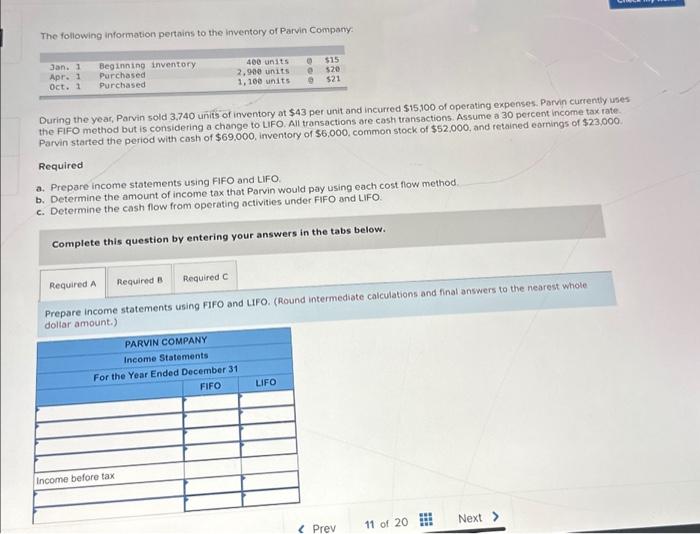

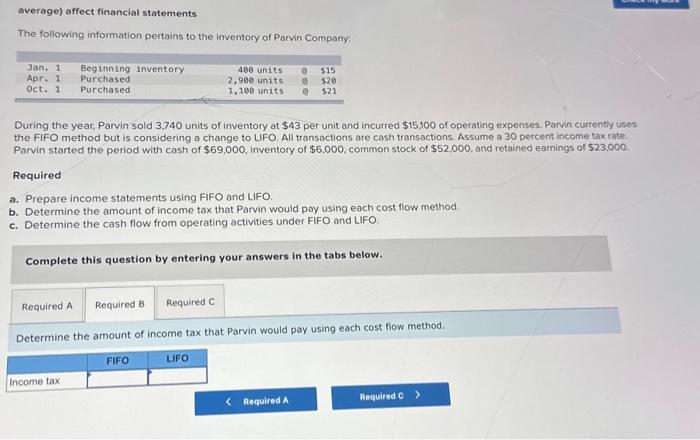

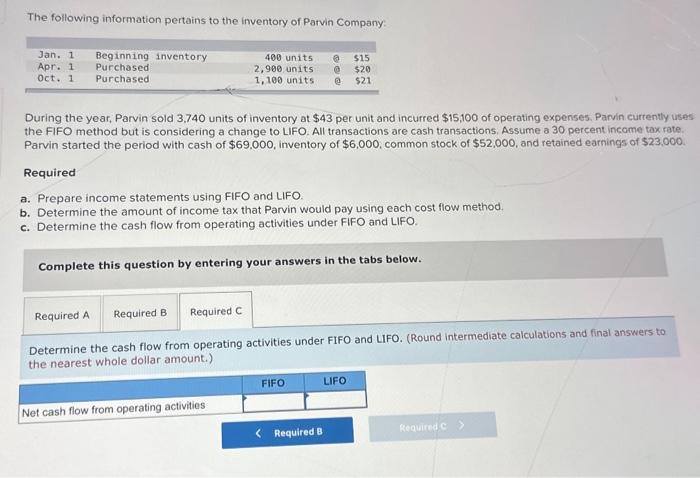

The following information pertains to the inventory of Parvin Company. During the year, Parvin sold 3,740 units of inventory at $43 per unit and incurred $15,100 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $69,000, inventory of $6,000. common stock of $52.000, and retained earnings of $23,000. Required a. Prepare income statements using FIFO and LIFO. b. Determine the amount of income tax that Parvin would pay using each cost flow method. c. Determine the cash flow from operating activities under FIFO and L.IFO. Complete this question by entering your answers in the tabs below. Prepare income statements using FIFO and LFO. (Round intermediate calculations and final answers to the nearest whole Anllar amount.) average) affect financial statements The following information pertains to the inventory of Parvin Company. During the year, Parvin sold 3,740 units of inventory at $43 per unit and incurred $15,100 of operating expenses. Parvin currentiy uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $69,000. inventory of $6,000, common stock of $52,000, and retained earnings of $23,000. Required a. Prepare income statements using FIFO and LIFO. b. Determine the amount of income tax that Parvin would pay using each cost flow method. c. Determine the cash flow from operating activities under FIFO and LIFO. Complete this question by entering your answers in the tabs below. Determine the amount of income tax that Parvin would pay using each cost flow method. The following information pertains to the inventory of Parvin Company: During the year, Parvin sold 3,740 units of inventory at $43 per unit and incurred $15,100 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $69,000, inventory of $6,000, common stock of $52,000, and retained earnings of $23,000. Required a. Prepare income statements using FIFO and LIFO. b. Determine the amount of income tax that Parvin would pay using each cost flow method. c. Determine the cash flow from operating activities under FIFO and LIFO. Complete this question by entering your answers in the tabs below. Determine the cash flow from operating activities under FIFO and LIFO. (Round intermediate calculations and final answers to the nearest whole dollar amount.)