Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information pertains to the medical practice of Larry Sharp, M.D., Inc. Based on the transactions recorded in Part 2, prepare an Income

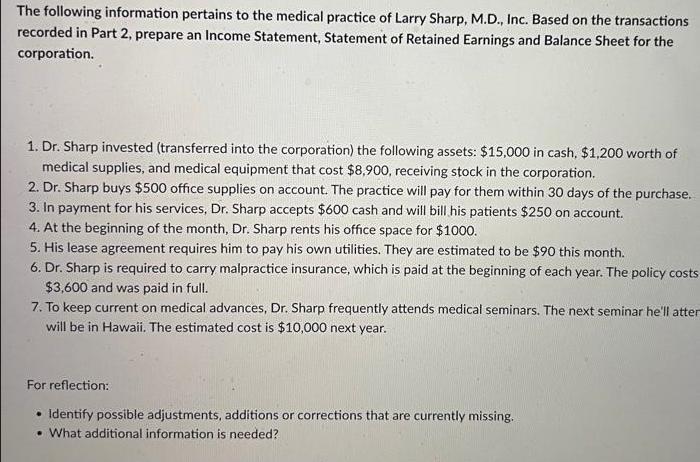

The following information pertains to the medical practice of Larry Sharp, M.D., Inc. Based on the transactions recorded in Part 2, prepare an Income Statement, Statement of Retained Earnings and Balance Sheet for the corporation. 1. Dr. Sharp invested (transferred into the corporation) the following assets: $15,000 in cash, $1,200 worth of medical supplies, and medical equipment that cost $8,900, receiving stock in the corporation. 2. Dr. Sharp buys $500 office supplies on account. The practice will pay for them within 30 days of the purchase. 3. In payment for his services, Dr. Sharp accepts $600 cash and will bill his patients $250 on account. 4. At the beginning of the month, Dr. Sharp rents his office space for $1000. 5. His lease agreement requires him to pay his own utilities. They are estimated to be $90 this month. 6. Dr. Sharp is required to carry malpractice insurance, which is paid at the beginning of each year. The policy costs $3,600 and was paid in full. 7. To keep current on medical advances, Dr. Sharp frequently attends medical seminars. The next seminar he'll atter will be in Hawaii. The estimated cost is $10,000 next year. For reflection: Identify possible adjustments, additions or corrections that are currently missing. What additional information is needed?

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part 1 Adjustments additions or corrections The company should record the cash and stock inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started