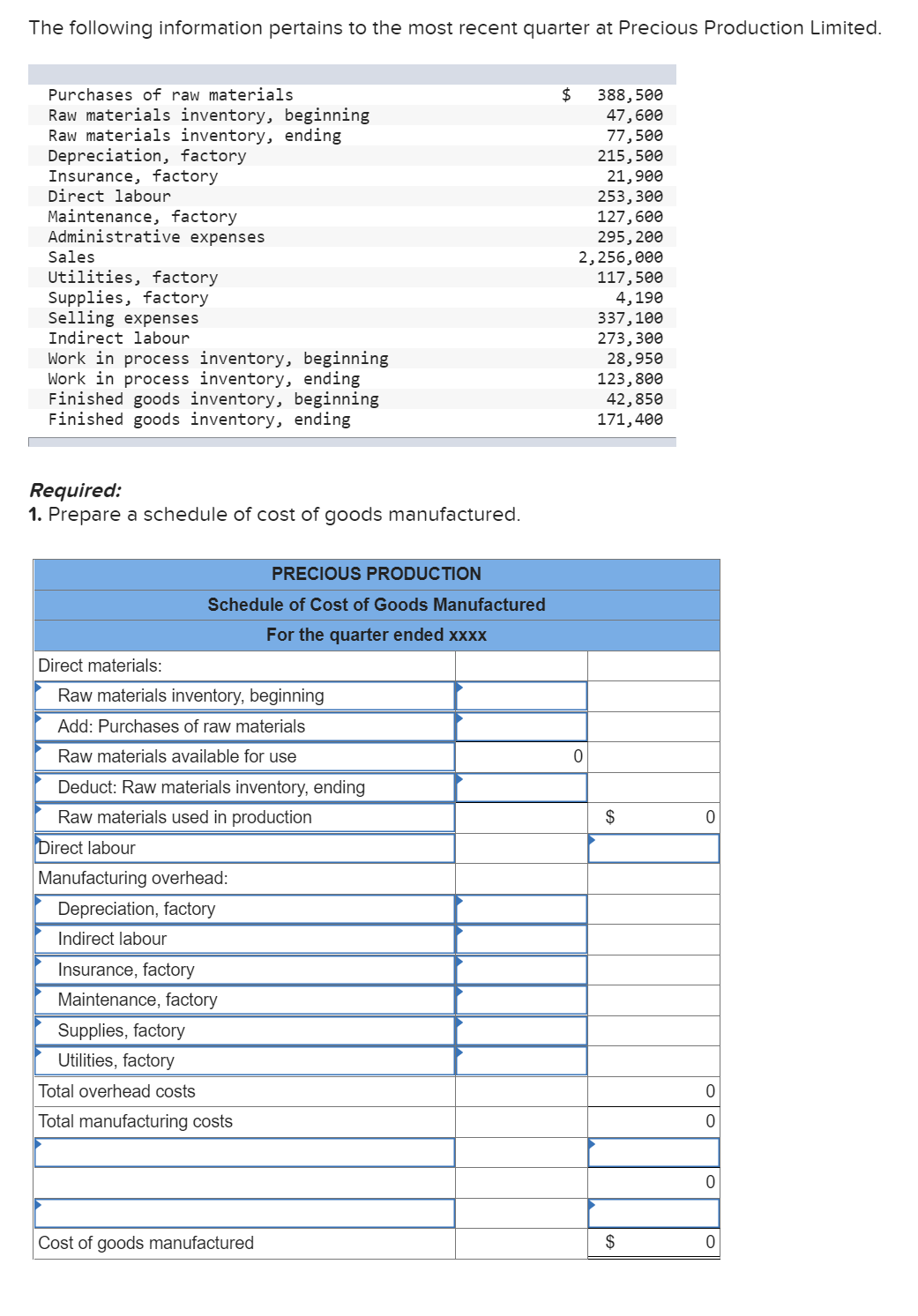

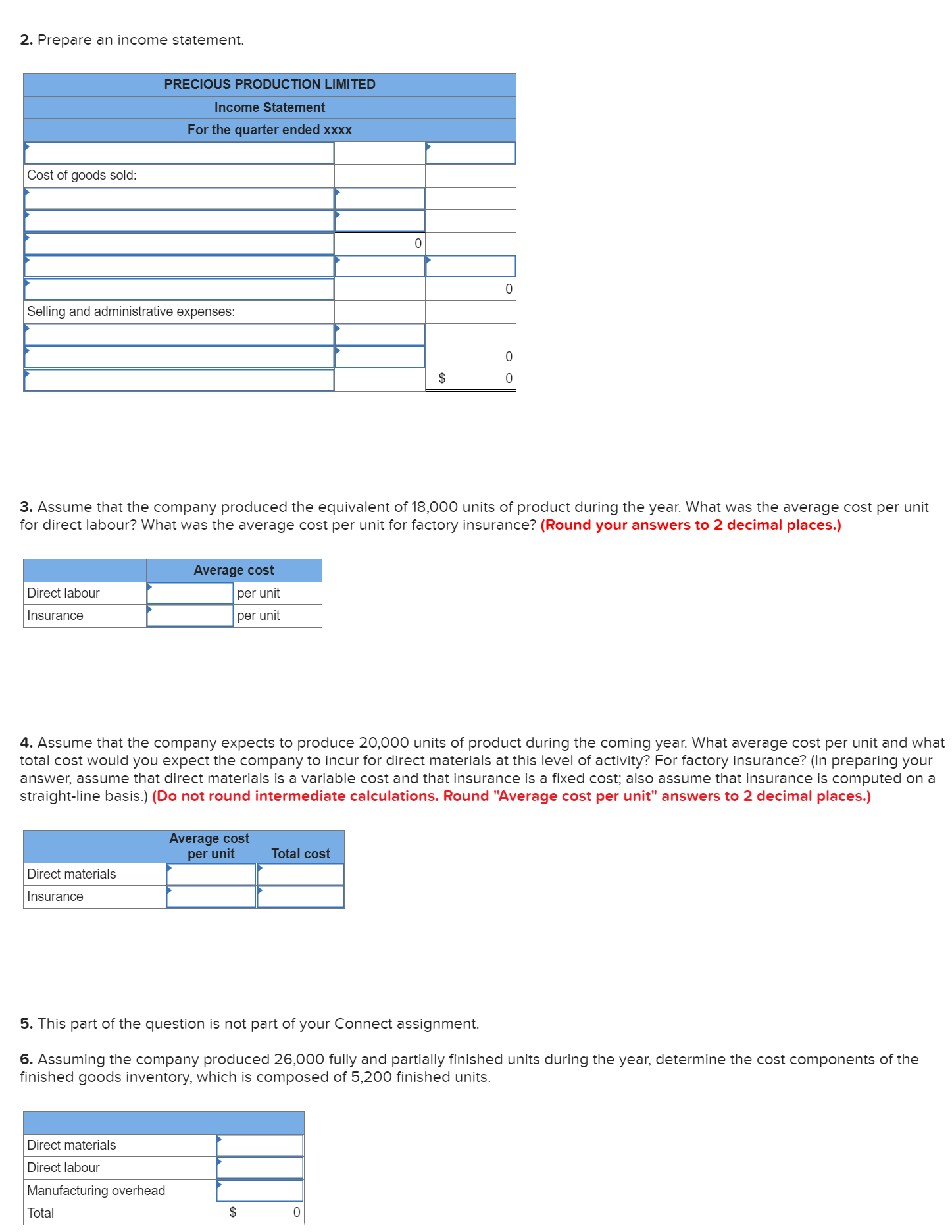

The following information pertains to the most recent quarter at Precious Production Limited. Purchases oF raw materials $ 388,569 Raw materials inventory, beginning 47,669 Raw materials inventory, ending 77,569 Depreciation, Factory 215,599 Insurance, Factory 21,969 Direct labour 253,399 Maintenance, Factory 127,669 Administrative expenses 295,299 Sales 2,259,999 Utilities, Factory 117,599 Supplies, Factory 4,199 Selling expenses 337,169 Indirect labour 273,369 Work in process inventory, beginning 28,959 work in process inventory, ending 123,869 Finished goods inventory, beginning 42,859 Finished goods inventory, ending 171,469 | Required: 1. Prepare a schedule of cost of goods manufactured. Direct materials: Raw materials inventory, beginning _ Add: Purchases of raw materials _ Raw materials available for use 0 Deduct: Raw materials inventory, ending _ Raw materials used in production ___ Manufacturing overhead: _ _ _ _ Supplies, factory Utilities, factory _ '69 O Total overhead oosts Total manufacturing costs |l |l Cost of goods manufactured $ 0 2. Prepare an income statement. Cost of goods sold: Selling and administrative expenses: 3. Assume that the company produced the equivalent of18,000 units of product during the year. What was the average cost per unit for direct labour? What was the average cost per unit for factory insurance? (Round your answers to 2 decimal places.) Direct labour per unit Insurance per unit 4. Assume that the company expects to produce 20,000 units of product during the coming year. What average cost per unit and what total cost would you expect the company to incur for direct materials at this level of activity? For factory insurance? (In preparing your answer, assume that direct materials is a variable cost and that insurance is a fixed cost; also assume that insurance is computed on a straight-line basis.) (Do not round intermediate calculations. Round "Average cost per unit" answers to 2 decimal places.) Direct materials Insurance 5. This part of the question is not part of your Connect assignment. 6. Assuming the company produced 26,000 fully and partially finished units during the year, determine the cost components of the finished goods inventory, which is composed of 5,200 finished units. Direct materials Direct labour Manufacturing overhead Total $