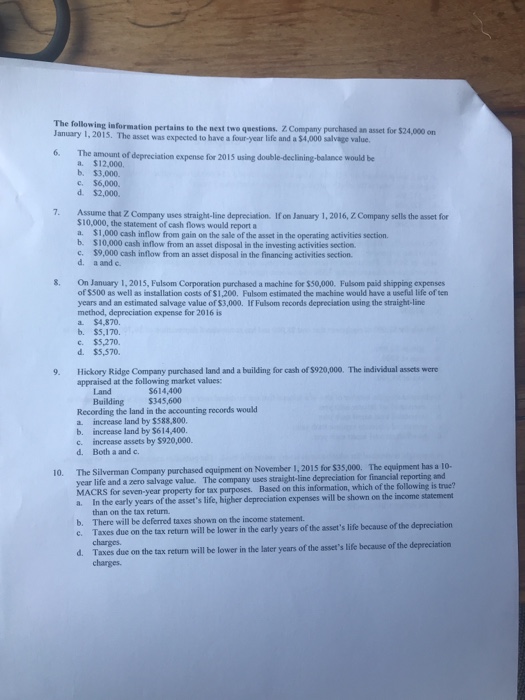

The following information pertains to the nest twe questions January 1, 2015. The . Z Company purchased an asset for $24,000 on asset was expected to have a four-year life and a $4,000 salvage value. 6. The amount of depreciation expense for 2015 using double-declining-balance would be a. $12,000. b. $3,000. c. $6,000. d. $2,000. 7. Assume that Z Company uses straigh-line depreciation. If on January 1, 2016, Z Company sells the asset for $10,000, the statement of cash flows would reporta a. $1,000 cash inflow from gain on the sale of the asset in the operating activities section. b. $10,000 cash inflow from an asset disposal in the investing activities section c. $9,000 cash inflow from an asset disposal in the financing activities section. d. a and c. 8 On January 1, 2015, Fulsorn Corporation purchased a machine for SS0000. Fulsom paid shipping expenses of $300 as well as installation costs of $1,200. Fulsom estimated the machine would have a useful life of ten years and an estimated salvage value of $3,000. If Fulsom records depreciation using the straight-line method, depreciation expense for 2016 is a $4,870. b. $5,170. c. $5,270. d. $5,570. 9 Hickory Ridge Company purchased land and a building for cash of $920,000. The individual assets were appraised at the following market values: Land $614,400 $345,600 Building Recording the land in the accounting records would a. increase land by $588,800. b. increase land by $614,400. c. increase assets by $920,000. d. Both a and c. 10. The Silverman Company parchased equipment on November I, 2015 for $35,000. The equipment has a 10- for tax purposes. Based on this information, which of the following is true? y years of the asset's life, higher deprociation expenses will be shown on the income statement value. The company uses straight-line depreciation for financial reporting and year life and a zero salvage MACRS for seven-year property a. In the earl than on the tax return There will be deferred taxes shown on the income statement Taxes due on the tax return will be lower charges b. c. in the early years of the asset's life because of the depreciation d. Taxes due on the tax return will be lower in the later years of the asset's life because of the deprecistion charges