Question

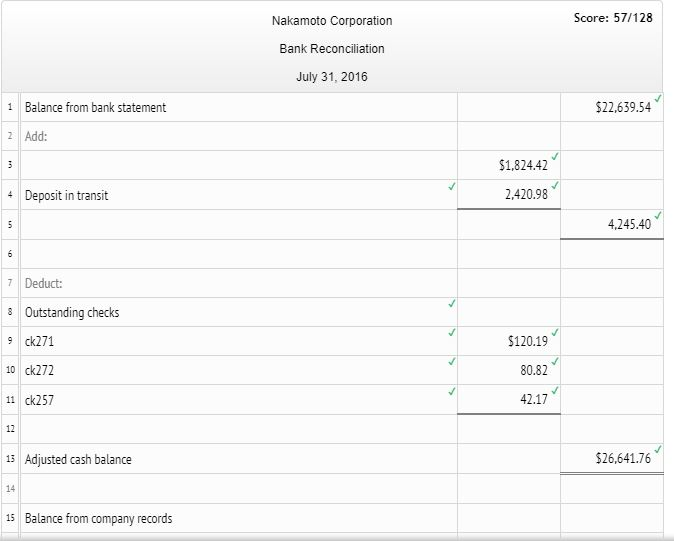

The following information pertains to the Cash account of Nakamoto Corporation for the month of July 2016: Bank Statement Balance July 31 $22,639.54 Service charge

The following information pertains to the Cash account of Nakamoto Corporation for the month of July 2016:

| Bank Statement | |

| Balance July 31 | $22,639.54 |

| Service charge (Miscellaneous expense) for July | 15.00 |

| NSF check returned with July bank statement | 184.50 |

| Note receivable collected by bank (not previously recorded on the books) | 2,000.00 |

| Interest on note collected by bank (not previously recorded on the books) | 60.00 |

| Books | ||

| Balance July 31 | ? | |

| Cash on hand awaiting deposit | 1,824.42 | |

| Outstanding checks: | ||

| #257 | $42.17 | |

| #271 | 120.19 | |

| #272 | 80.82 | |

| Deposit in transit | $2,420.98 | |

| Required: | |

| 1. | Prepare a bank reconciliation to determine Nakamotos adjusted cash balance on July 31. |

| 2. | Next Level Determine Nakamotos unadjusted cash balance (per books) on July 31. |

| 3. | Prepare the adjusting entries necessary to bring Nakamotos cash account balance up to date on July 31. |

Labels:

Outstanding checks

Amount Descriptions:

Ck257

Ck271

Ck272

Adjusted cash

balance

Cash on hand awaiting deposit

Deposit in transit

Interest on note receivable

Note collected by bank

NSF checks

Service charge (Miscellaneous expense)

Prepare the adjusting entries necessary to bring Nakamotos cash account balance up to date on July 31.

GENERAL JOURNAL

| DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | |

|---|---|---|---|---|---|

| 1 |

|

|

|

|

|

| 2 |

|

|

|

|

|

| 3 |

|

|

|

|

|

| 4 |

|

|

|

|

|

| 5 |

|

|

|

|

|

| 6 |

|

|

|

|

|

Determine Nakamotos unadjusted cash balance (per books) on July 31.

Nakamotos unadjusted cash balance (per books) on July 31 is $ _____________.

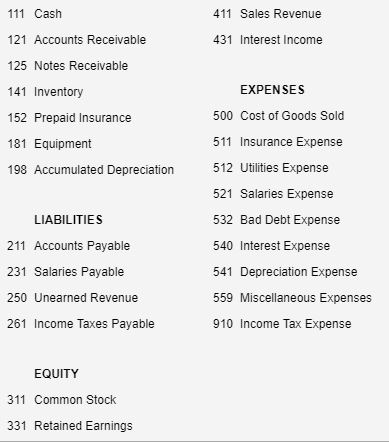

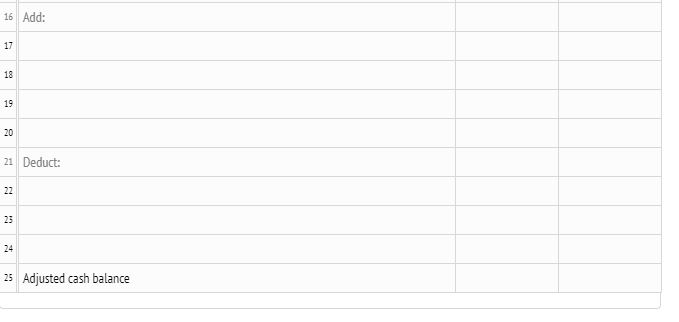

111 Cash 121 Accounts Receivable 125 Notes Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 198 Accumulated Depreciation 411 Sales Revenue 431 Interest Income EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 521 Salaries Expense 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings Score: 57/128 Nakamoto Corporation Bank Reconciliation July 31, 2016 1Balance from bank statement $22.639.54 2 Add: $1,824.42 4Deposit in transit 2.420.98 4.245.40 7 Deduct: 8Outstanding checks 9 ck271 10 ck272 11ck257 $120.19 80.82 42.17 12 Adjusted cash balance 26,641.76 13 14 15 Balance from company records 16 Add: 17 18 19 20 21 Deduct: 23 24 25 Adjusted cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started