Answered step by step

Verified Expert Solution

Question

1 Approved Answer

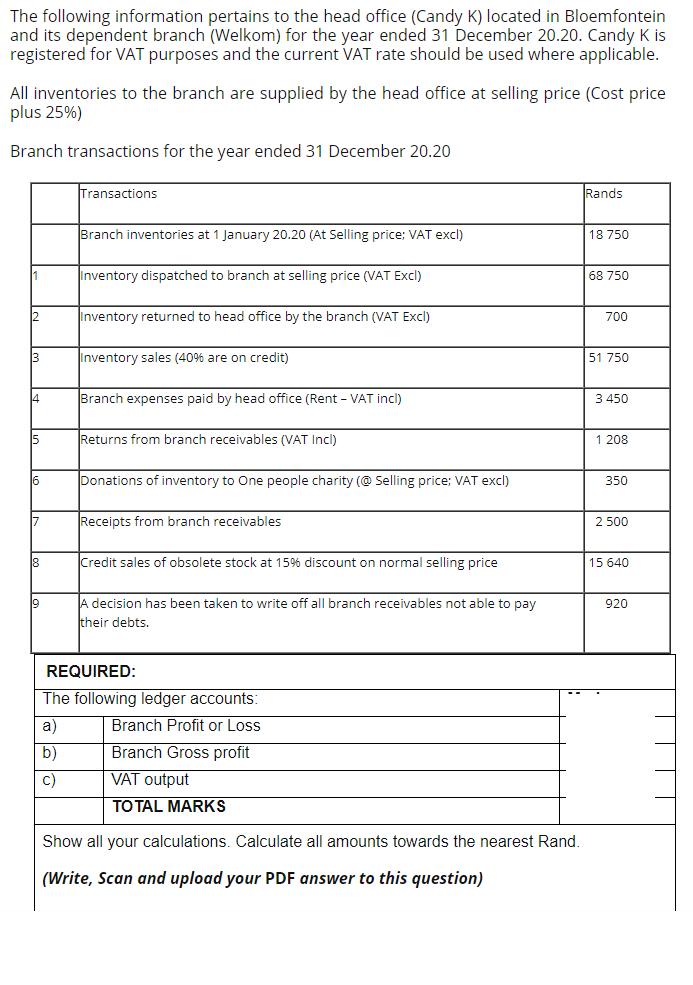

The following information pertains to the head office (Candy K) located in Bloemfontein and its dependent branch (Welkom) for the year ended 31 December

The following information pertains to the head office (Candy K) located in Bloemfontein and its dependent branch (Welkom) for the year ended 31 December 20.20. Candy K is registered for VAT purposes and the current VAT rate should be used where applicable. All inventories to the branch are supplied by the head office at selling price (Cost price plus 25%) Branch transactions for the year ended 31 December 20.20 1 12 3 14 15 6 17 18 19 Transactions Branch inventories at 1 January 20.20 (At Selling price; VAT excl) Inventory dispatched to branch at selling price (VAT Excl) Inventory returned to head office by the branch (VAT Excl) Inventory sales (40% are on credit) Branch expenses paid by head office (Rent - VAT incl) Returns from branch receivables (VAT Incl) Donations of inventory to One people charity (@ Selling price; VAT excl) Receipts from branch receivables Credit sales of obsolete stock at 15% discount on normal selling price A decision has been taken to write off all branch receivables not able to pay their debts. REQUIRED: The following ledger accounts: a) Branch Profit or Loss b) Branch Gross profit c) VAT output TOTAL MARKS Show all your calculations. Calculate all amounts towards the nearest Rand. (Write, Scan and upload your PDF answer to this question) Rands 18 750 68 750 700 51 750 3 450 1 208 350 2 500 15 640 920

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Branch Profit or Loss Sales 51 750 Less Cost of goo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started