3.75% 4% 4.25% 5% 0.9804 0.9756 0.9732 09709 0.9639 0 0.9612 0.9518 0.9472 0.9426 0.9290 0.9246 0.9201 0.9070 0.9423 0.9286 0.9218 0.9151 0.8954 0.8890 0.8826 0.8638 0.9238 0.9060 0.8972 0.8885 0.8631 0.8548 0.8466 0.8227 0.8072 0.9057 0.8839 0.8732 0.8626 0.8319 0.8219 0.8121 0.7835 0.7651 0.8880 0.8623 0.898 0.8375 0.8018 0.7903 0.7790 0.7462 0.7252 0.8706 0.8413 0.8270 0.8131 0.7728 0.7599 0.7473 0.7107 0.6874 0.8535 0.8207 0.8049 0.7894 0.7449 0.7307 0.7168 0.6768 0.6516 0.8368 0.8007 0.7834 0.7664 0.7180 0.7026 0.6876 0.6446 0.6176 0.8203 0.7812 0.7624 0.7441 0.6920 0.6756 0.6595 0.6139 0.5854 0.6730 0.6103 0.5813 0.5534 0.4789 0.4564 0.4350 0.3769 0.3427 5.5% 0.9615 0.9592 0.9524 0.9479 0.8985 4 10 20 Periods 6% 7% 8% 9% 10% 11% 12% 13% 14% 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 5 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.4803 0.4556 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.4251 0.3996 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.0728 10 20 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 0.0868 TABLE A2 Present Value of Annuity of S1, P = [1-1/ (1 + i)'li Periods 2% 2.5% 2.75% 3% 3.75% 4% 4.25% 5% 5.5% 0.9804 0.9756 0.9732 0.9709 0.9639 09615 0.9592 0.9524 09479 9416 1.9274 1.9204 1.9135 1.8929 1.8861 1.8794 1.8594 1.8463 2.8839 2.8560 2.8423 2.8286 2.7883 2.7751 2.7620 2.7232 2.6979 3.8077 3.7620 3.7394 3.7171 3.6514 3.6299 3.6086 3.5460 3.5052 4.7135 4.6458 4.6126 4.5797 4.4833 4.4518 4.4207 4.3295 4.2703 5.6014 5.508 5.4624 5.4172 5.2851 5.2421 5.1997 5.07574.9955 6.4720 6.3494 6.2894 6.2303 6.0579 6.0021 5.9470 5.7864 5.6830 7.3255 7.1701 7.0943 7.0197 6.8028 6.7327 6.6638 6.4632 6.3346 8.1622 7.9709 7.8777 7.81 7.5208 7.4353 7.3513 7.1078 69522 8.9826 8.7521 .6401 8.5302 8.2128 8.109 8.0109 7.7217 75376 16.3514 15.5892 15.2273 148775 13.8962 13,5903 13.2944 12.4622 119504 4 10 20 Periods 6% 10% 11% 12% 13% 14% 0.9434 0.9346 09259 0.9174 0.9091 09009 0.8929 0.8550 0.8772 1.8334 1.8080 1.7833 17591 35 1.7125 1.6901 1.6681 1.6467 2.6730 2.6243 2.5771 2.5313 2.4869 24437 2.4018 2.3612 2.3216 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 6.8017 6.5152 6.2469 .9952 5.7590 5.5370 5.3282 4.1317 49464 7.3601 7.0236 6.7101 64177 6.1446 5.8892 5.6502 54262 52161 11.4699 10.5940 9.8181 9.1285 85136 7.9633 7.4694 7.0248 6.6231 7% 8% 9% 10 20

The following information pertains to Questions 1, 2 and 3: On January 1,/2018 ABCissued bonds with a face value of $5,000,000. The bonds mature on December 31.2022 and pay interest Semi-annunly rah June 30 and Decmber 31. The bonds carry annual stated (coupon! rate of 5%.-The annual market rate on the date ofissue was 6%. The bonds are amortized using theemective interest method. 1. How much interest is paid at each interest payment date? a) S250,000. b) S300,000. S125,000 S150,000. 2. The total interest expense to be reported for 2018 would be: b) S300,000. $287,763 d) S212,237 2. For this question only, assume that the carrying value of the bonds on December 31, 2020 was $4,900,000. On that day, half the bonds were retired at 95. This retirement would 3. 2,500, 00 900 00 have resulted in a: abwh Loss of$125,000, b)Gain of $125,000, Loss of $75,000 Gain of $75,000 2460,600 2 alim : 143 C0 TABLE A1 Present Value of Si, p-1/ (1 + i)n Periods 2% 2.5% 2.75% 3% 3.75% 4% 4.25% 5% 0.9804 0.9756 0.9732 09709 0.9639 0 0.9612 0.9518 0.9472 0.9426 0.9290 0.9246 0.9201 0.9070 0.9423 0.9286 0.9218 0.9151 0.8954 0.8890 0.8826 0.8638 0.9238 0.9060 0.8972 0.8885 0.8631 0.8548 0.8466 0.8227 0.8072 0.9057 0.8839 0.8732 0.8626 0.8319 0.8219 0.8121 0.7835 0.7651 0.8880 0.8623 0.898 0.8375 0.8018 0.7903 0.7790 0.7462 0.7252 0.8706 0.8413 0.8270 0.8131 0.7728 0.7599 0.7473 0.7107 0.6874 0.8535 0.8207 0.8049 0.7894 0.7449 0.7307 0.7168 0.6768 0.6516 0.8368 0.8007 0.7834 0.7664 0.7180 0.7026 0.6876 0.6446 0.6176 0.8203 0.7812 0.7624 0.7441 0.6920 0.6756 0.6595 0.6139 0.5854 0.6730 0.6103 0.5813 0.5534 0.4789 0.4564 0.4350 0.3769 0.3427 5.5% 0.9615 0.9592 0.9524 0.9479 0.8985 4 10 20 Periods 6% 7% 8% 9% 10% 11% 12% 13% 14% 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 5 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.4803 0.4556 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.4251 0.3996 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.0728 10 20 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 0.0868 TABLE A2 Present Value of Annuity of S1, P = [1-1/ (1 + i)'li Periods 2% 2.5% 2.75% 3% 3.75% 4% 4.25% 5% 5.5% 0.9804 0.9756 0.9732 0.9709 0.9639 09615 0.9592 0.9524 09479 9416 1.9274 1.9204 1.9135 1.8929 1.8861 1.8794 1.8594 1.8463 2.8839 2.8560 2.8423 2.8286 2.7883 2.7751 2.7620 2.7232 2.6979 3.8077 3.7620 3.7394 3.7171 3.6514 3.6299 3.6086 3.5460 3.5052 4.7135 4.6458 4.6126 4.5797 4.4833 4.4518 4.4207 4.3295 4.2703 5.6014 5.508 5.4624 5.4172 5.2851 5.2421 5.1997 5.07574.9955 6.4720 6.3494 6.2894 6.2303 6.0579 6.0021 5.9470 5.7864 5.6830 7.3255 7.1701 7.0943 7.0197 6.8028 6.7327 6.6638 6.4632 6.3346 8.1622 7.9709 7.8777 7.81 7.5208 7.4353 7.3513 7.1078 69522 8.9826 8.7521 .6401 8.5302 8.2128 8.109 8.0109 7.7217 75376 16.3514 15.5892 15.2273 148775 13.8962 13,5903 13.2944 12.4622 119504 4 10 20 Periods 6% 10% 11% 12% 13% 14% 0.9434 0.9346 09259 0.9174 0.9091 09009 0.8929 0.8550 0.8772 1.8334 1.8080 1.7833 17591 35 1.7125 1.6901 1.6681 1.6467 2.6730 2.6243 2.5771 2.5313 2.4869 24437 2.4018 2.3612 2.3216 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 6.8017 6.5152 6.2469 .9952 5.7590 5.5370 5.3282 4.1317 49464 7.3601 7.0236 6.7101 64177 6.1446 5.8892 5.6502 54262 52161 11.4699 10.5940 9.8181 9.1285 85136 7.9633 7.4694 7.0248 6.6231 7% 8% 9% 10 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started