Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information pertains to Trenton Glass Works for the year just ended. Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour

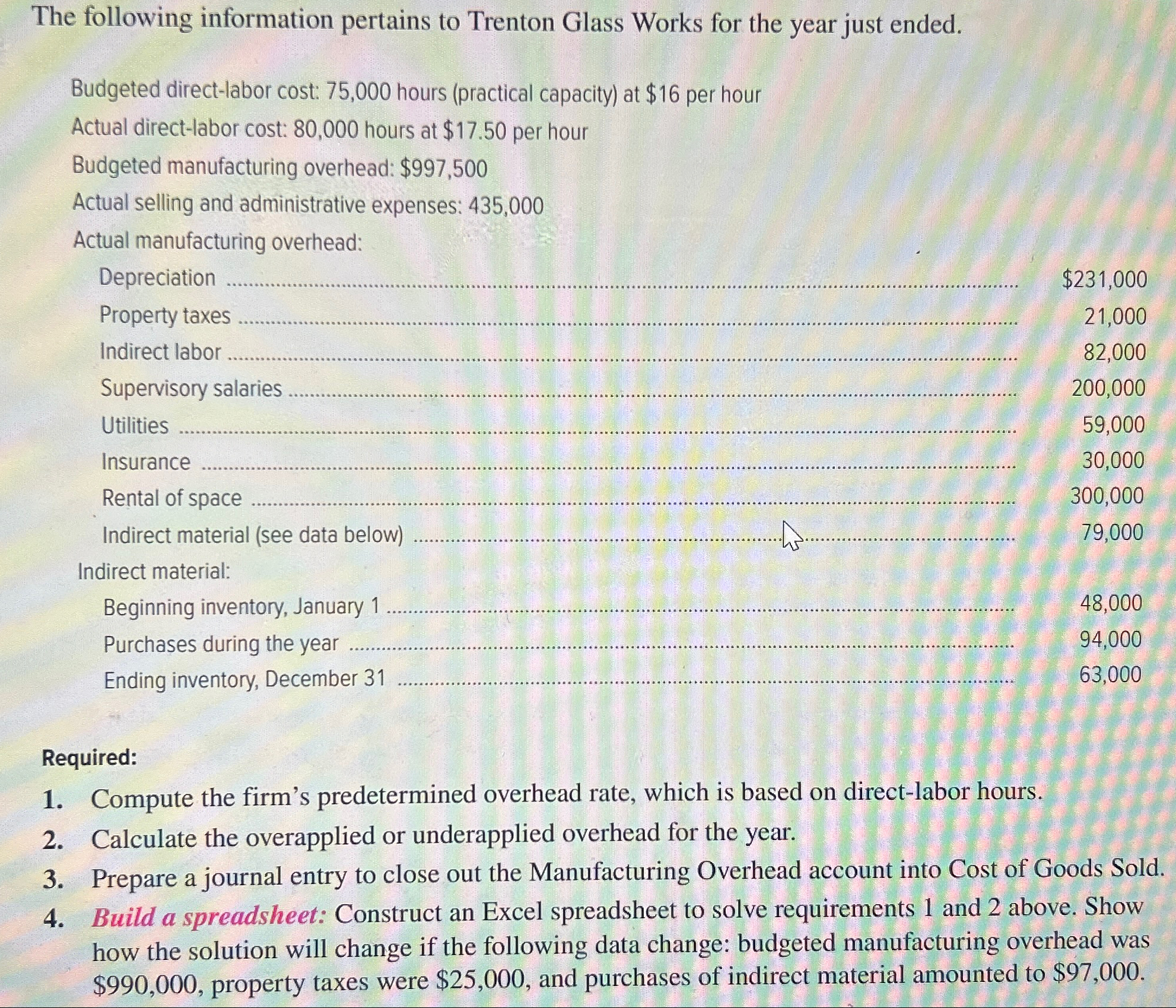

The following information pertains to Trenton Glass Works for the year just ended. Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation Property taxes Indirect labor Supervisory salaries Utilities Insurance Rental of space Indirect material (see data below) Indirect material: Beginning inventory, January 1 Purchases during the year Ending inventory, December 31 Required: $231,000 21,000 82,000 200,000 59,000 30,000 300,000 79,000 48,000 94,000 63,000 1. Compute the firm's predetermined overhead rate, which is based on direct-labor hours. 2. Calculate the overapplied or underapplied overhead for the year. 3. Prepare a journal entry to close out the Manufacturing Overhead account into Cost of Goods Sold. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements 1 and 2 above. Show how the solution will change if the following data change: budgeted manufacturing overhead was $990,000, property taxes were $25,000, and purchases of indirect material amounted to $97,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started